Mantic Revenue Predictions for S&P 500 Companies

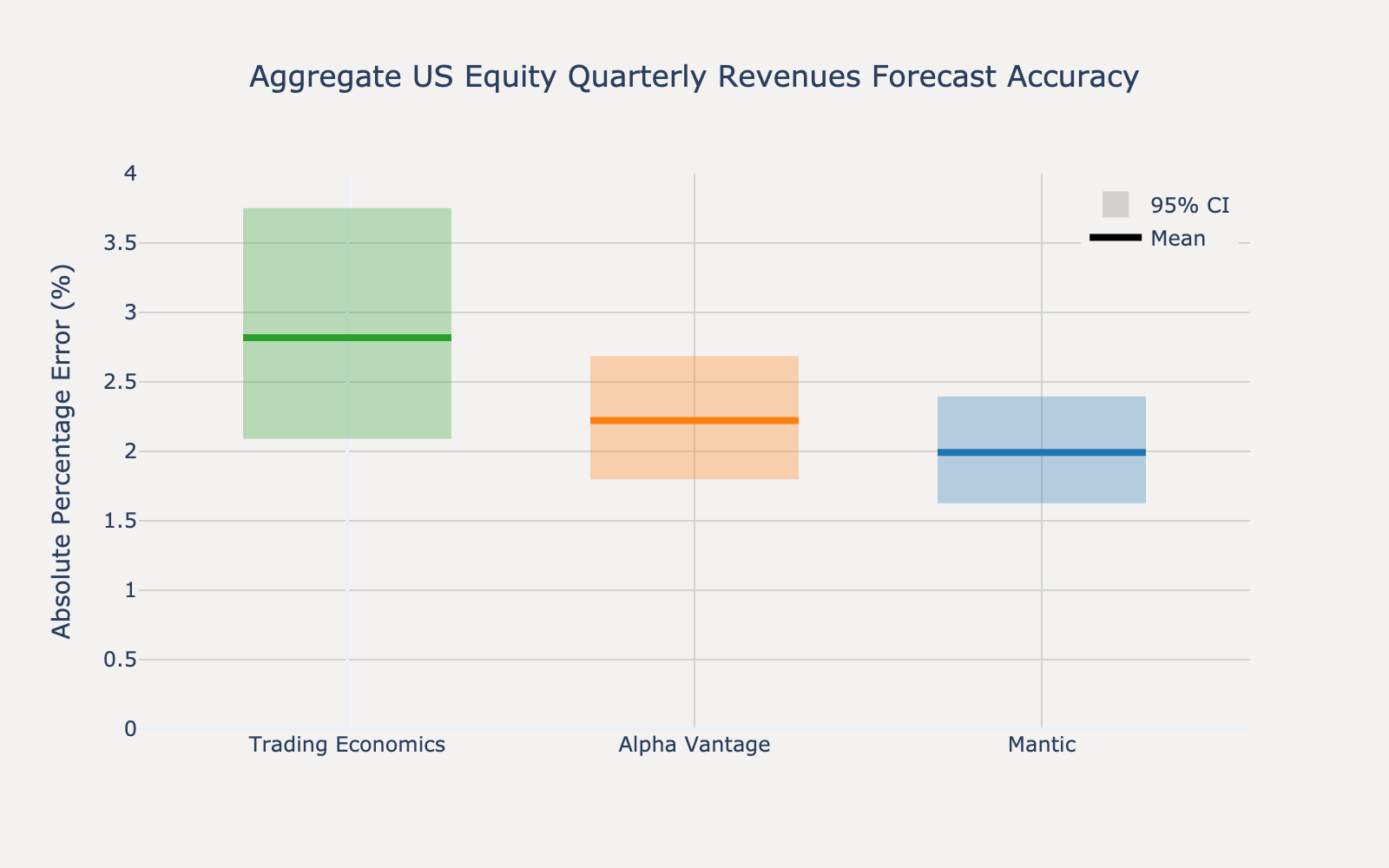

We backtested quarterly revenues predictions for 46 companies from the S&P 500 from Q4 2024 to Q2 2025. Predictions were generated two days prior to the relevant earnings call. We compare the mean of our predicted distribution to consensus forecasts from Trading Economics and Alpha Vantage.

Individual Company Predictions

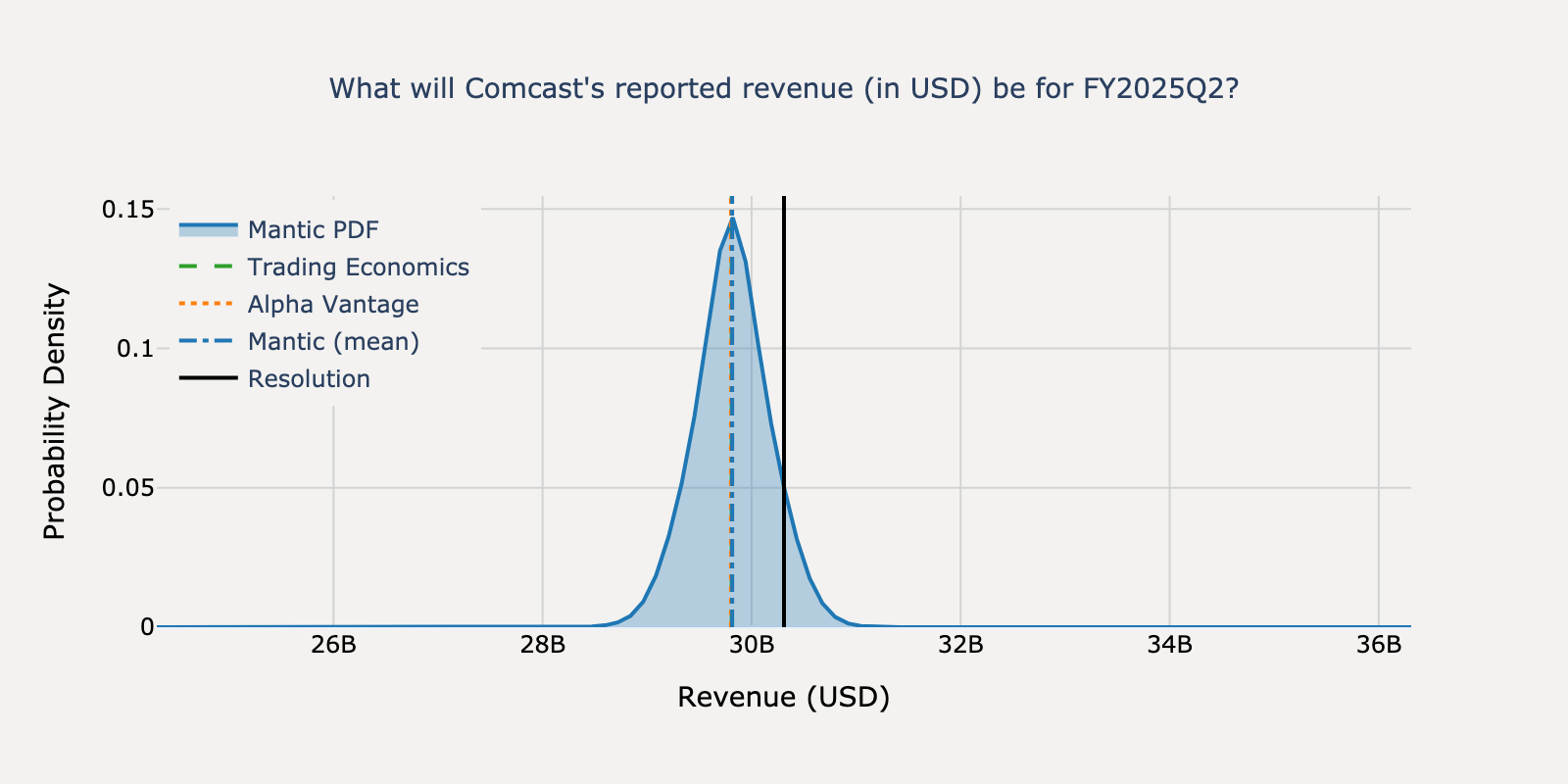

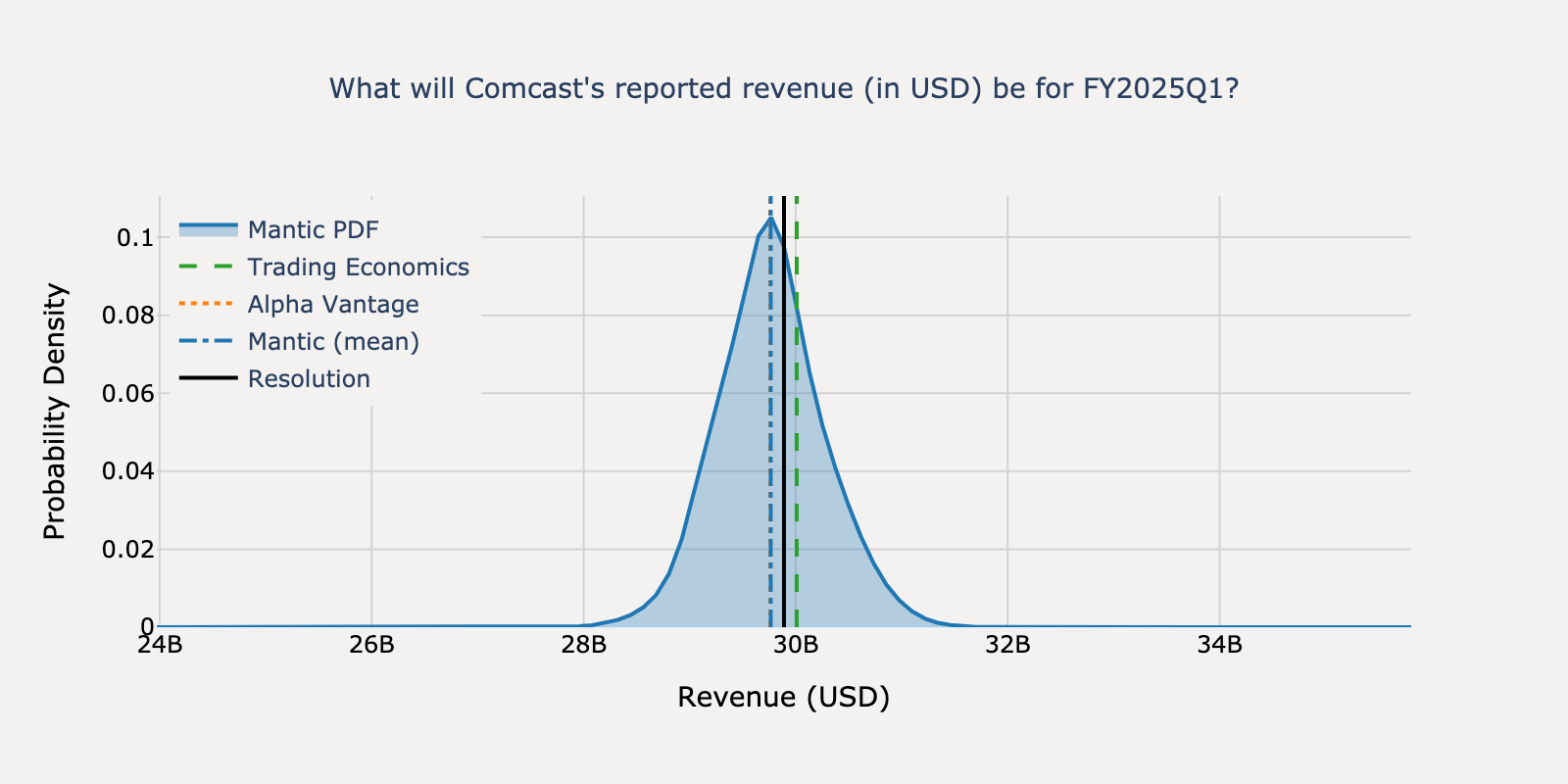

Comcast - Q2 2025

Actual Resolution: $30.31B

Mantic

$29.81BBEST

TE Consensus

$29.81B

AV Consensus

$29.80B

Absolute Percentage Errors

Mantic

1.64%

TE Consensus

1.65%

AV Consensus

1.67%

View Mantic Prediction Analysis

- I estimate Comcast's FY2025Q2 revenue will be $29.8 billion, with a 50% confidence interval of $29.4 billion to $30.2 billion.

- Consensus analyst estimates for Q2 2025 revenue are approximately $29.8 billion. This figure represents a roughly flat year-over-year performance, consistent with recent trends and Q1 2025 revenue of $29.9 billion.

- Revenue faces headwinds from subscriber losses in the core Connectivity & Platforms segment. In the prior quarter, Comcast lost 199,000 broadband customers to competitors and 427,500 video customers due to cord-cutting.

- Positive revenue drivers are expected from the Content & Experiences segment. The new Epic Universe theme park opened on May 22, 2025, and a major film was released in June, both contributing to Q2 results.

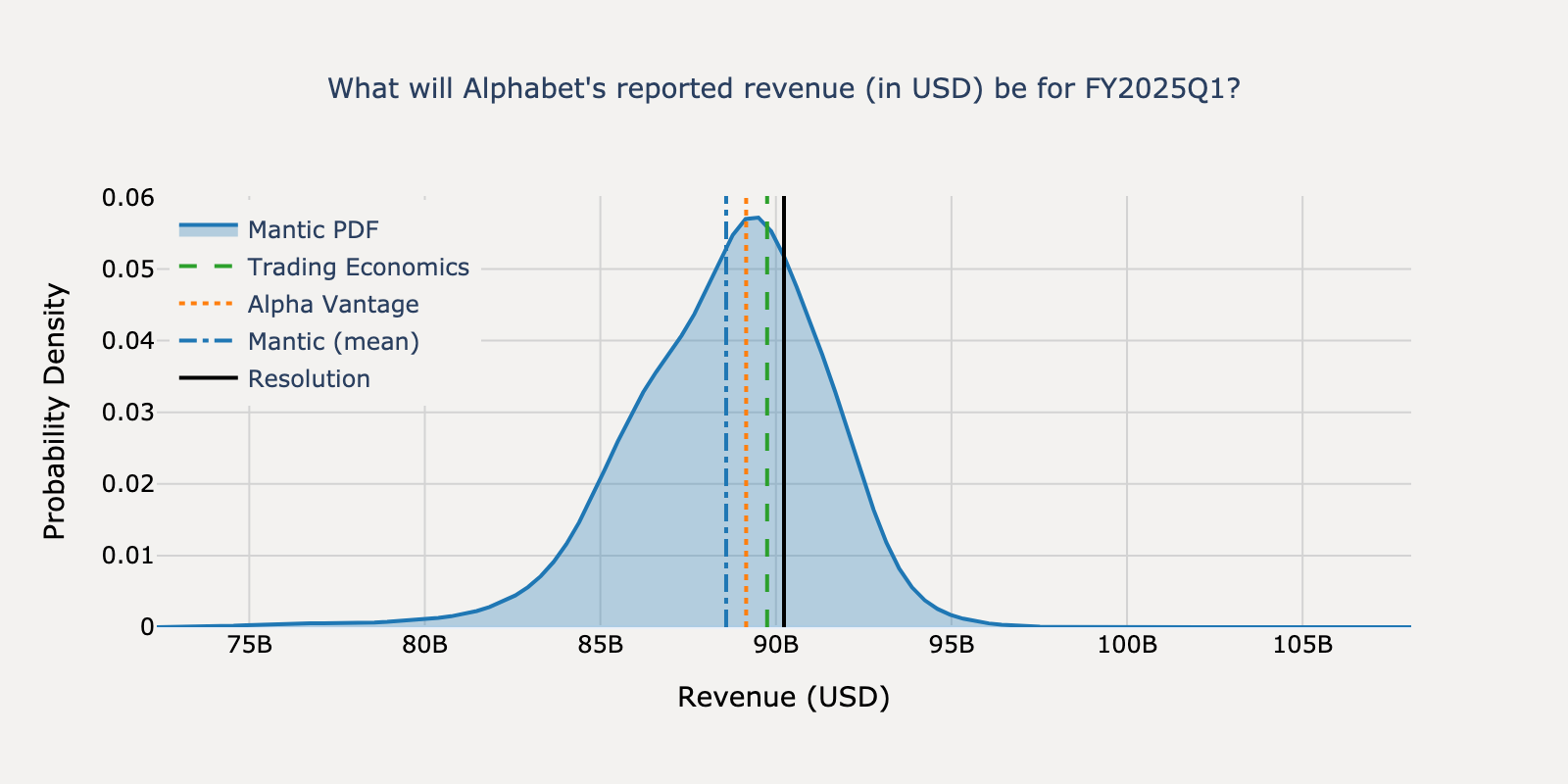

Alphabet - Q1 2025

Actual Resolution: $90.23B

Mantic

$88.58B

TE Consensus

$89.75BBEST

AV Consensus

$89.15B

Absolute Percentage Errors

Mantic

1.83%

TE Consensus

0.53%

AV Consensus

1.19%

View Mantic Prediction Analysis

- My median forecast for Alphabet's FY2025Q1 revenue is $89.3 billion, with a 50% confidence interval of $87.2 billion to $91.7 billion. This aligns with analyst consensus estimates of approximately $89.2 billion.

- Company management guided towards headwinds in the Q4 2024 earnings call. These include negative impacts from a strengthening U.S. dollar and one fewer day in the quarter compared to the Q1 2024 leap year.

- The forecast is supported by strong U.S. retail sales reported for March, which bolsters the outlook for the core advertising business. Google's Cloud segment is also a key growth driver, having increased revenue by 30% year-over-year in the prior quarter.

- Some lower analyst forecasts, such as one for $74.1 billion, likely represent revenue excluding traffic acquisition costs (ex-TAC). These are not comparable to the official GAAP revenue that this forecast targets.

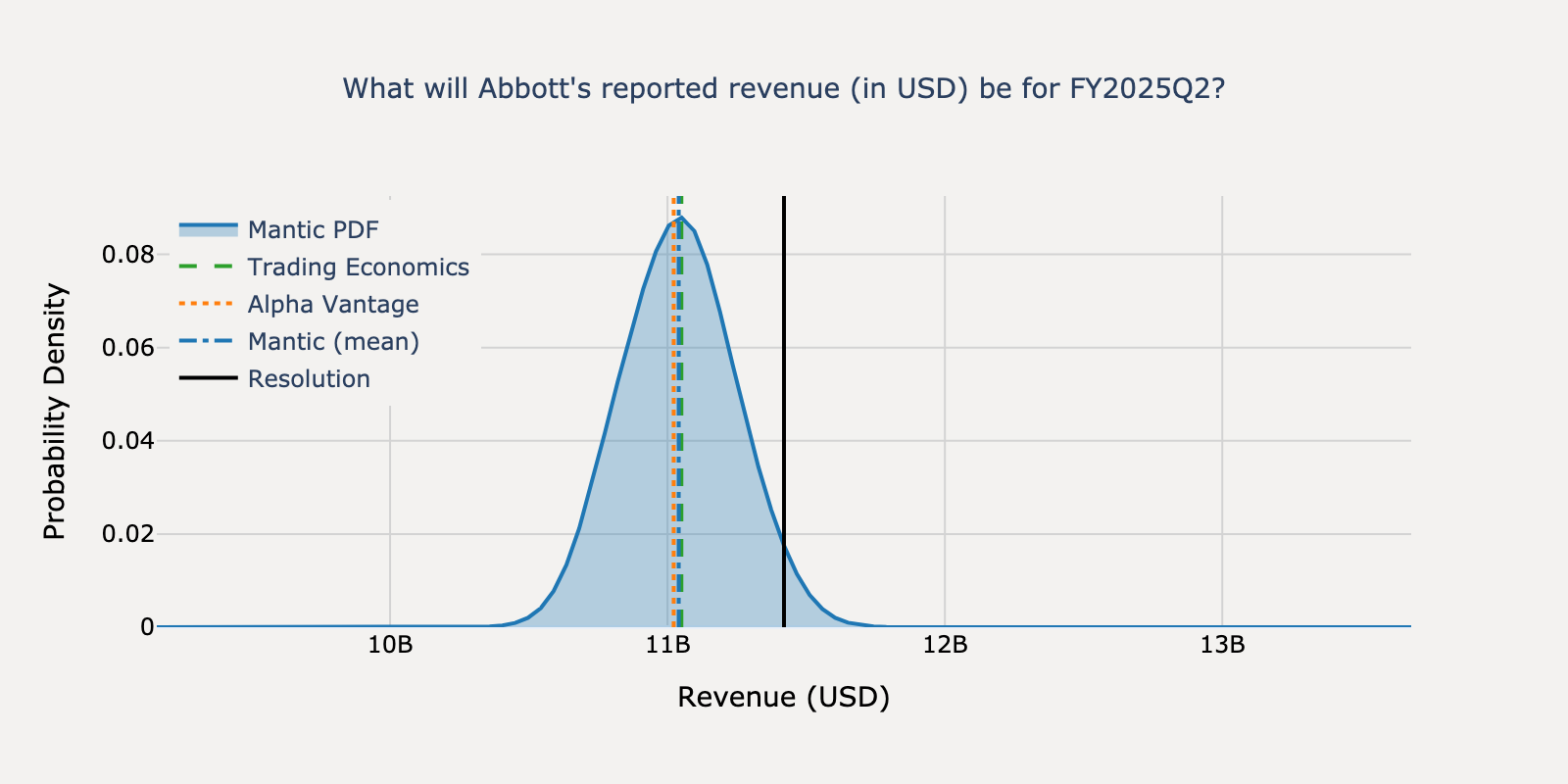

Abbott - Q2 2025

Actual Resolution: $11.42B

Mantic

$11.04B

TE Consensus

$11.05BBEST

AV Consensus

$11.02B

Absolute Percentage Errors

Mantic

3.32%

TE Consensus

3.24%

AV Consensus

3.48%

View Mantic Prediction Analysis

- We estimate Abbott's FY2025Q2 revenue will be $11.1 billion, with a 50% confidence interval of $10.9 billion to $11.2 billion.

- Strong growth in the Medical Devices division is the primary driver of expected revenue. Sales of the FreeStyle Libre continuous glucose monitor grew over 20% in the first quarter of 2025, and this momentum is expected to have continued.

- The Diagnostics division acts as a headwind to overall growth. This is due to declining sales of COVID-19 tests and significant pricing pressure from volume-based procurement programs in China.

- Analyst consensus estimates for second-quarter revenue are between $11.01 billion and $11.07 billion. Our forecast is also supported by expected mid-single-digit growth in the Nutrition and Established Pharmaceuticals divisions.

- New U.S. tariffs are not expected to impact second-quarter results. Company executives stated the financial impact will begin in the third quarter of 2025.

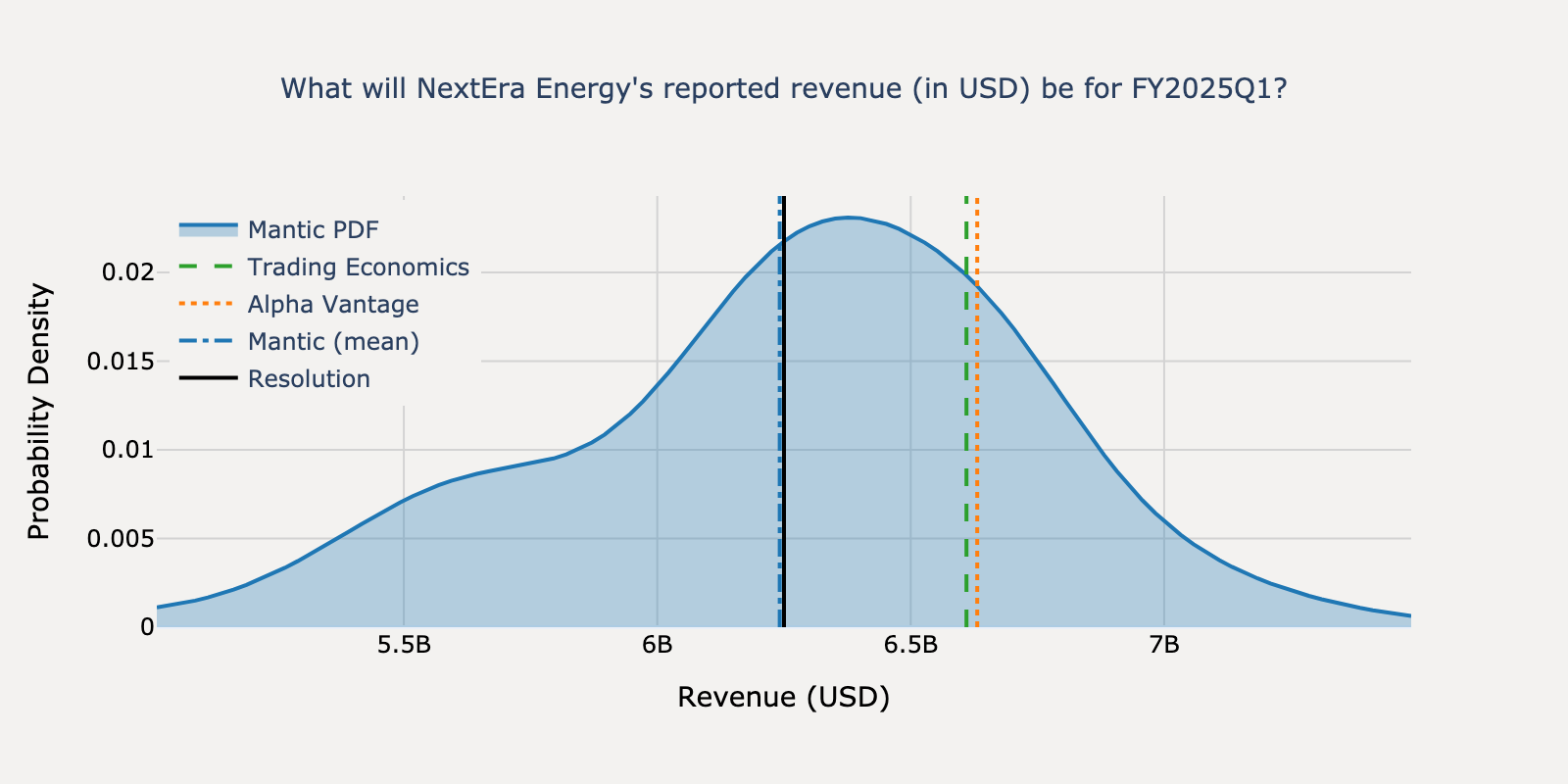

NextEra Energy - Q1 2025

Actual Resolution: $6.25B

Mantic

$6.24BBEST

TE Consensus

$6.61B

AV Consensus

$6.63B

Absolute Percentage Errors

Mantic

0.13%

TE Consensus

5.76%

AV Consensus

6.10%

View Mantic Prediction Analysis

- My median forecast for NextEra Energy's FY2025Q1 revenue is $6.33 billion. The forecast distribution is skewed to the upside, reflecting a significant probability of the final number being higher.

- A TipRanks article notes that the Wall Street analyst consensus forecast is for revenue of $6.64 billion.

- Florida Power & Light will add approximately $300 million to Q1 revenue from a new storm cost recovery surcharge approved by regulators, according to company SEC filings.

- NextEra Energy Resources' revenue is expected to increase after adding over 4.6 gigawatts of new renewable energy projects to its portfolio in 2024.

- Reported revenue remains difficult to predict precisely due to significant volatility from the mark-to-market accounting of commodity hedges within the NextEra Energy Resources segment.

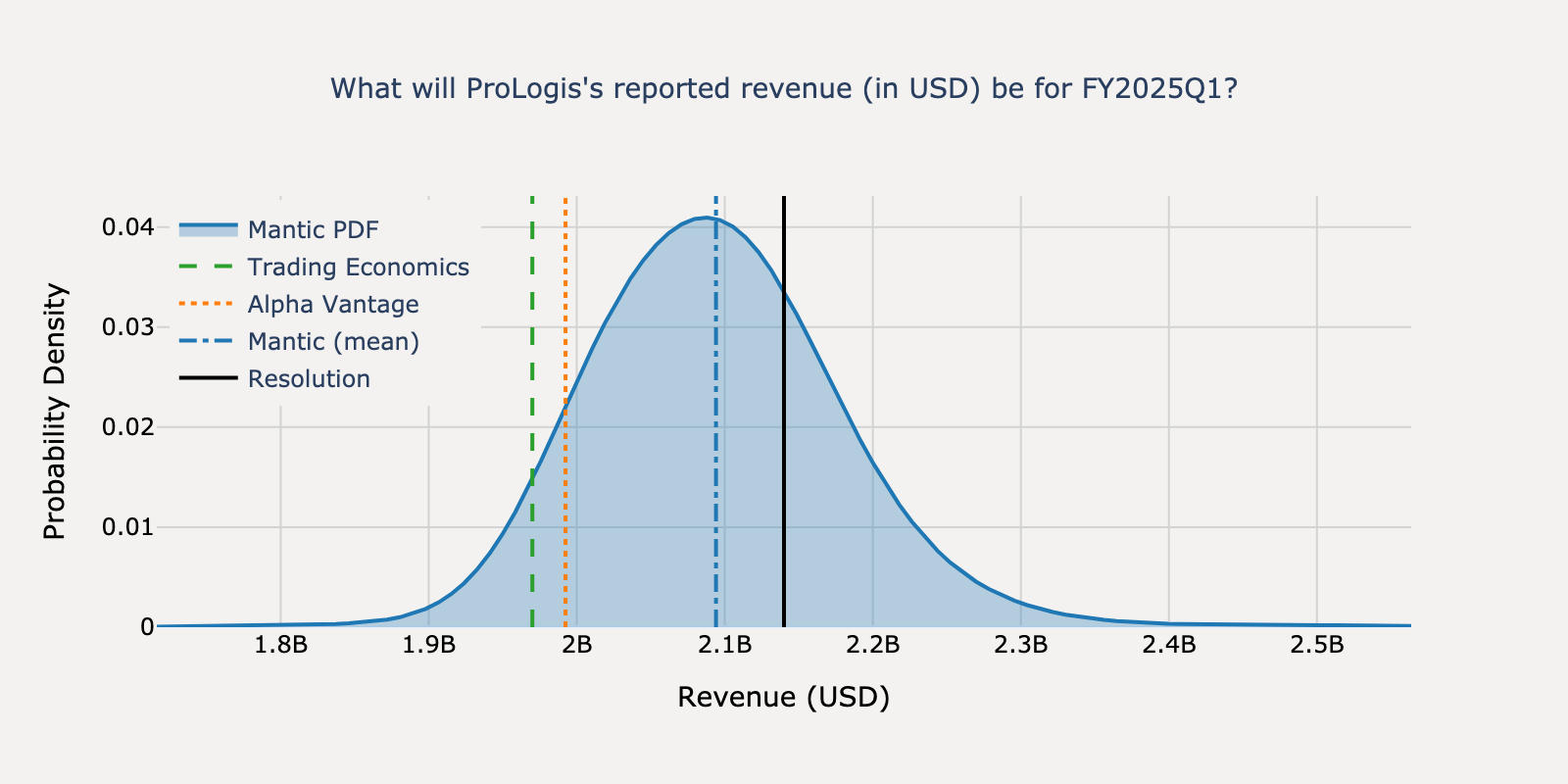

ProLogis - Q1 2025

Actual Resolution: $2.14B

Mantic

$2.09BBEST

TE Consensus

$1.97B

AV Consensus

$1.99B

Absolute Percentage Errors

Mantic

2.15%

TE Consensus

7.94%

AV Consensus

6.90%

View Mantic Prediction Analysis

- I estimate ProLogis's revenue for FY2025Q1 will be $2.08 billion, with an 80% confidence interval of $1.9 billion to $2.4 billion.

- ProLogis's primary revenue source is rental income, which benefits from strong rent growth as old leases are renewed at higher market rates.

- Management has guided for a temporary dip in occupancy in the first half of 2025, which is expected to be a headwind for Q1 revenue.

- The second largest revenue component, strategic capital fees, is guided to be between $560 million and $580 million for the full year 2025, but the timing of this income is variable between quarters.

- Key logistics indicators, such as the Logistics Managers' Index, remained in expansionary territory throughout Q1 2025, suggesting a healthy underlying market.

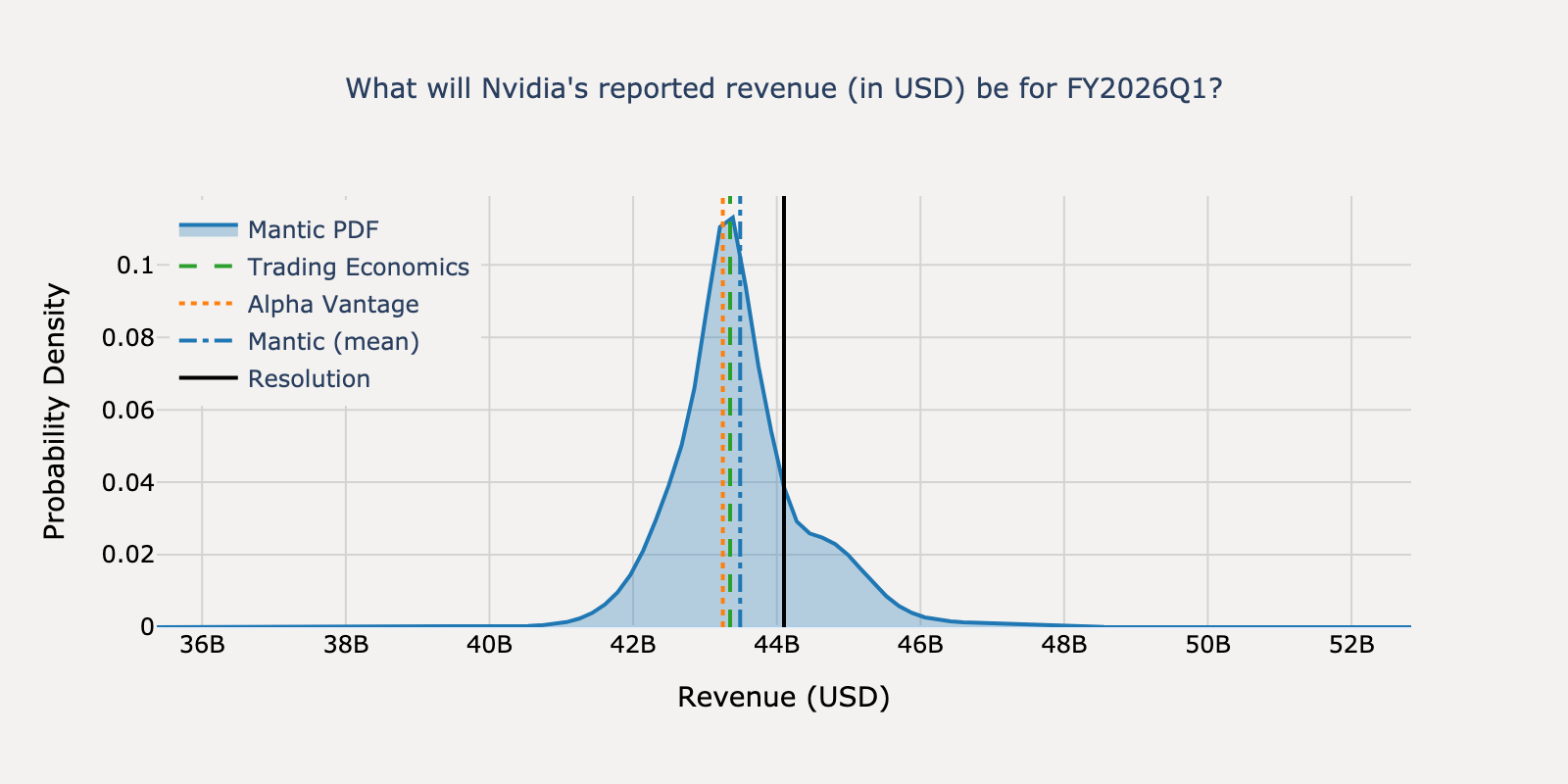

Nvidia - Q1 2025

Actual Resolution: $44.10B

Mantic

$43.49BBEST

TE Consensus

$43.35B

AV Consensus

$43.25B

Absolute Percentage Errors

Mantic

1.38%

TE Consensus

1.70%

AV Consensus

1.93%

View Mantic Prediction Analysis

- My estimate for Nvidia's reported revenue for FY2026Q1 is $43.2 billion. The 50% confidence interval for this forecast is $42.5 billion to $43.8 billion.

- The forecast is primarily anchored by Nvidia's own guidance of $43.0 billion, plus or minus 2%. As the fiscal quarter has already closed, the company has high visibility into the final number, making large deviations unlikely.

- Sustained, strong demand from large cloud providers and sovereign AI initiatives supports a result in the upper part of the guided range. Key customers like Microsoft and Meta raised their 2025 capital expenditure forecasts to expand AI data centers.

- The widely reported $5.5 billion charge related to new US export restrictions on chips for China primarily affects inventory and profitability, not the recognized top-line revenue for this quarter.

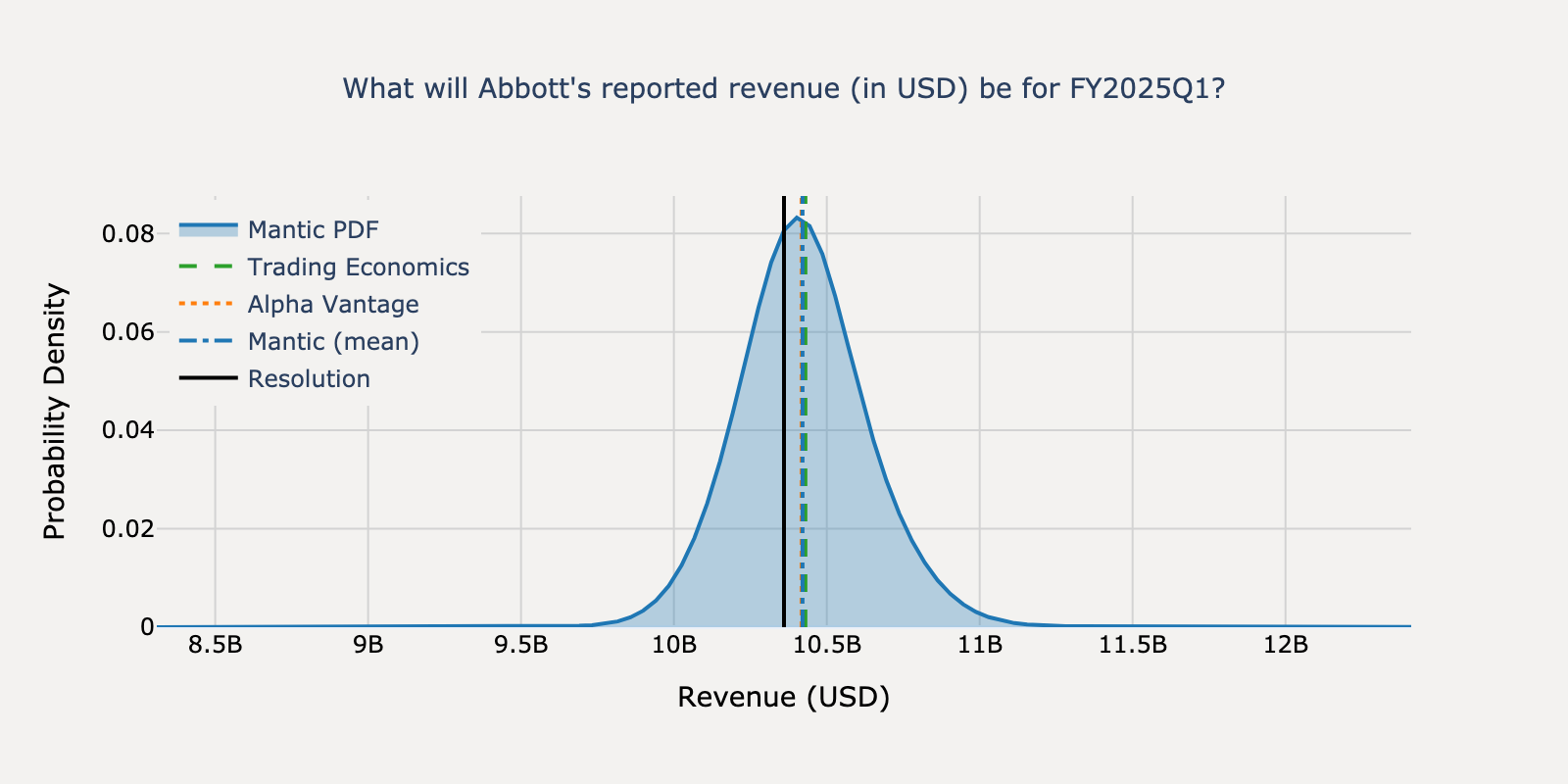

Abbott - Q1 2025

Actual Resolution: $10.36B

Mantic

$10.42B

TE Consensus

$10.43B

AV Consensus

$10.42BBEST

Absolute Percentage Errors

Mantic

0.58%

TE Consensus

0.68%

AV Consensus

0.56%

View Mantic Prediction Analysis

- My central estimate for Abbott's FY2025Q1 revenue is $10.5 billion, with a 50% confidence interval of $10.2 billion to $10.7 billion.

- Wall Street analyst consensus projects revenue of $10.4 billion for the quarter.

- Company guidance projects full-year 2025 organic sales growth of 7.5% to 8.5%, but this is tempered by an expected 3.5% negative impact from foreign exchange rates on first-quarter reported sales.

- The Medical Devices segment is the primary growth driver, led by the FreeStyle Libre product line which saw sales grow by 21.8% in 2024.

- Growth is partially offset by the continued, sharp decline in COVID-19 testing revenue and pricing pressure on the diagnostics business in China due to new procurement policies.

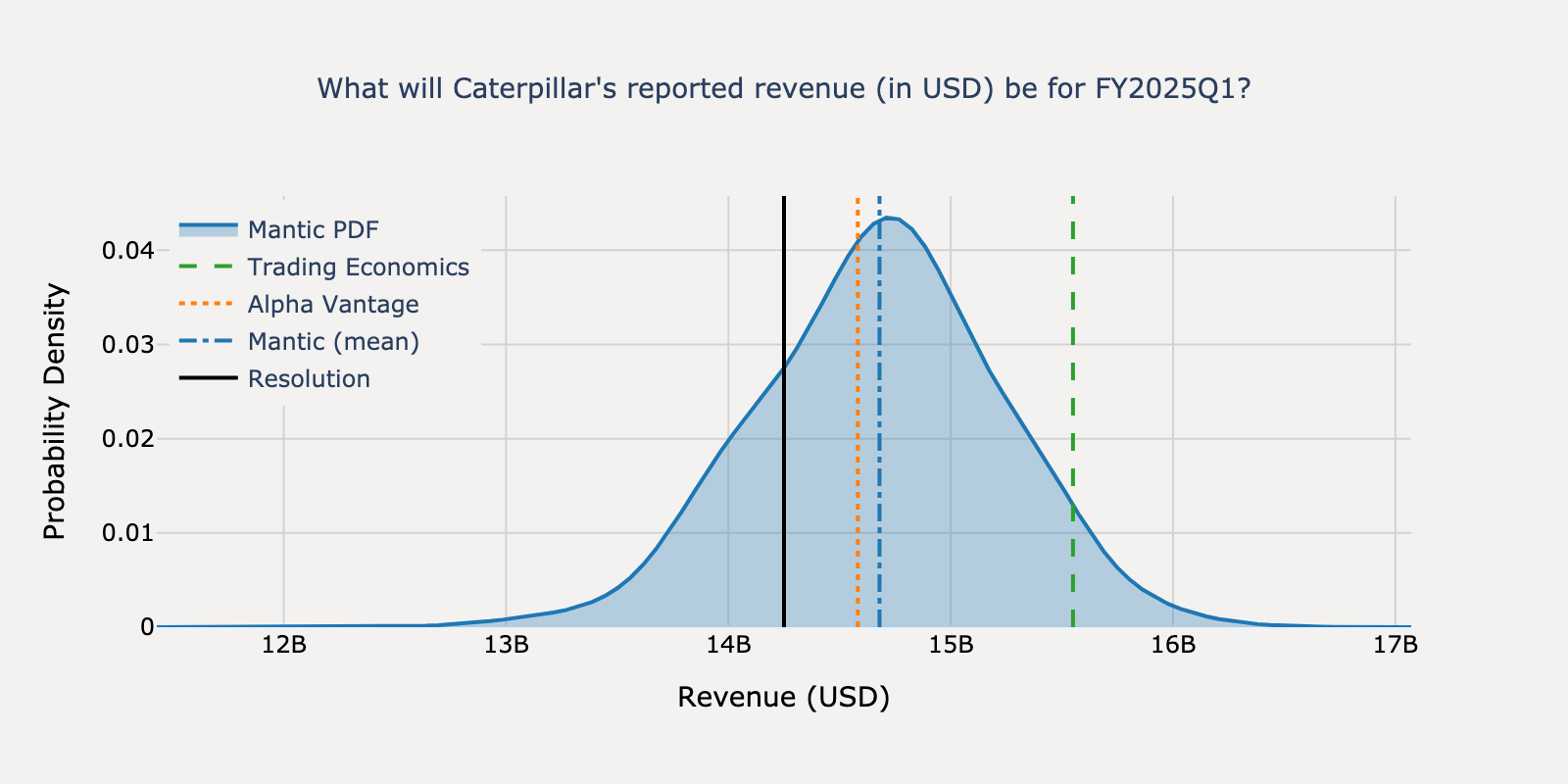

Caterpillar - Q1 2025

Actual Resolution: $14.25B

Mantic

$14.68B

TE Consensus

$15.55B

AV Consensus

$14.58BBEST

Absolute Percentage Errors

Mantic

3.02%

TE Consensus

9.12%

AV Consensus

2.33%

View Mantic Prediction Analysis

- I estimate Caterpillar's revenue for FY2025Q1 will be $14.8 billion, with a 50% confidence interval of $14.2 billion to $15.3 billion.

- My forecast is informed by Caterpillar's guidance for lower first-quarter revenue compared to the prior year. Key drivers include a substantially smaller increase in dealer inventories than the $1.1 billion build in Q1 2024 and an estimated $300 million headwind from unfavorable machine pricing.

- The forecast aligns with the Wall Street analyst consensus, which projects Q1 revenue of approximately $14.72 billion.

- Expected weakness in the Construction and Resource Industries segments is a primary factor. This is partly counterbalanced by anticipated stable performance in the Energy & Transportation segment, supported by strong demand for power generation equipment for data centers.

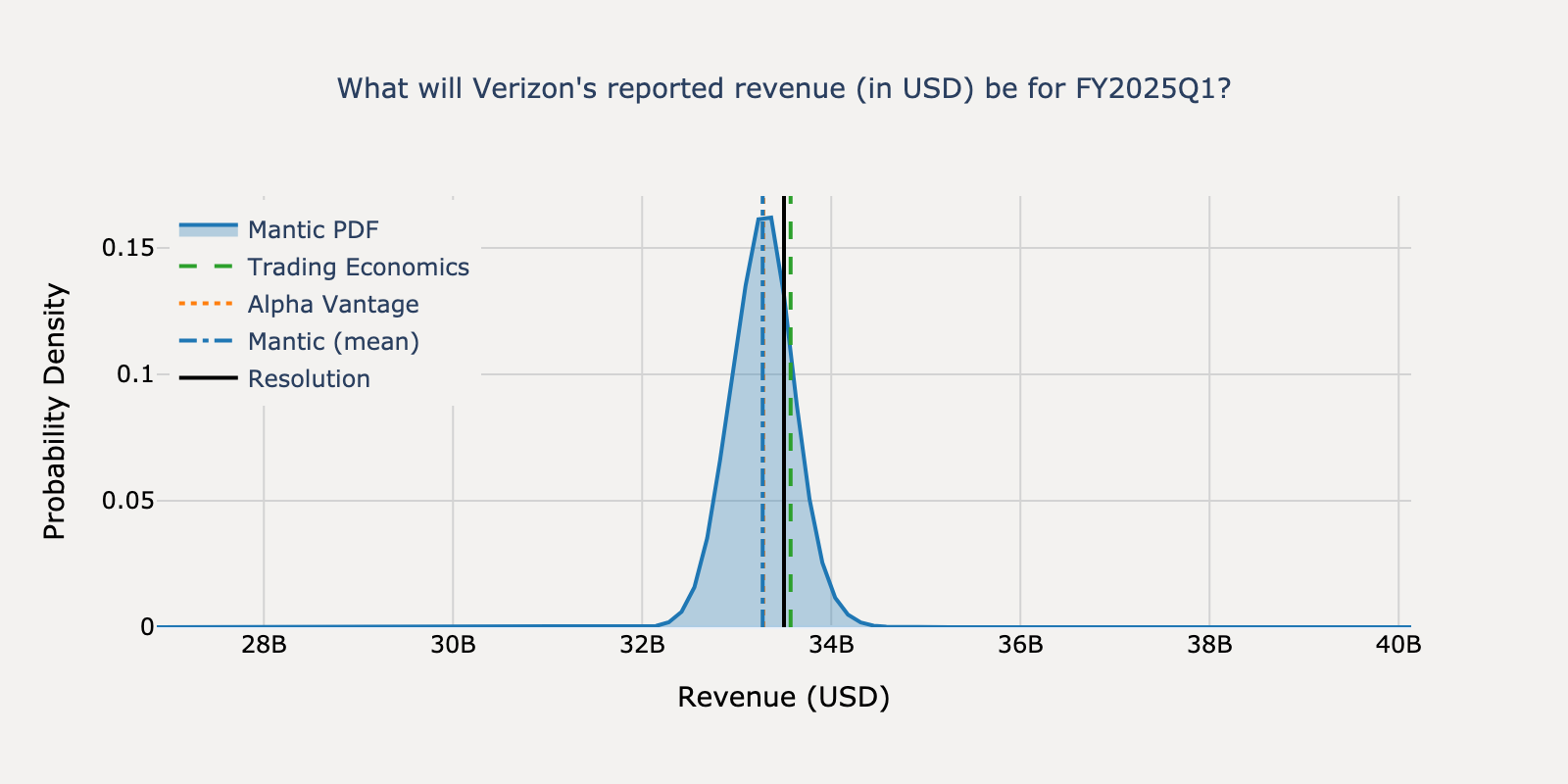

Verizon - Q1 2025

Actual Resolution: $33.50B

Mantic

$33.27B

TE Consensus

$33.57BBEST

AV Consensus

$33.28B

Absolute Percentage Errors

Mantic

0.67%

TE Consensus

0.21%

AV Consensus

0.65%

View Mantic Prediction Analysis

- I estimate Verizon's revenue for FY2025Q1 will be $33.3 billion, with a 50% confidence interval of $33.0 billion to $33.7 billion.

- Wall Street analyst consensus forecasts revenue between $33.28 billion and $33.30 billion. This is a modest increase from the $32.98 billion reported in the same quarter of the prior year.

- Management commentary from March 2025 flagged a 'soft' quarter for subscriber growth and noted that customers are delaying device upgrades. This is expected to pressure wireless equipment revenue.

- Price increases implemented across 2024 and early 2025 are expected to boost higher-margin wireless service revenue. Continued growth in the Fixed Wireless Access (FWA) business will also contribute positively to revenue.

- Starting in Q1 2025, over $2.9 billion in annual revenue is reclassified into wireless service revenue. This accounting change does not affect the total consolidated revenue figure that this forecast addresses.

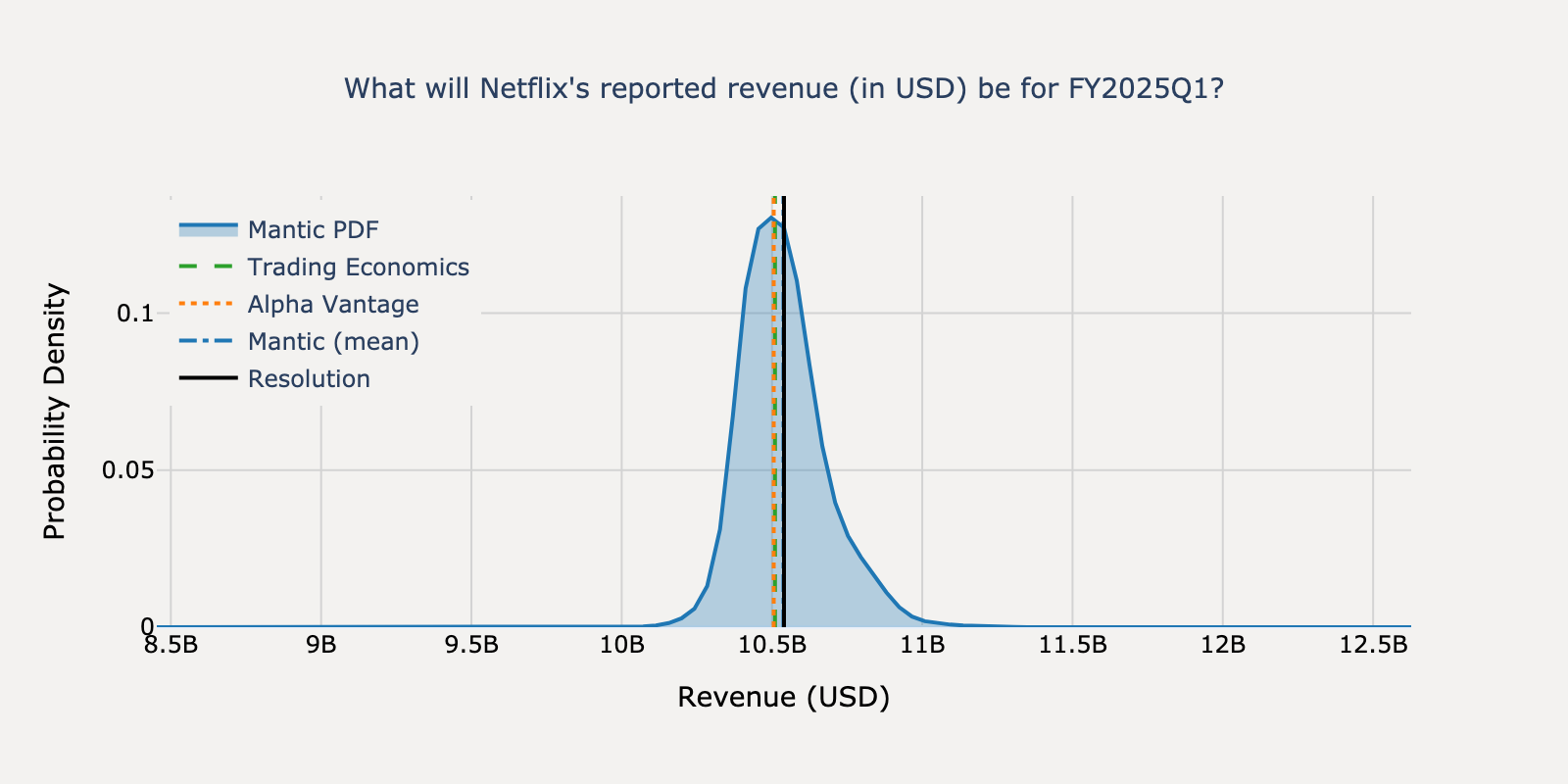

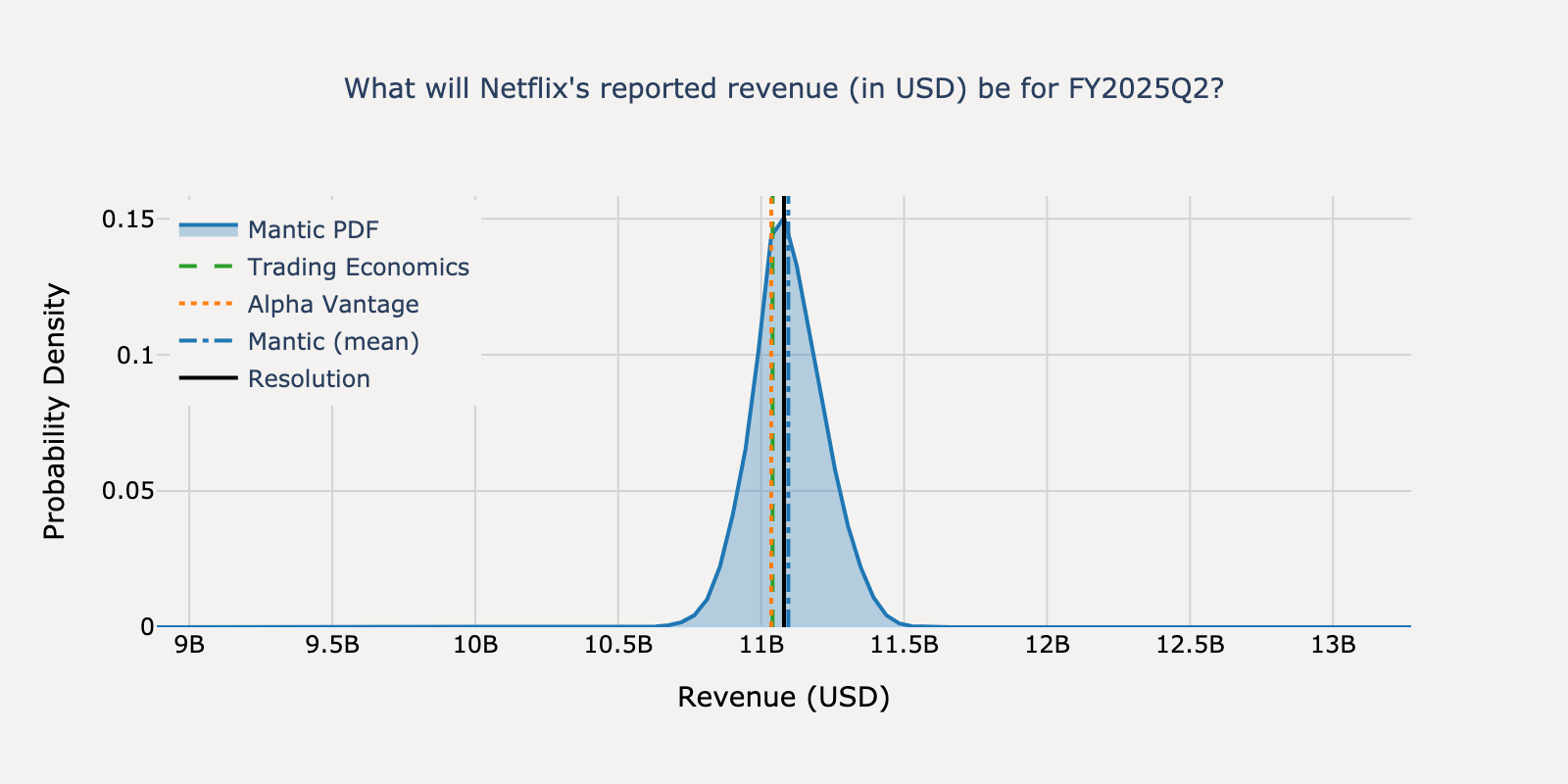

Netflix - Q1 2025

Actual Resolution: $10.54B

Mantic

$10.54BBEST

TE Consensus

$10.51B

AV Consensus

$10.51B

Absolute Percentage Errors

Mantic

0.02%

TE Consensus

0.28%

AV Consensus

0.32%

View Mantic Prediction Analysis

- My median forecast for Netflix's FY2025Q1 revenue is $10.5 billion, with a 50% confidence interval of $10.4 billion to $10.6 billion.

- This estimate is slightly above Netflix's official guidance of $10.416 billion and analyst consensus estimates that cluster around $10.52 billion.

- Revenue growth is supported by price increases implemented in January 2025 in key markets including the U.S. and U.K., which are expected to lift average revenue per membership (ARM).

- The ad-supported subscription tier is a significant growth driver. Ad plan membership grew by nearly 30% quarter-over-quarter in Q4 2024, and management expects advertising revenue to double in 2025.

- A weaker U.S. dollar since January provides a tailwind to reported revenue, as about 60% of revenue is international. This positive impact is partially offset by the company's currency hedging strategy.

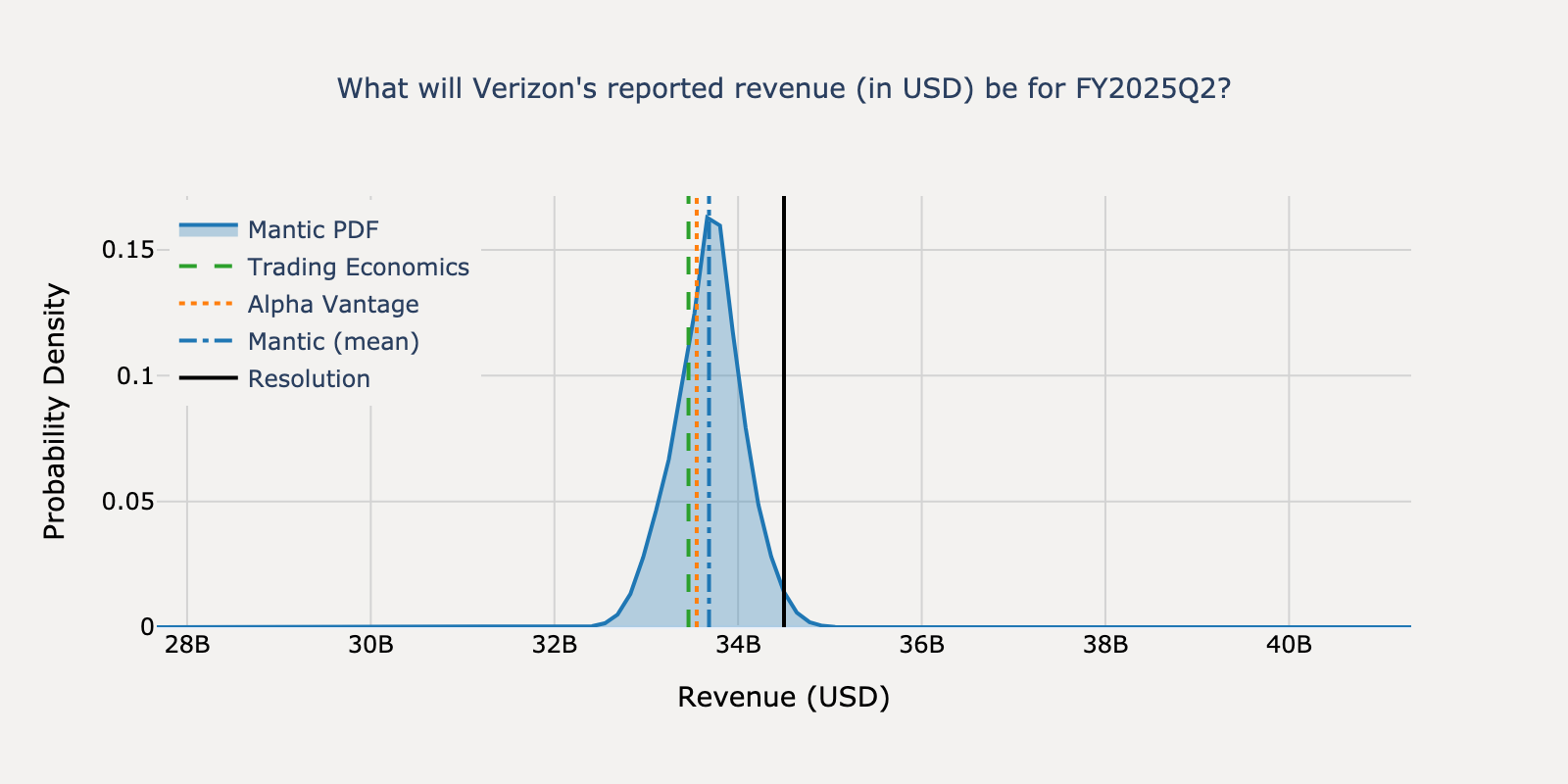

Verizon - Q2 2025

Actual Resolution: $34.50B

Mantic

$33.68BBEST

TE Consensus

$33.46B

AV Consensus

$33.55B

Absolute Percentage Errors

Mantic

2.37%

TE Consensus

3.01%

AV Consensus

2.75%

View Mantic Prediction Analysis

- I estimate Verizon's reported revenue for FY2025Q2 will be $33.7 billion, with a 50% confidence interval of $33.4 billion to $34.0 billion.

- This forecast aligns with Wall Street analyst consensus estimates, which articles show are tightly clustered between $33.47 billion and $33.74 billion.

- Verizon's reported revenue for the prior quarter (Q1 2025) was $33.5 billion, providing a stable recent baseline for this estimate.

- Growth is expected from continued strength in Fixed Wireless Access (FWA) subscriber additions and improving consumer postpaid phone gross additions, as noted in the Q1 2025 earnings call.

- Headwinds that limit upside potential include the ongoing secular decline in the Business wireline services segment and the financial impact of promotional activity.

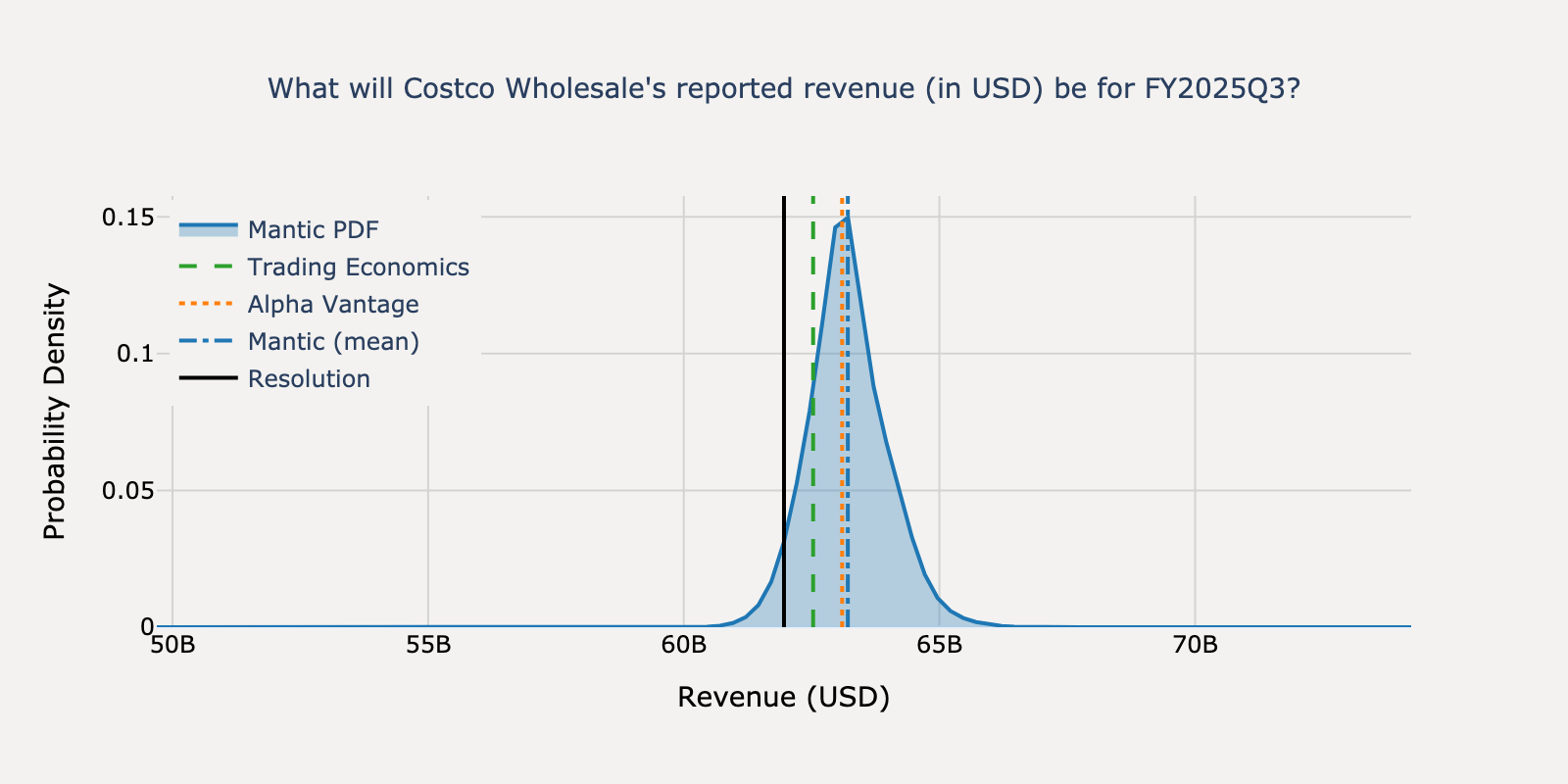

Costco Wholesale - Q1 2025

Actual Resolution: $61.96B

Mantic

$63.21B

TE Consensus

$62.53BBEST

AV Consensus

$63.10B

Absolute Percentage Errors

Mantic

2.02%

TE Consensus

0.92%

AV Consensus

1.83%

View Mantic Prediction Analysis

- I estimate Costco's reported revenue for FY2025Q3 will be $63.2 billion, a figure that aligns with the consensus analyst forecast of approximately $63.1 billion.

- Costco's reported net sales for the first 35 weeks of its fiscal year total $180.05 billion. This implies that net sales for approximately 11 of the 12 weeks in the third quarter are already known, providing a strong basis for the forecast.

- Core comparable sales, which exclude gasoline prices and foreign exchange impacts, showed robust growth of 9.1% in March and 6.7% in April 2025. This underlying strength is driven by a reported increase in worldwide shopping traffic.

- Headline revenue growth is tempered by headwinds from unfavorable foreign exchange rates and lower gasoline prices. The calendar shift of Easter also negatively impacted reported sales in April by an estimated 1.5% to 2.0%.

- Membership fee income is expected to contribute over $1.2 billion to revenue. This reflects continued high renewal rates of over 90% and the positive impact of a recent membership fee increase.

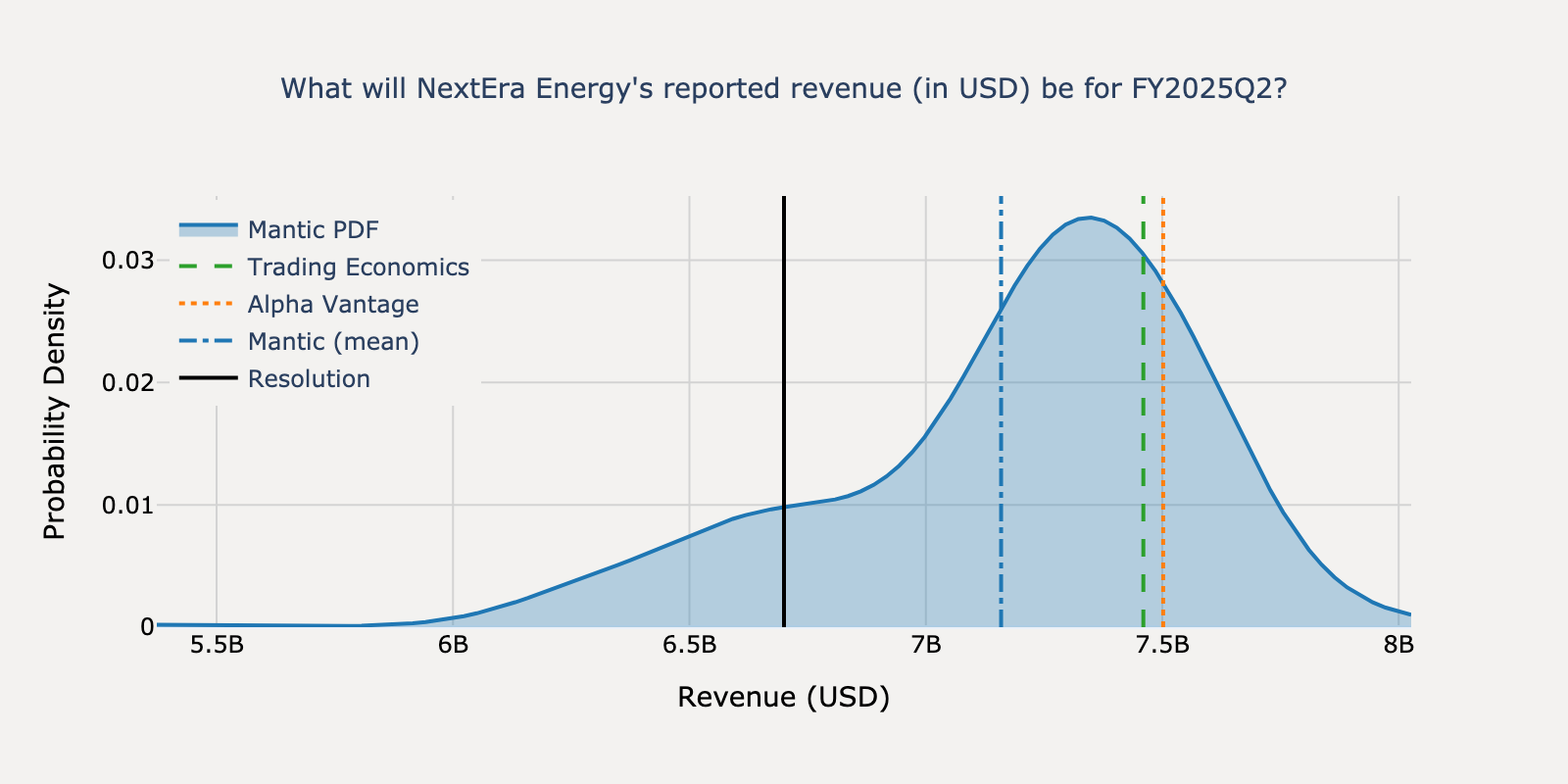

NextEra Energy - Q2 2025

Actual Resolution: $6.70B

Mantic

$7.16BBEST

TE Consensus

$7.46B

AV Consensus

$7.50B

Absolute Percentage Errors

Mantic

6.85%

TE Consensus

11.34%

AV Consensus

11.97%

View Mantic Prediction Analysis

- I estimate NextEra Energy's FY2025Q2 revenue will be $7.28 billion, with a 50% confidence interval from $6.89 billion to $7.45 billion.

- Analyst consensus estimates for Q2 2025 revenue range from $7.29 billion to $7.52 billion, based on information from MarketBeat and TipRanks.

- Revenue for the company's Florida Power & Light (FPL) subsidiary is supported by a storm surcharge that began in January 2025, recovering approximately $1.2 billion in costs over a 12-month period.

- The NextEra Energy Resources (NEER) segment introduces significant revenue volatility due to mark-to-market accounting for its commodity hedges, which can cause large fluctuations in reported results.

- For the first quarter of 2025, NextEra Energy reported revenue of $6.25 billion, which missed analyst estimates but represented a 9.0% increase year-over-year.

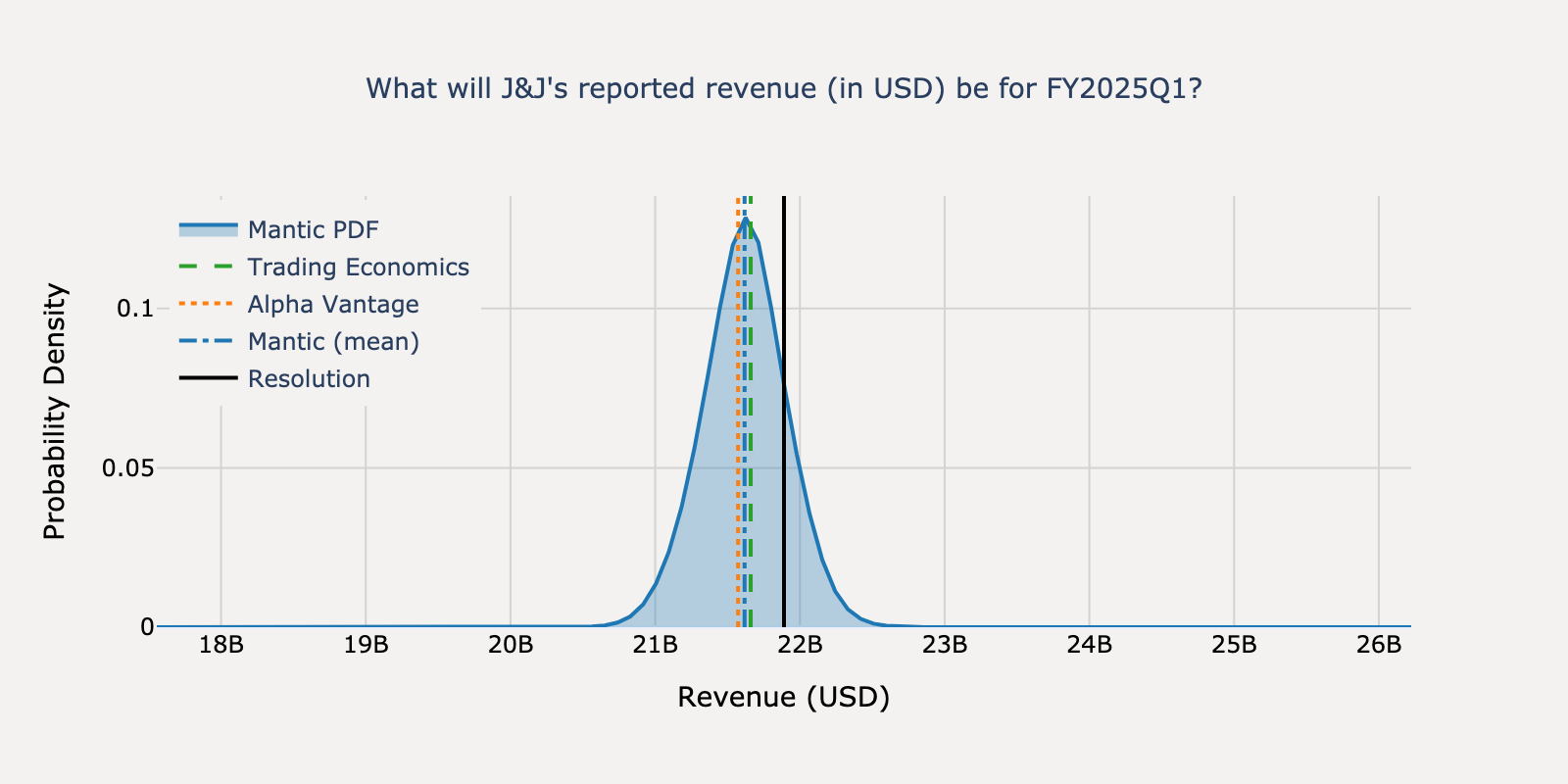

J&J - Q1 2025

Actual Resolution: $21.89B

Mantic

$21.62B

TE Consensus

$21.66BBEST

AV Consensus

$21.57B

Absolute Percentage Errors

Mantic

1.24%

TE Consensus

1.05%

AV Consensus

1.45%

View Mantic Prediction Analysis

- I estimate Johnson & Johnson's FY2025Q1 revenue will be $21.6 billion, with a 50% confidence interval of $21.3 billion to $22.0 billion. This forecast aligns with analyst consensus estimates, which range from $21.6 billion to $21.65 billion.

- A significant headwind is the U.S. loss of patent exclusivity for the major immunology drug Stelara, which began facing biosimilar competition in January 2025. Additional pressures include challenges in China's MedTech market and the financial impact of the Medicare Part D redesign.

- Growth is expected from the Innovative Medicine portfolio, driven by strong sales of oncology drugs like Darzalex and Erleada. The MedTech segment is also anticipated to contribute positively, bolstered by the acquisition of Shockwave Medical.

- This forecast represents modest growth over the $21.4 billion revenue reported in the prior-year quarter (FY2024Q1). This is consistent with company guidance for a slower first half of the year due to tougher year-over-year comparisons.

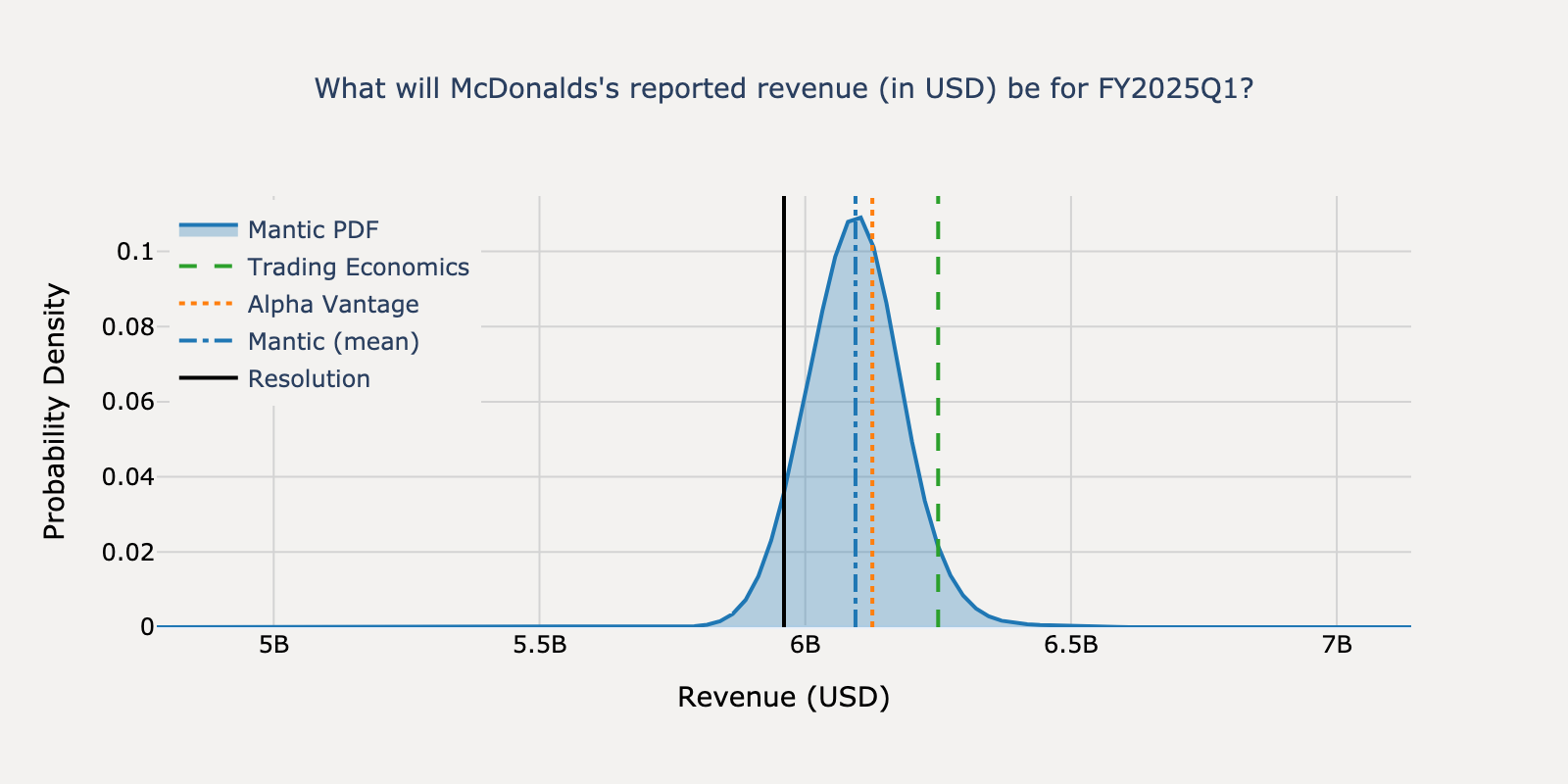

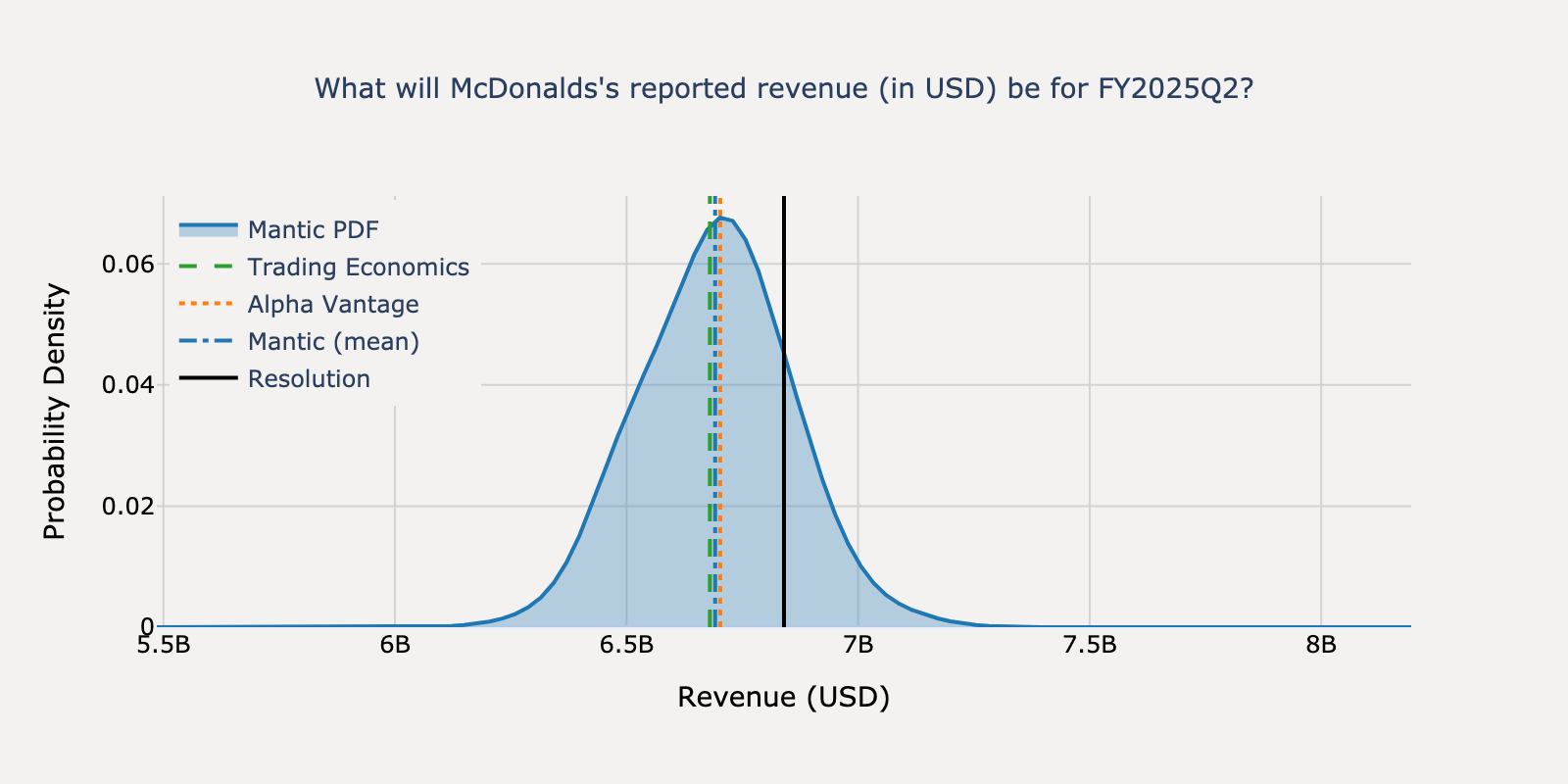

McDonalds - Q1 2025

Actual Resolution: $5.96B

Mantic

$6.09BBEST

TE Consensus

$6.25B

AV Consensus

$6.13B

Absolute Percentage Errors

Mantic

2.26%

TE Consensus

4.87%

AV Consensus

2.79%

View Mantic Prediction Analysis

- I estimate McDonald's FY2025Q1 revenue will be $6.09 billion, with a 50% confidence interval of $5.99 billion to $6.20 billion. This forecast aligns with the Wall Street consensus, which ranges from $6.06 billion to $6.13 billion.

- The forecast represents an expected year-over-year revenue decline of about 1-1.5%. Company management has guided that Q1 will be a "low point for the year," citing headwinds from lapping a leap year in 2024 and a generally sluggish start for the U.S. restaurant industry.

- Performance in the U.S. market is expected to be soft, dampened by the lingering reputational impact of an E. coli outbreak in Q4 2024 and weaker spending among low-income consumers.

- International results are mixed. Strong performance in markets like Germany and Canada is expected to be partially offset by weakness in the U.K., Australia, and continued negative sales impact from the conflict in the Middle East.

- Analysts' detailed forecasts suggest that a slight growth in franchised revenues will be more than offset by a decline of nearly 5% in sales from company-owned restaurants, driving the overall revenue down.

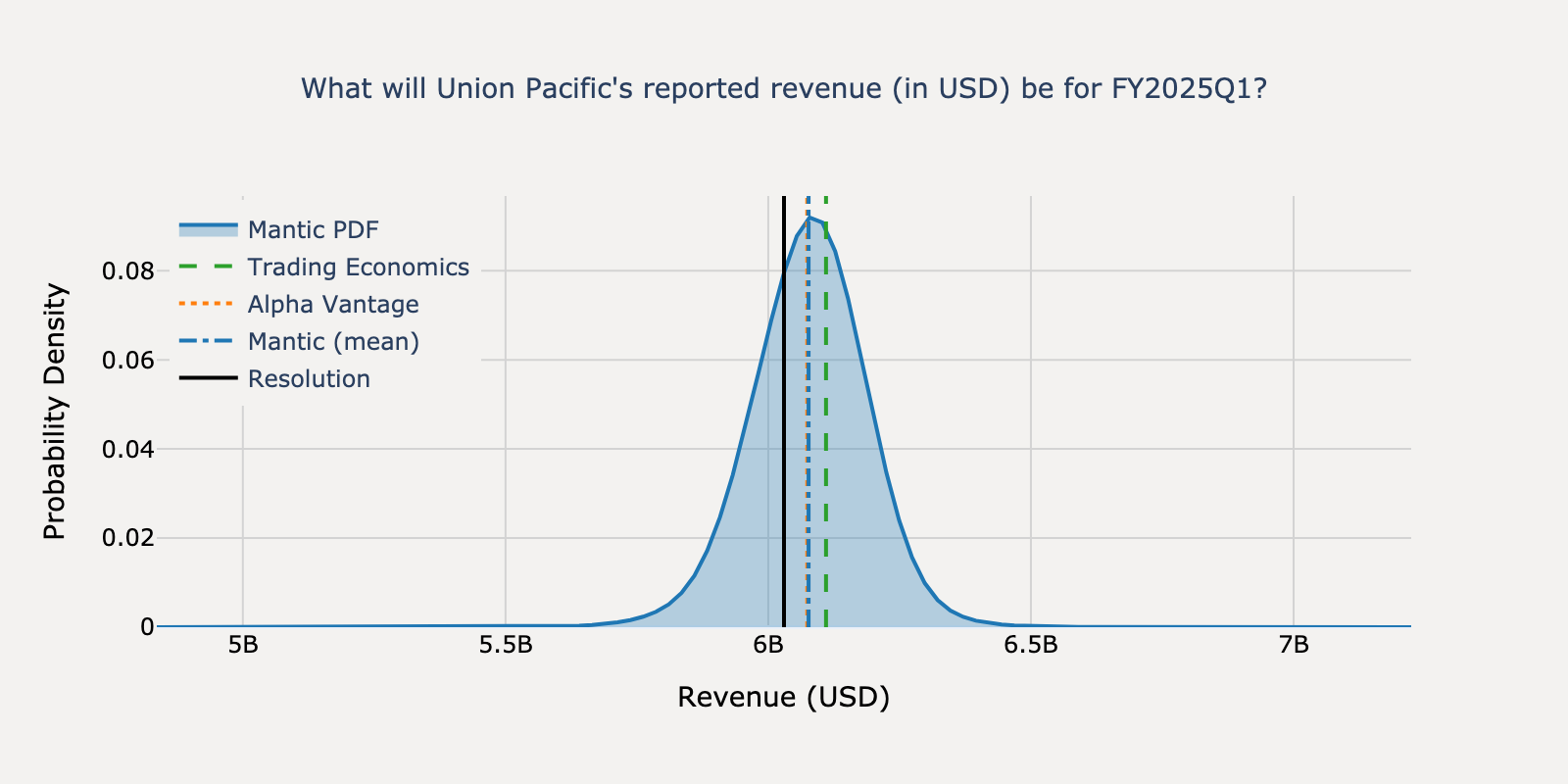

Union Pacific - Q1 2025

Actual Resolution: $6.03B

Mantic

$6.08B

TE Consensus

$6.11B

AV Consensus

$6.07BBEST

Absolute Percentage Errors

Mantic

0.78%

TE Consensus

1.33%

AV Consensus

0.73%

View Mantic Prediction Analysis

- I estimate Union Pacific's FY2025Q1 revenue will be $6.08 billion. My 50% confidence interval is $5.95 billion to $6.20 billion. This is broadly in line with analyst consensus estimates of $6.09 billion.

- Competitor CSX Corporation reported a 7% year-over-year revenue decline for Q1 2025. CSX cited lower coal revenue and fuel surcharges as primary drivers. Union Pacific faces similar pressures in these areas.

- Union Pacific's service improvements and volume growth in early 2025 provide a key offset to industry-wide headwinds. Analyst commentary from Redburn-Atlantic and Citi notes that cargo volumes may exceed initial consensus forecasts.

- Union Pacific's revenue is supported by strong grain product shipments, driven by renewable diesel demand. This strength is counterbalanced by an expected decline in coal shipments and tougher year-over-year comparisons for international intermodal volumes.

- Union Pacific's revenue for the prior quarter, Q4 2024, was approximately $6.1 billion. My forecast reflects a slight sequential decrease, consistent with the expected impact of lower fuel surcharges and softening coal demand.

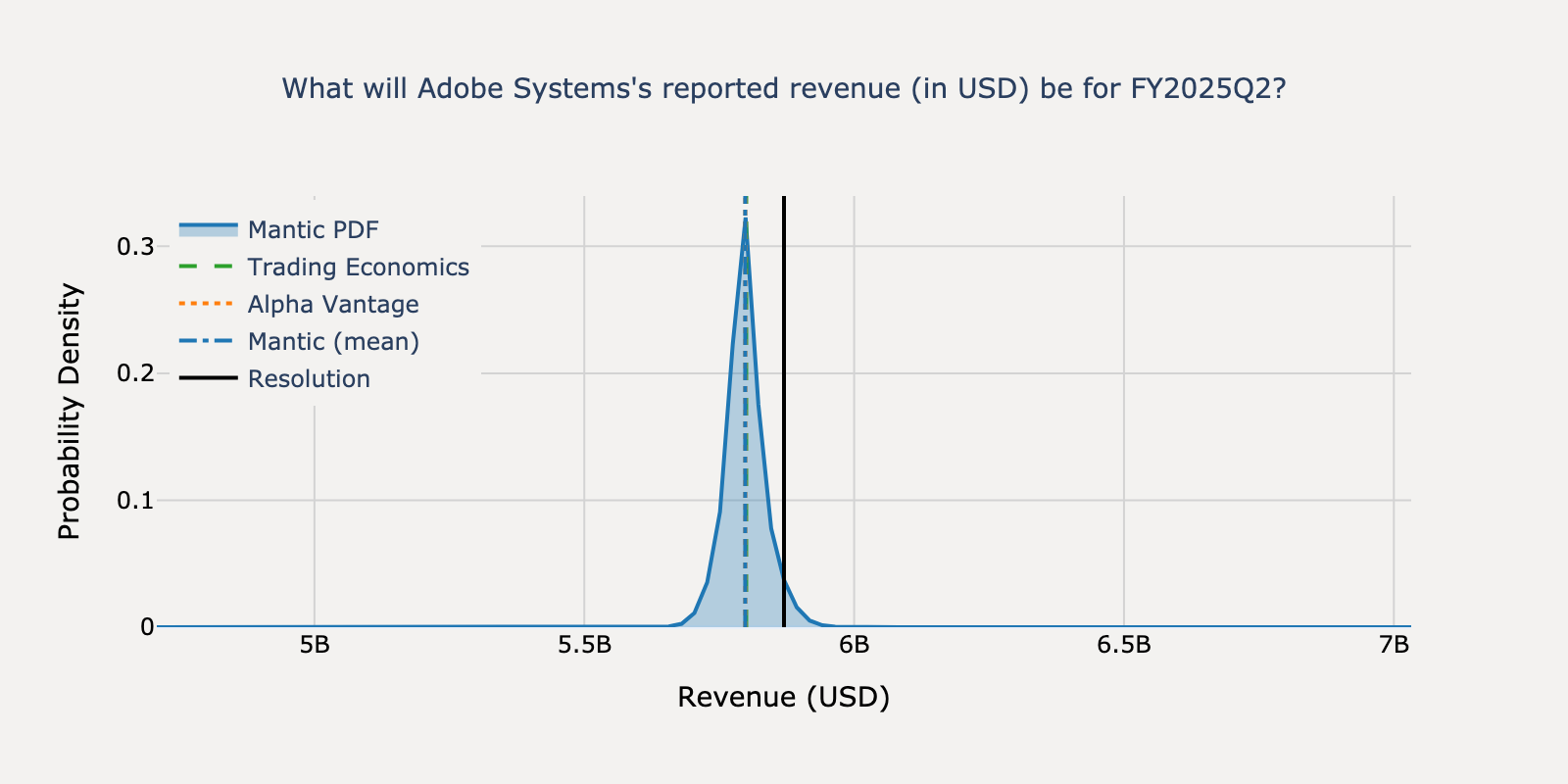

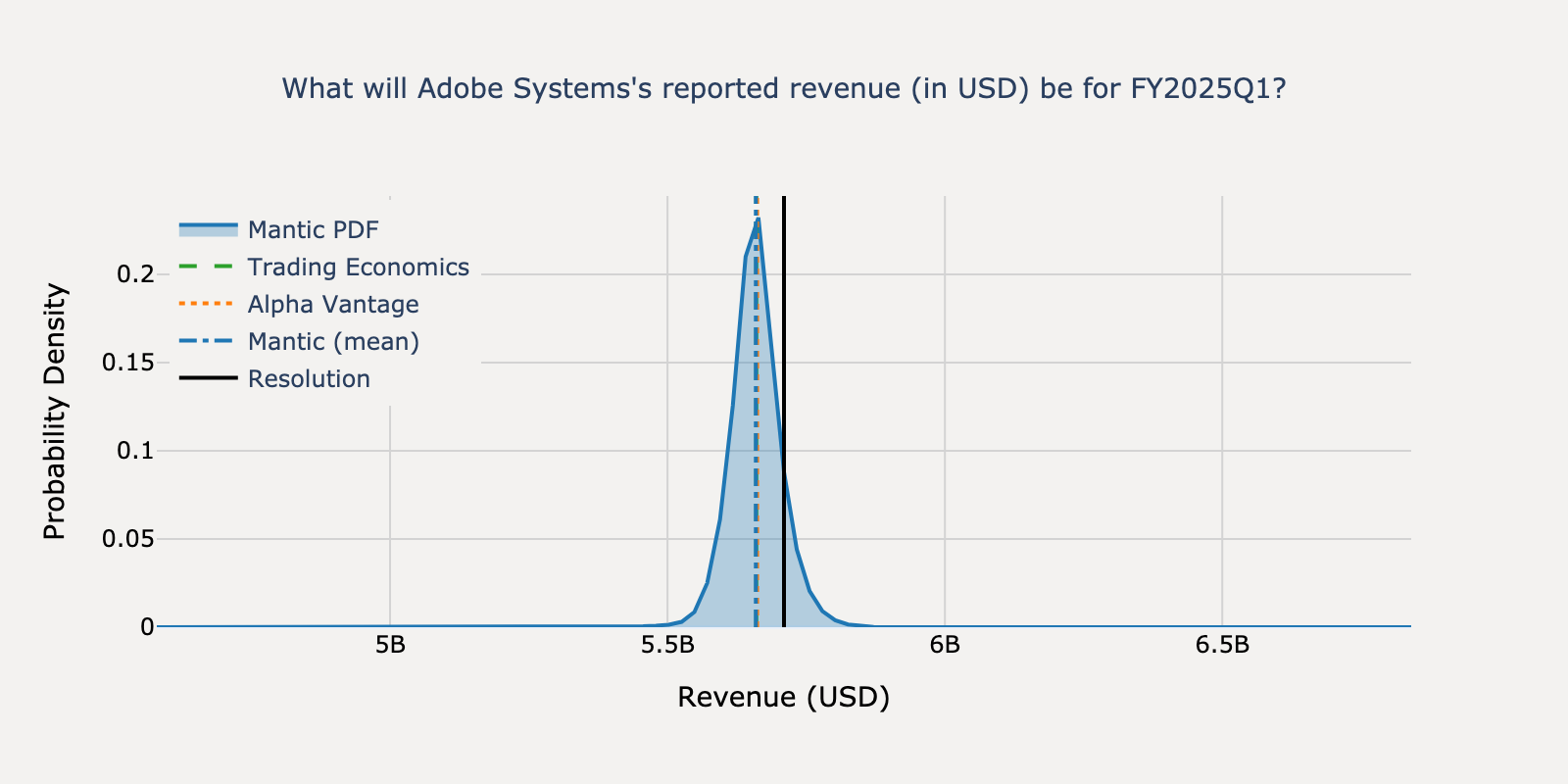

Adobe Systems - Q1 2025

Actual Resolution: $5.87B

Mantic

$5.80B

TE Consensus

$5.80BBEST

AV Consensus

$5.80B

Absolute Percentage Errors

Mantic

1.22%

TE Consensus

1.19%

AV Consensus

1.22%

View Mantic Prediction Analysis

- My median forecast for Adobe's FY2025Q2 revenue is $5.80 billion, with a 50% confidence interval of $5.76 billion to $5.83 billion.

- This forecast is strongly anchored by Adobe's own guidance from its Q1 2025 earnings call, which projected Q2 revenue between $5.77 billion and $5.82 billion.

- Wall Street analyst consensus estimates are highly consistent, clustering around $5.79 billion to $5.80 billion, as reported by sources including Nasdaq and TipRanks.

- Adobe's revenue in the prior quarter, Q1 FY2025, was $5.714 billion, showing a strong growth trend.

- Subscription services, which provide predictable revenue streams, accounted for 96% of total revenue in Q1 2025.

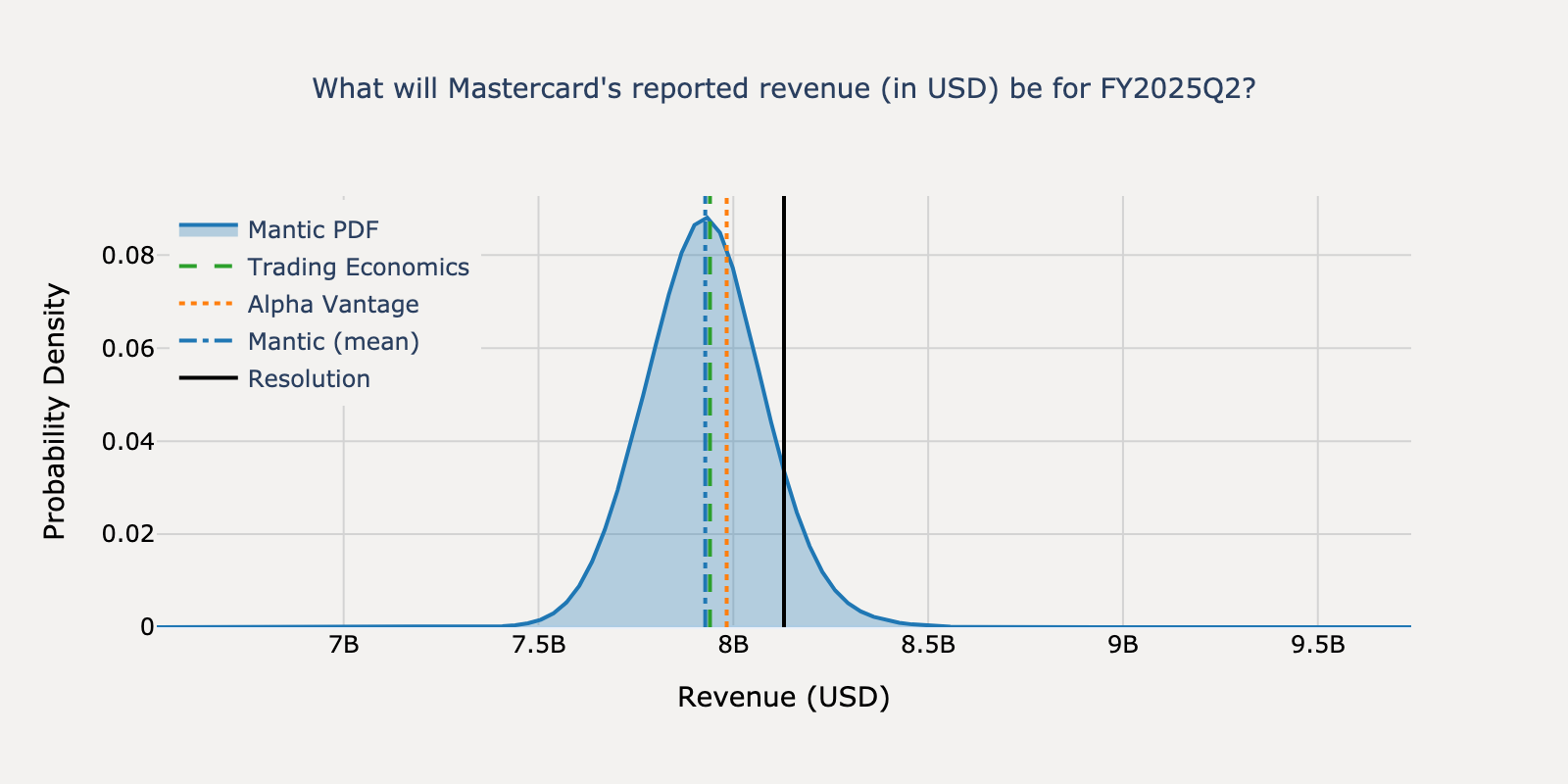

Mastercard - Q2 2025

Actual Resolution: $8.13B

Mantic

$7.93B

TE Consensus

$7.94B

AV Consensus

$7.98BBEST

Absolute Percentage Errors

Mantic

2.49%

TE Consensus

2.34%

AV Consensus

1.81%

View Mantic Prediction Analysis

- We estimate Mastercard's reported revenue for FY2025Q2 will be approximately $7.91 billion, with a 50% confidence interval of $7.74 billion to $8.06 billion.

- This forecast is anchored by Mastercard's guidance for low-teens year-over-year revenue growth for the quarter, plus an additional 1 to 1.5 percentage points from acquisitions. Wall Street analyst consensus is similar at $7.93 billion.

- Supporting this growth are healthy macroeconomic trends, including positive US consumer spending in Q2 2025 and robust cross-border transaction volumes, which grew 16% year-to-date through late April 2025.

- Uncertainty in the forecast stems primarily from the timing of higher rebates and incentives, which management indicated would increase as the year progresses, and unpredictable foreign exchange volatility.

- Concerns about disruption from stablecoins are considered a minor factor for this quarter's revenue, a view supported by several analyst reports.

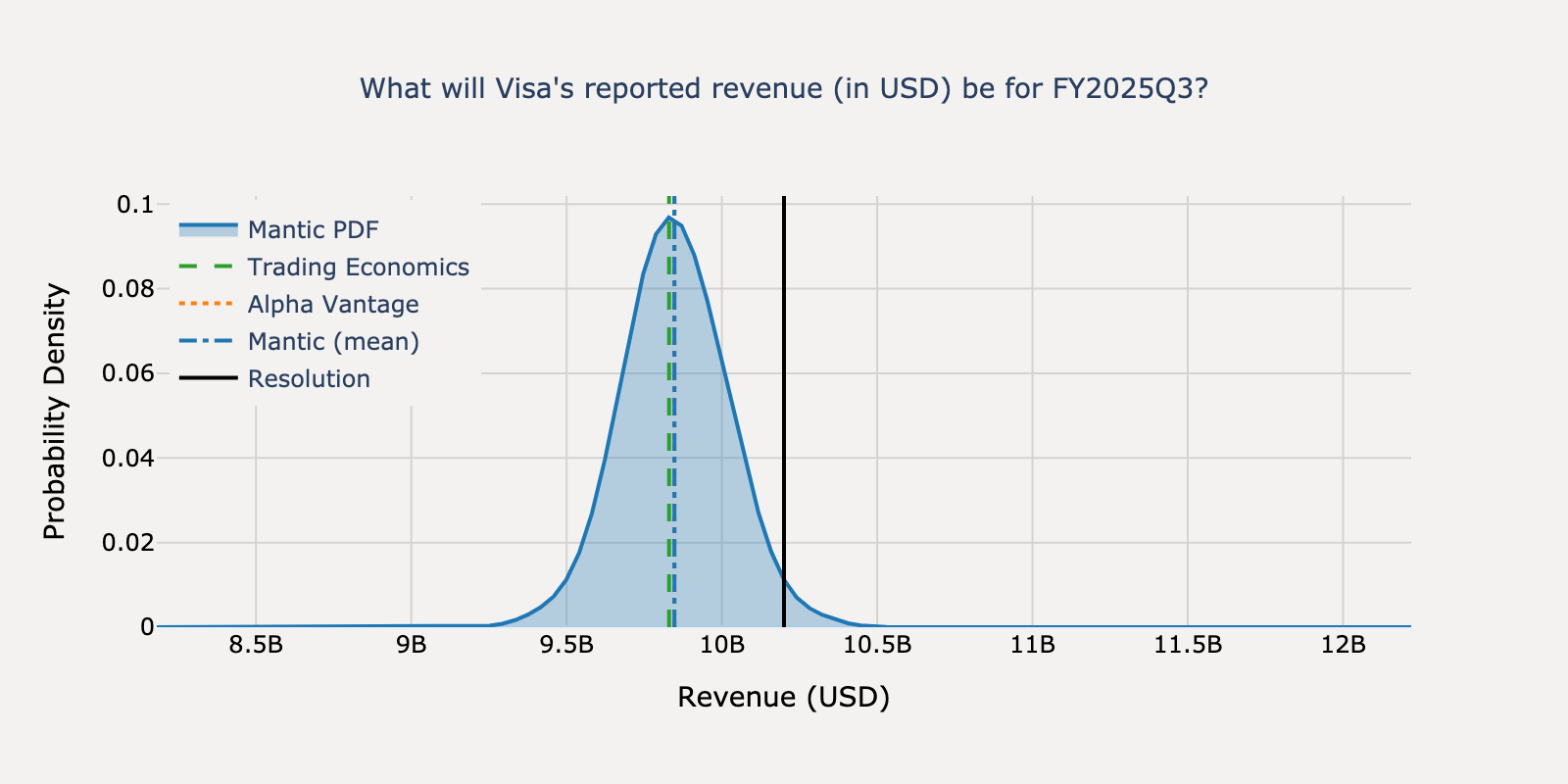

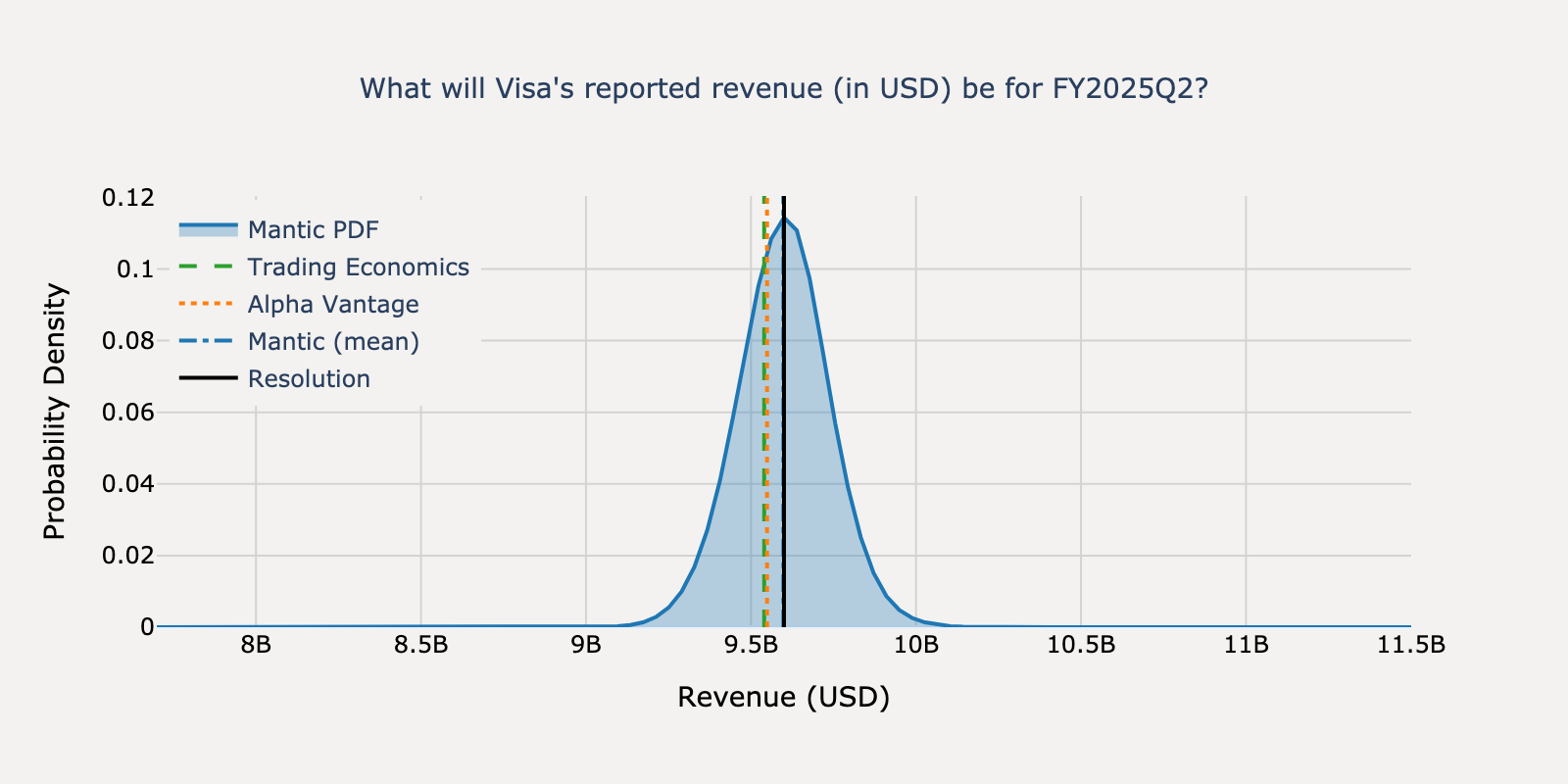

Visa - Q2 2025

Actual Resolution: $10.20B

Mantic

$9.85B

TE Consensus

$9.83B

AV Consensus

$9.85BBEST

Absolute Percentage Errors

Mantic

3.46%

TE Consensus

3.63%

AV Consensus

3.46%

View Mantic Prediction Analysis

- I estimate Visa's FY2025Q3 revenue will be $9.85 billion, with a 50% confidence interval of $9.7 billion to $10.0 billion.

- This forecast represents approximately 10.7% year-over-year growth from the $8.9 billion in revenue reported for the same quarter last year (FY2024Q3).

- The estimate is supported by resilient US consumer spending, with retail sales growing 4.4% year-over-year in June 2025, and continued strength in Visa's cross-border transaction volumes.

- Key headwinds tempering growth include client incentives, a contra-revenue item that grew 15% in the prior quarter, and adverse foreign exchange rate movements which reduced Q2 revenue growth by two percentage points.

- The forecast is slightly above the analyst consensus of $9.82 billion, reflecting Visa's tendency to deliver modest positive revenue surprises.

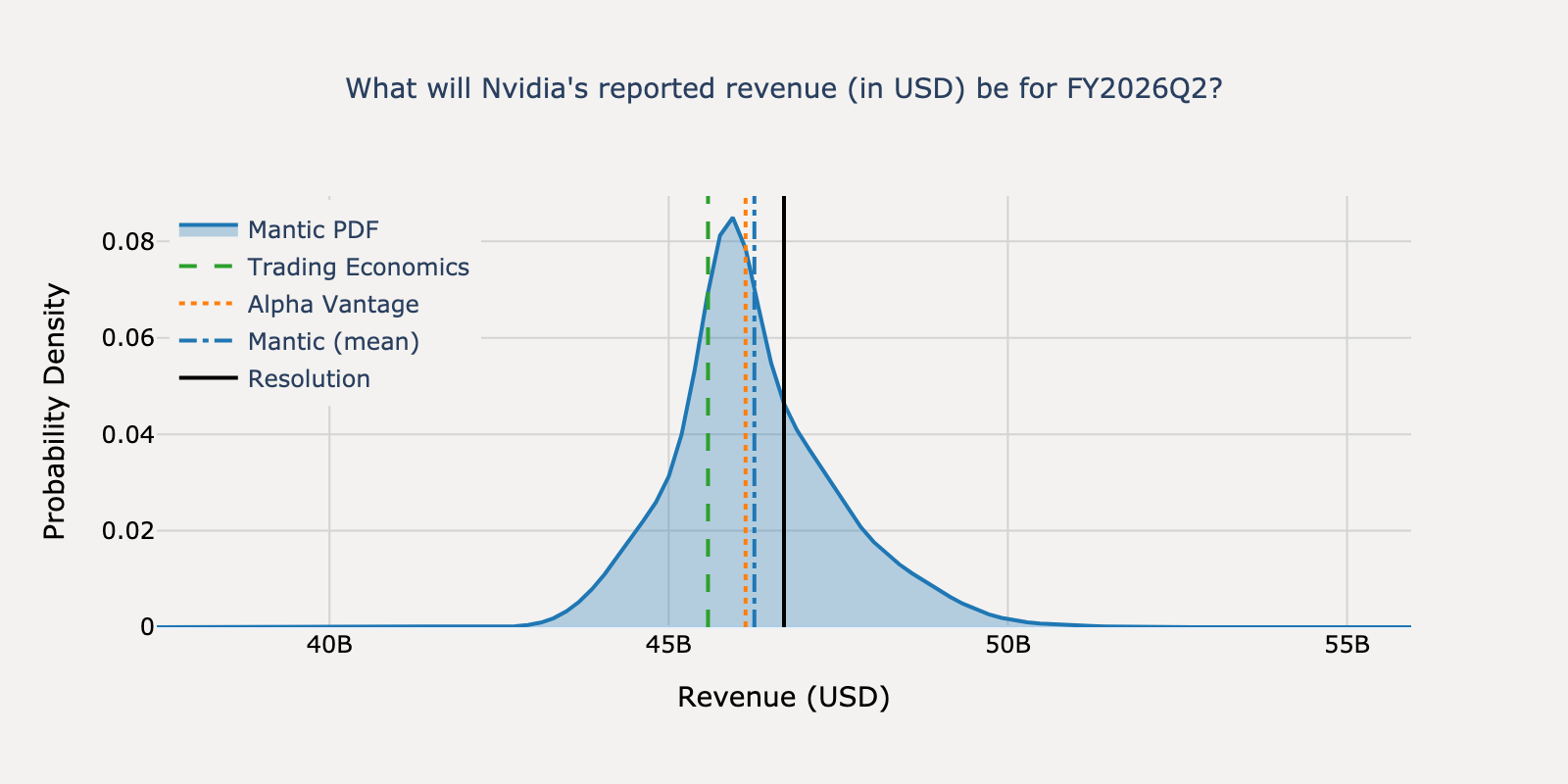

Nvidia - Q2 2025

Actual Resolution: $46.70B

Mantic

$46.26BBEST

TE Consensus

$45.58B

AV Consensus

$46.13B

Absolute Percentage Errors

Mantic

0.94%

TE Consensus

2.40%

AV Consensus

1.21%

View Mantic Prediction Analysis

- Our median estimate for Nvidia's FY2026Q2 revenue is $46.0 billion, with a 50% confidence interval of $45.1 billion to $47.1 billion.

- This forecast is slightly above both Nvidia's official guidance of $45 billion ±2% (from $44.1 billion to $45.9 billion) and the Wall Street consensus estimate of approximately $45.8 billion.

- Strong, ongoing demand for AI accelerators from major cloud providers and the initial revenue ramp from the new Blackwell GPU architecture are key drivers supporting growth above the company's guidance.

- The U.S. government's decision late in the quarter to license H20 chip sales to China creates potential for a revenue beat, although the timing of recognition and a 15% government levy on these sales introduce uncertainty.

- Nvidia's reported revenue for the prior quarter (Q1 FY2026) was $44.1 billion, with gross margins impacted by a $4.5 billion charge related to previous H20 export restrictions.

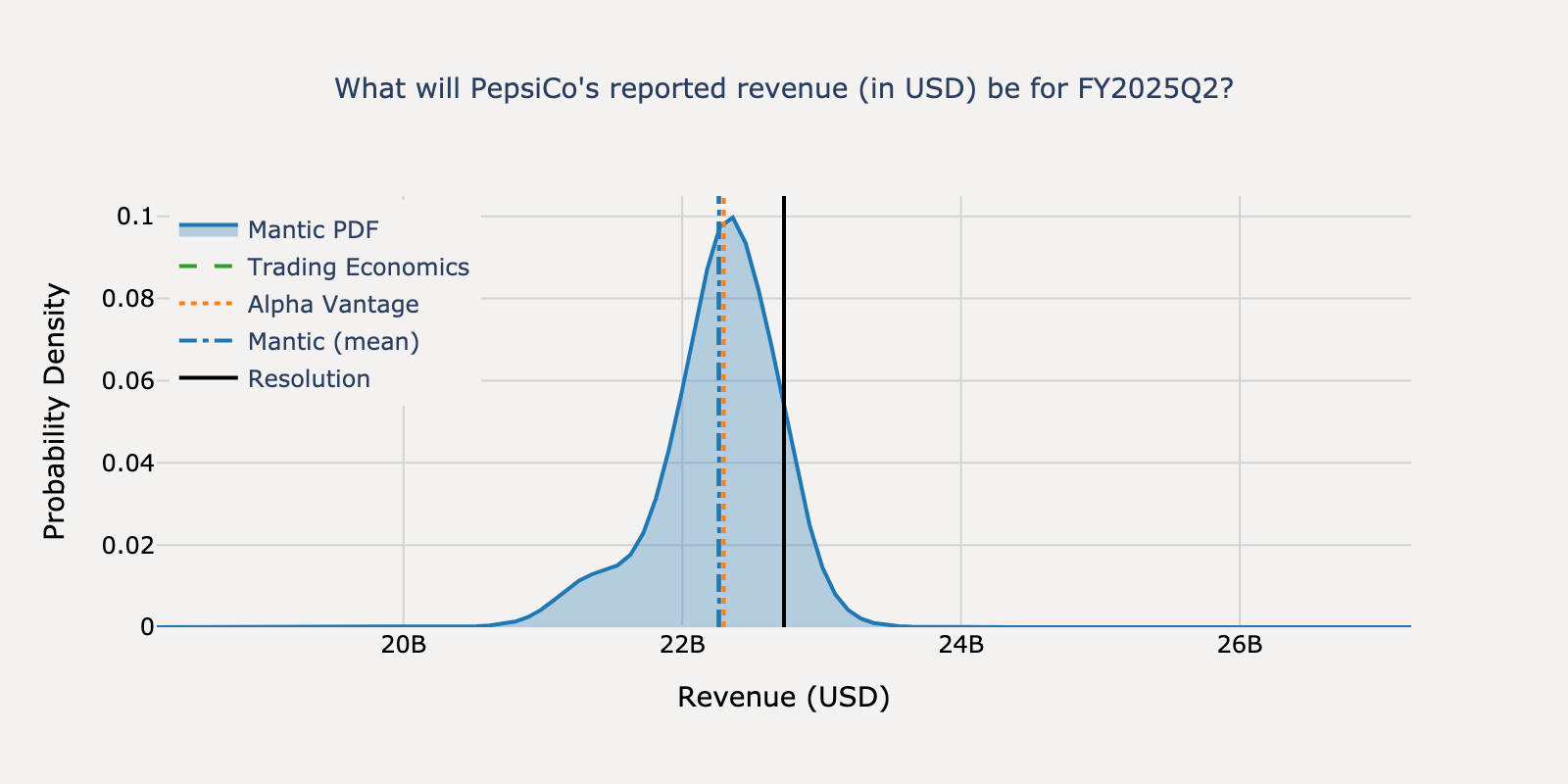

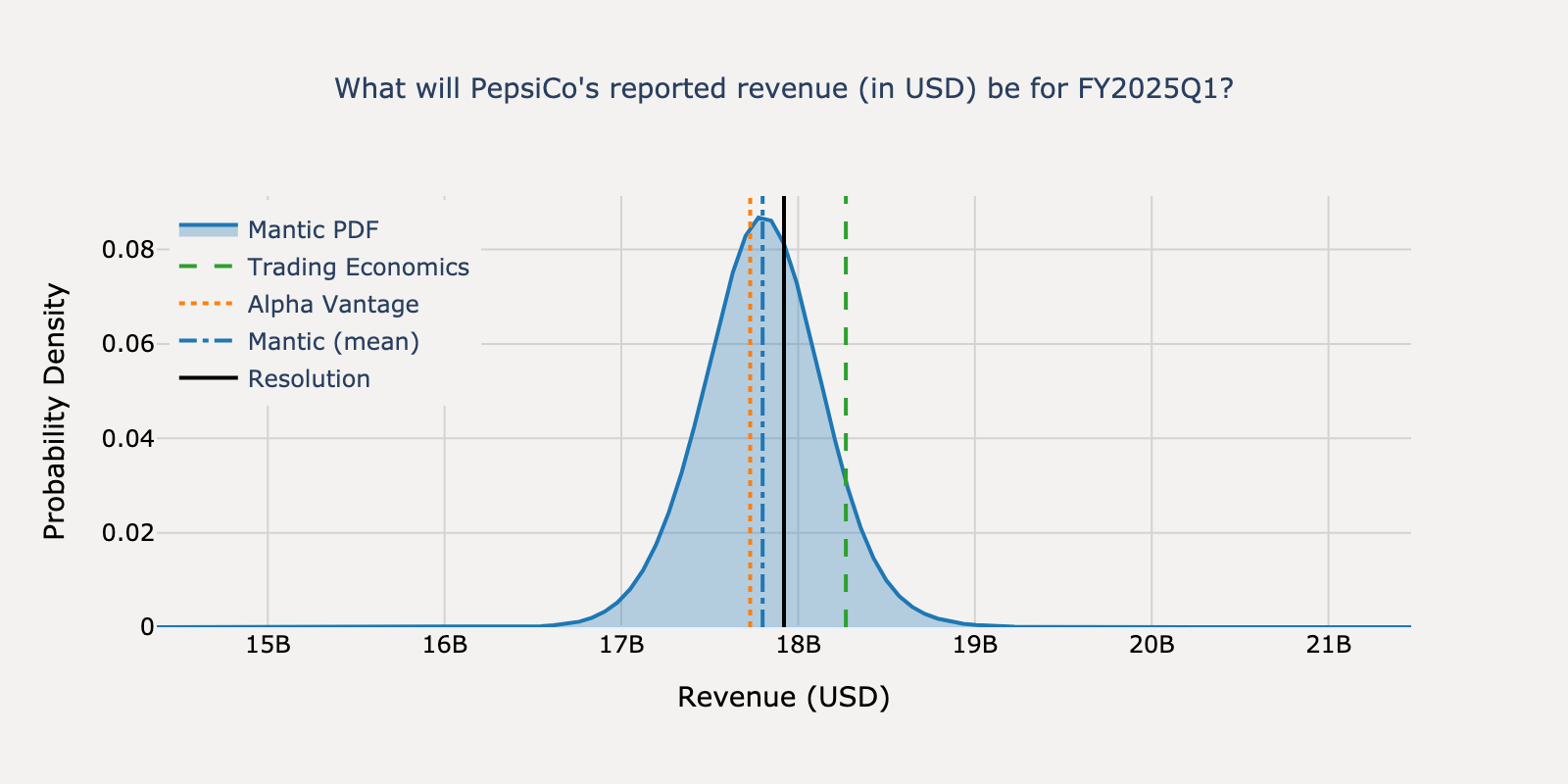

PepsiCo - Q2 2025

Actual Resolution: $22.73B

Mantic

$22.26B

TE Consensus

$22.26B

AV Consensus

$22.30BBEST

Absolute Percentage Errors

Mantic

2.05%

TE Consensus

2.07%

AV Consensus

1.90%

View Mantic Prediction Analysis

- I estimate PepsiCo's reported revenue for FY2025Q2 will be approximately $21.5 billion.

- This forecast is below the analyst consensus range of $22.25 billion to $22.4 billion, reflecting significant headwinds.

- The primary driver for this pessimistic outlook is ongoing volume weakness in the Frito-Lay North America (PFNA) division, which experienced a 3% organic volume decline in Q1 2025.

- Negative impacts from foreign exchange rates and new tariffs are also expected to reduce reported revenue. In Q1 2025, unfavorable currency translation alone reduced net revenue by 3 percentage points.

- A pressured US consumer backdrop, confirmed by management reports of reduced traffic in convenience stores, is expected to further depress sales volume.

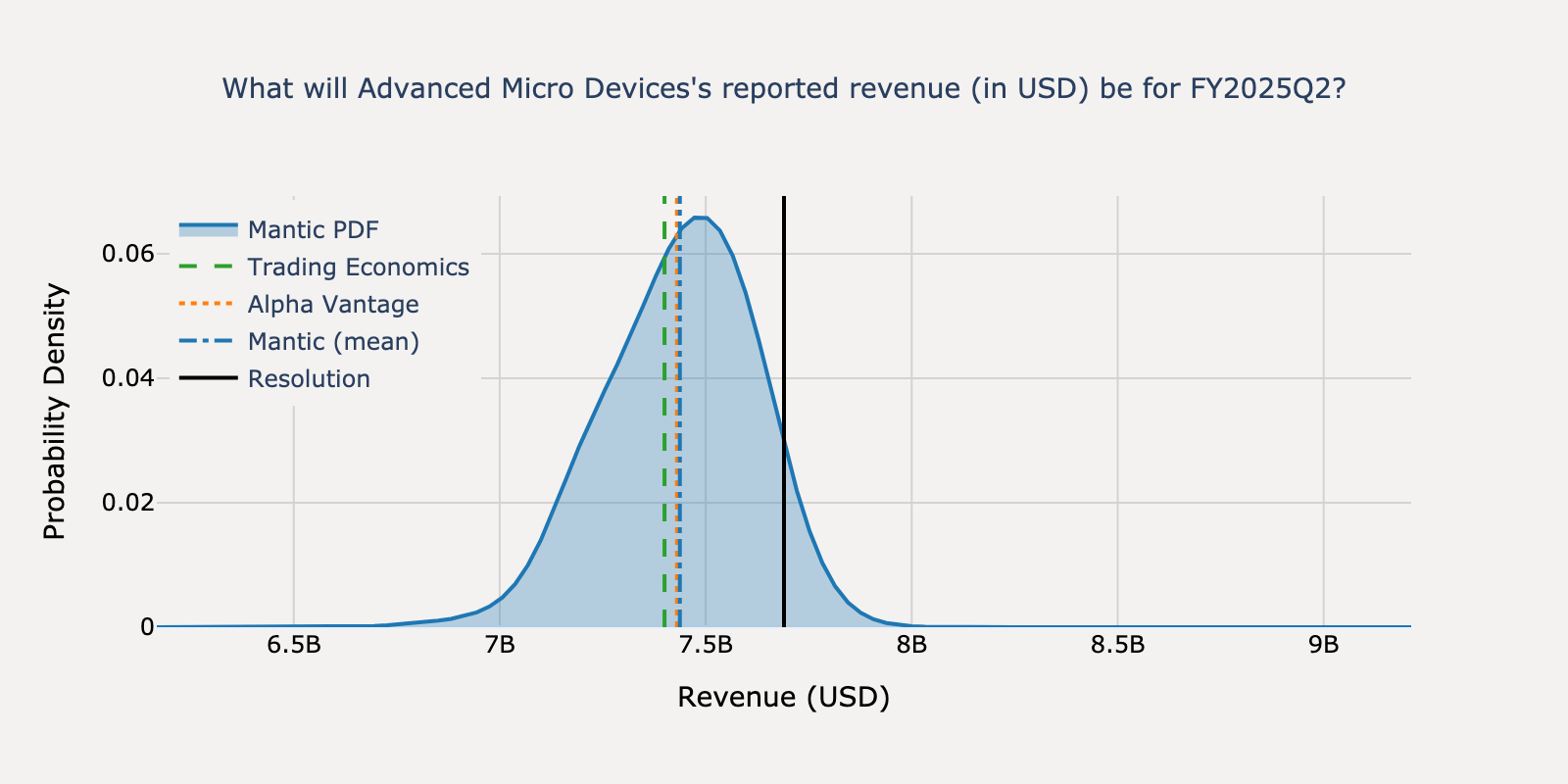

Advanced Micro Devices - Q2 2025

Actual Resolution: $7.69B

Mantic

$7.44BBEST

TE Consensus

$7.40B

AV Consensus

$7.43B

Absolute Percentage Errors

Mantic

3.29%

TE Consensus

3.77%

AV Consensus

3.38%

View Mantic Prediction Analysis

- My forecast for AMD's FY2025Q2 reported revenue is $7.44 billion, with a 50% confidence interval of $7.26 billion to $7.61 billion.

- AMD's guidance projects revenue of $7.4 billion, plus or minus $300 million. This official forecast accounts for an estimated $700 million revenue reduction from new U.S. export controls on AI chip sales to China.

- Wall Street consensus estimates are for revenue near $7.42 billion, aligning closely with company guidance. Some analysts project revenue could exceed $7.5 billion, citing stronger than expected demand.

- Key upside potential comes from the Client segment, which grew 68% year-over-year in Q1. This is supported by a broader PC market recovery, where global shipments increased 8.4% year-over-year in Q2 2025.

- While the Data Center segment is expected to decline sequentially due to China export controls, continued market share gains for EPYC server CPUs provide underlying strength.

Adobe Systems - Q4 2024

Actual Resolution: $5.71B

Mantic

$5.66B

TE Consensus

$5.66B

AV Consensus

$5.66BBEST

Absolute Percentage Errors

Mantic

0.89%

TE Consensus

0.88%

AV Consensus

0.85%

View Mantic Prediction Analysis

- I estimate Adobe's FY2025Q1 revenue will be $5.66 billion, with a 50% confidence interval of $5.62 billion to $5.70 billion.

- Adobe's management provided a revenue target of $5.63 billion to $5.68 billion for the first quarter of fiscal year 2025.

- Approximately 95% of Adobe's revenue is derived from subscriptions, which makes near-term financial results highly predictable and limits the potential for large surprises.

- For the prior quarter, Q4 FY2024, Adobe reported revenue of $5.61 billion. The Q1 guidance is consistent with continued high single-digit year-over-year growth.

- Upside to the revenue guidance could come from momentum in the Document Cloud and the adoption of new AI features. Downside risks include currency headwinds and variability in the timing of enterprise deal closures.

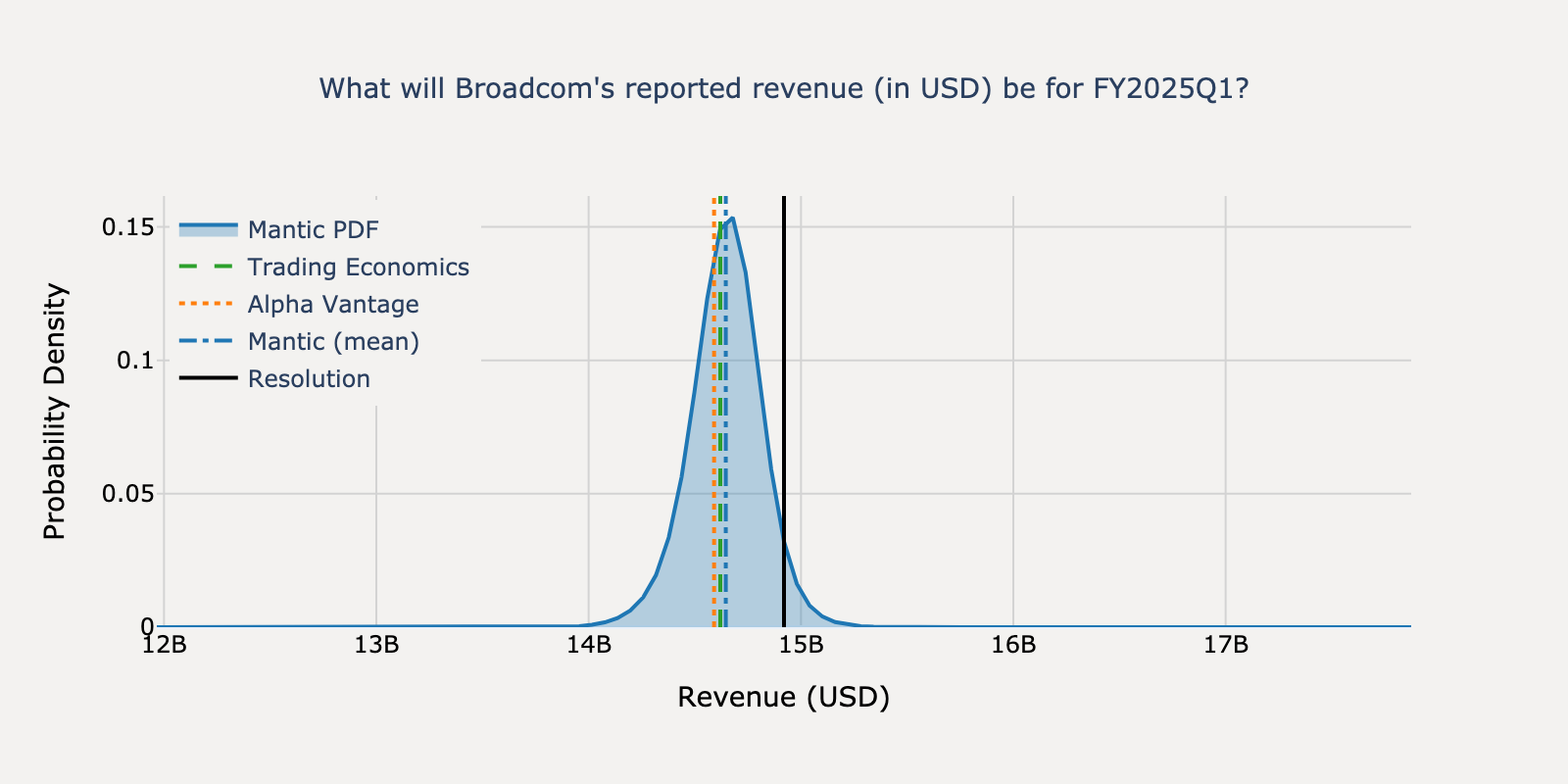

Broadcom - Q4 2024

Actual Resolution: $14.92B

Mantic

$14.65BBEST

TE Consensus

$14.62B

AV Consensus

$14.59B

Absolute Percentage Errors

Mantic

1.84%

TE Consensus

2.01%

AV Consensus

2.21%

View Mantic Prediction Analysis

- I estimate Broadcom's reported revenue for FY2025Q1 will be $14.62 billion. My 50% confidence interval is narrow, from $14.5 billion to $14.8 billion.

- The forecast is anchored on Broadcom's own guidance of approximately $14.6 billion. Analyst consensus estimates are also tightly clustered around this figure, from $14.59 billion to $14.7 billion.

- Potential for revenue to slightly exceed guidance is driven by strong demand for AI-related products. Management projects AI revenue will grow 65% year-over-year to $3.8 billion.

- The primary offsetting factor is an expected decline in non-AI semiconductor revenue. Management has guided this segment to be down by a mid-teens percentage year-on-year.

- Some infrastructure software deals slipping from the previous quarter into Q1 provide another small source of potential upside against the company's guidance.

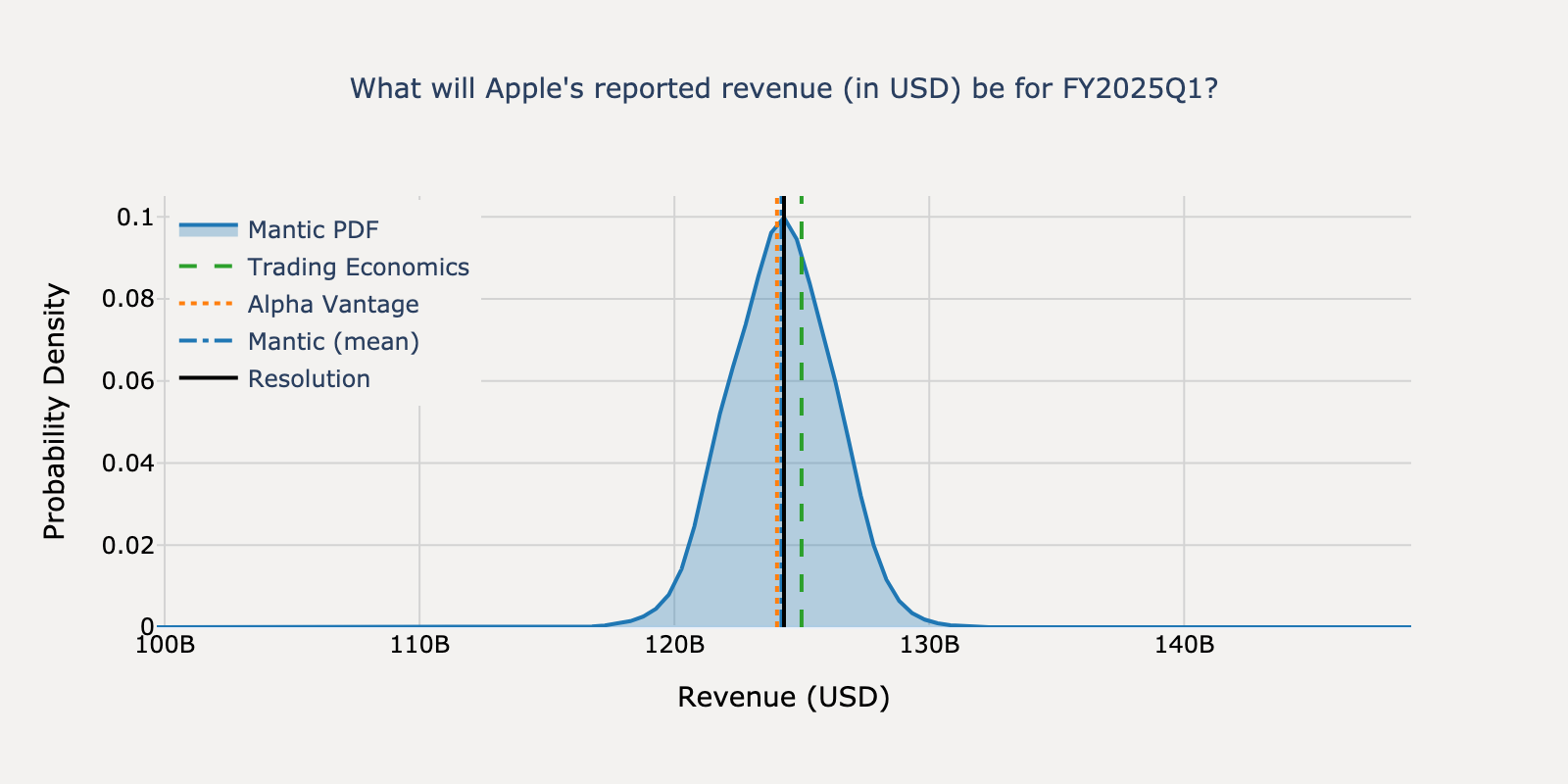

Apple - Q4 2024

Actual Resolution: $124.30B

Mantic

$124.20BBEST

TE Consensus

$124.99B

AV Consensus

$124.03B

Absolute Percentage Errors

Mantic

0.08%

TE Consensus

0.56%

AV Consensus

0.22%

View Mantic Prediction Analysis

- Our median forecast for Apple's FY2025Q1 revenue is $124.0 billion, with a 50% confidence interval between $122.0 billion and $126.0 billion.

- This estimate reflects Apple's own guidance for 'low-to-mid single-digit' year-over-year growth from the $119.6 billion reported in FY2024Q1. It also aligns with the analyst consensus which clusters around $124.2 billion.

- A primary headwind to revenue is weak iPhone demand in China. Reports indicate Apple lost market share to domestic competitors during the quarter, with some data suggesting a shipment decline of over 20%.

- This hardware softness is expected to be substantially offset by strong performance in Apple's Services division. This segment is projected to continue its double-digit year-over-year growth, providing a significant positive contribution to total revenue.

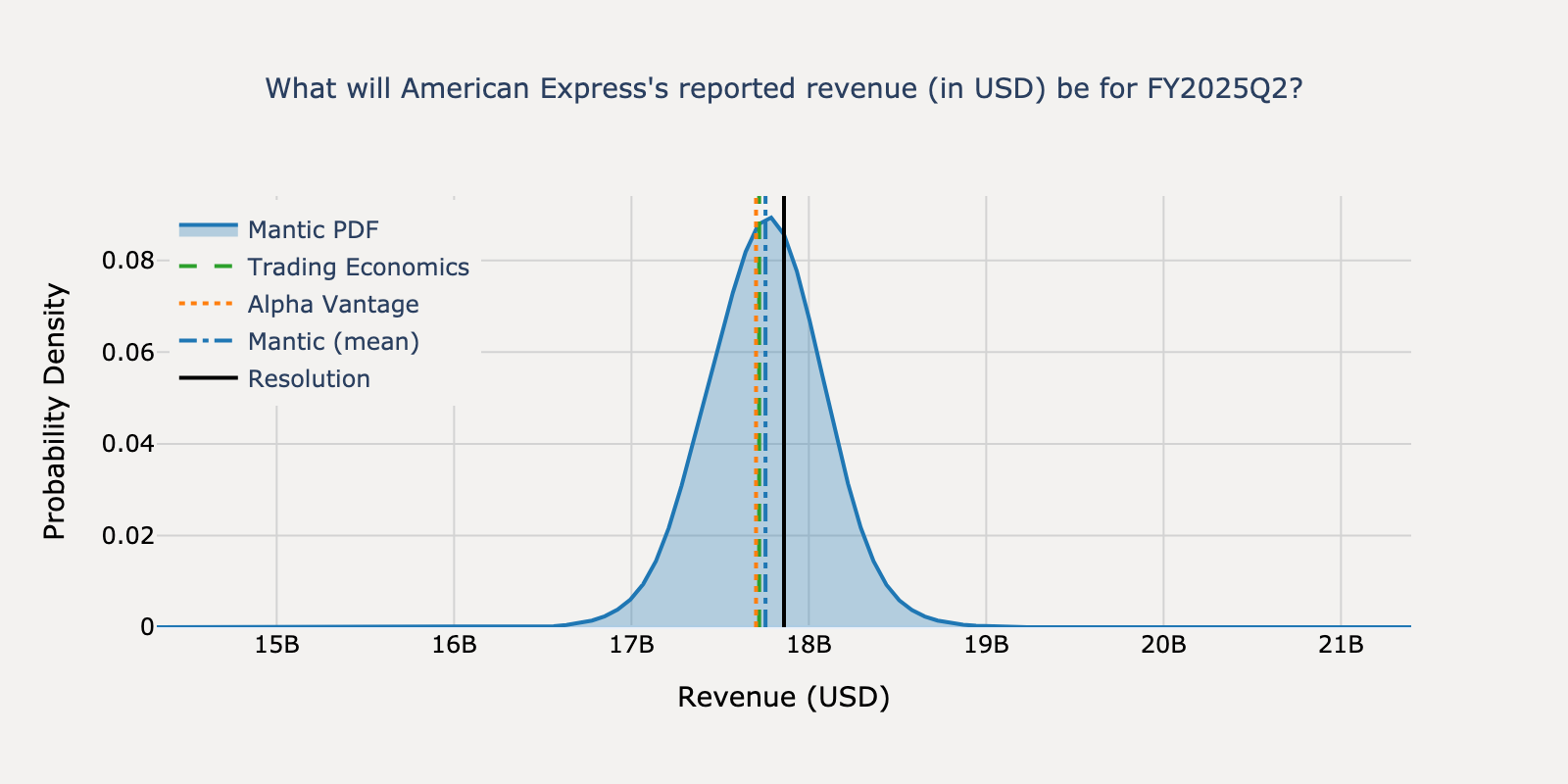

American Express - Q2 2025

Actual Resolution: $17.86B

Mantic

$17.76BBEST

TE Consensus

$17.72B

AV Consensus

$17.70B

Absolute Percentage Errors

Mantic

0.58%

TE Consensus

0.78%

AV Consensus

0.88%

View Mantic Prediction Analysis

- We forecast American Express's revenue for FY2025Q2 to be $17.7 billion. Our 50% confidence interval spans from $17.4 billion to $18.0 billion.

- This forecast is in line with Wall Street analyst consensus of $17.71 billion. It is also consistent with the company's standing guidance for 8% to 10% revenue growth for the full year 2025.

- A key positive indicator for the quarter is the performance of the Delta Air Lines co-brand card. Delta reported its remuneration from American Express increased 10% year-over-year to $2 billion in Q2 2025.

- Potential headwinds include a strong U.S. dollar, which negatively impacts international results. Management also noted a slowdown in the growth of airline billings during the first quarter.

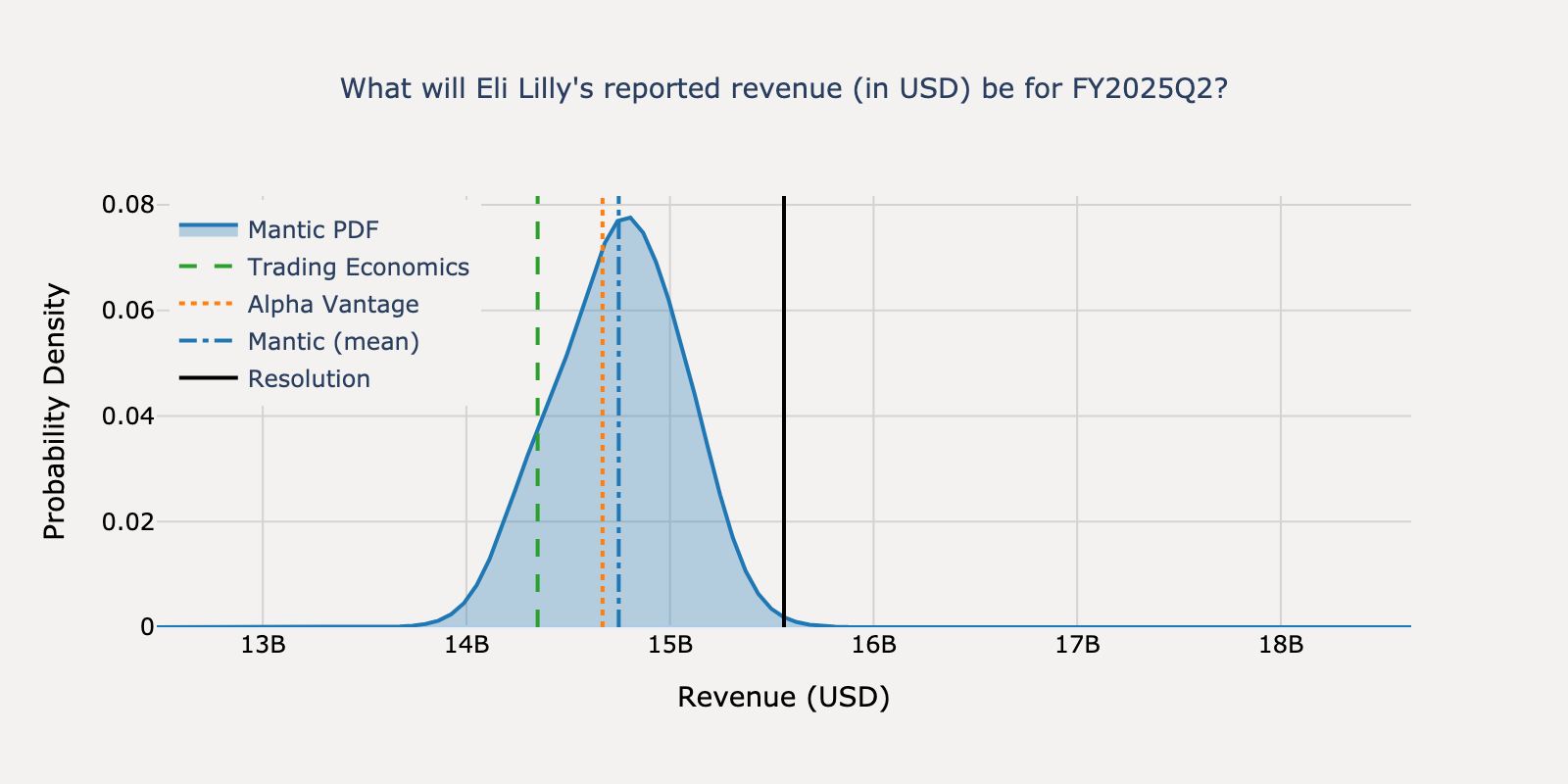

Eli Lilly - Q2 2025

Actual Resolution: $15.56B

Mantic

$14.75BBEST

TE Consensus

$14.35B

AV Consensus

$14.67B

Absolute Percentage Errors

Mantic

5.22%

TE Consensus

7.78%

AV Consensus

5.73%

View Mantic Prediction Analysis

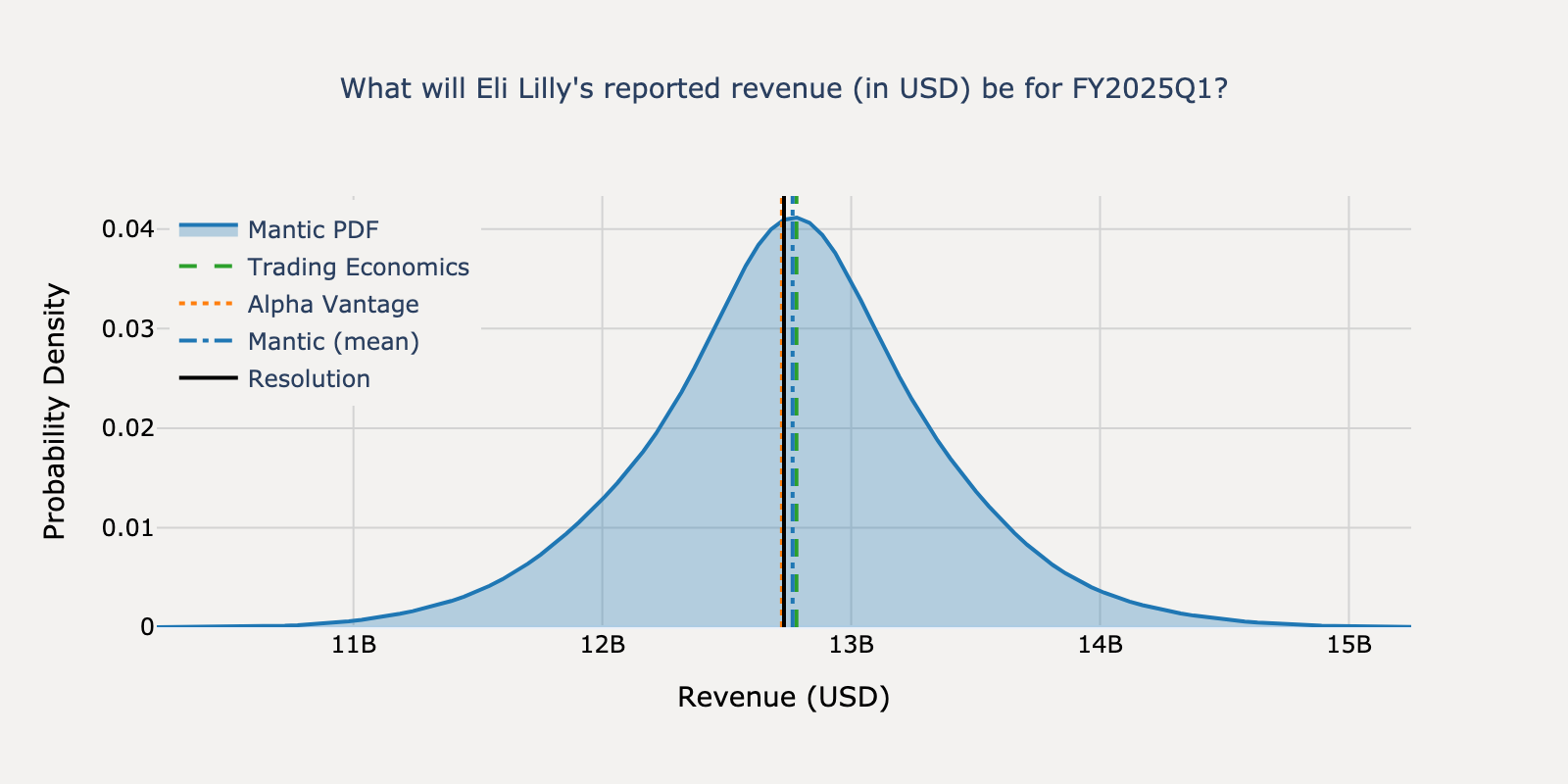

- My median forecast for Eli Lilly's FY2025Q2 revenue is $14.7 billion, with a 50% confidence interval of $14.2 billion to $14.9 billion.

- Analyst consensus estimates for Q2 2025 revenue are centered near $14.75 billion, with most projections falling between $14.4 billion and $14.8 billion.

- Revenue growth is primarily driven by strong sales volume of the GLP-1 products Mounjaro and Zepbound. These two drugs accounted for 48% of total revenue in Q1 2025.

- This volume growth is partially offset by price erosion. The company reported a 6% decrease in realized prices in Q1 2025 and anticipates a mid-to-high single-digit price decline for the full year.

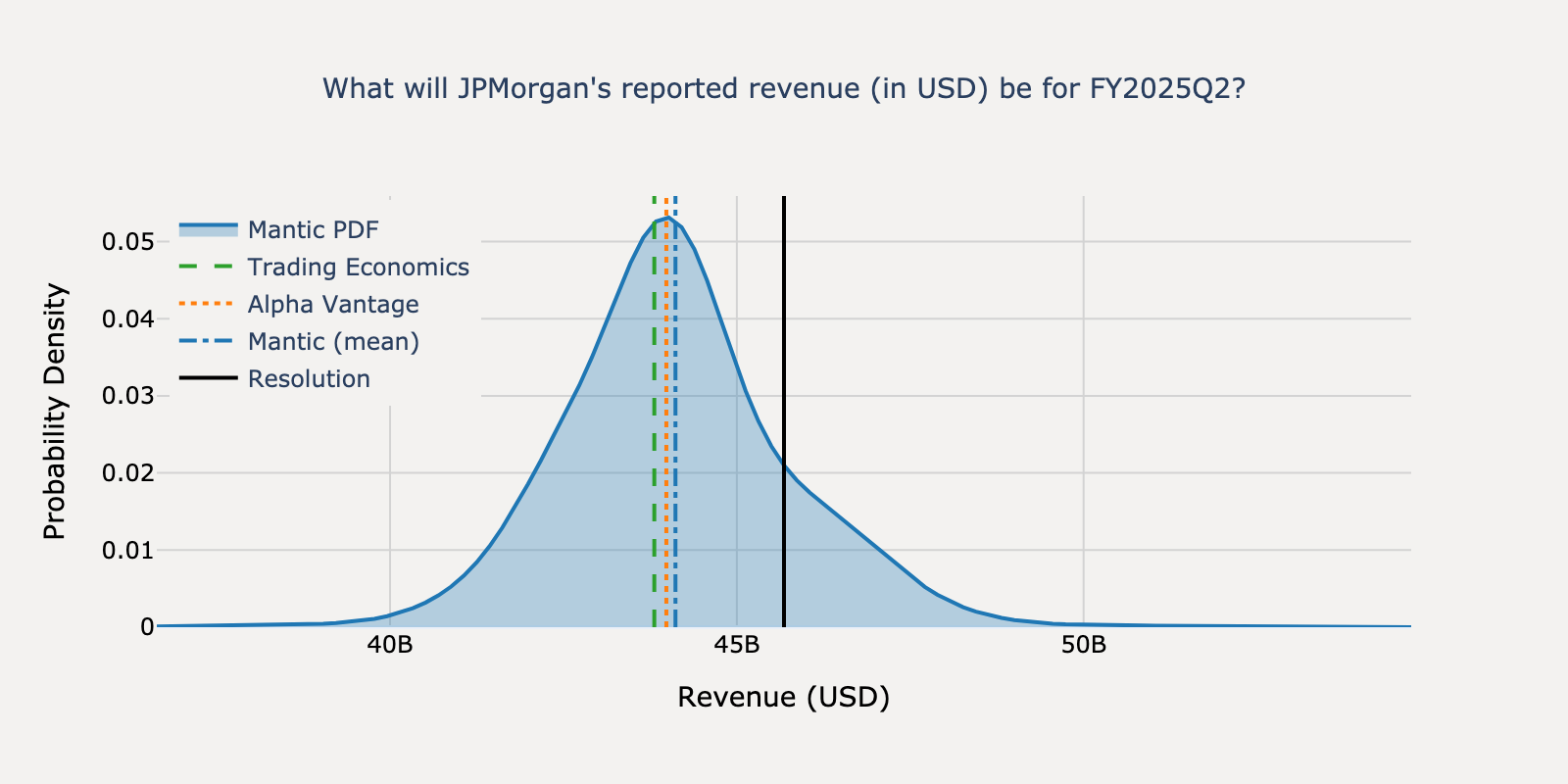

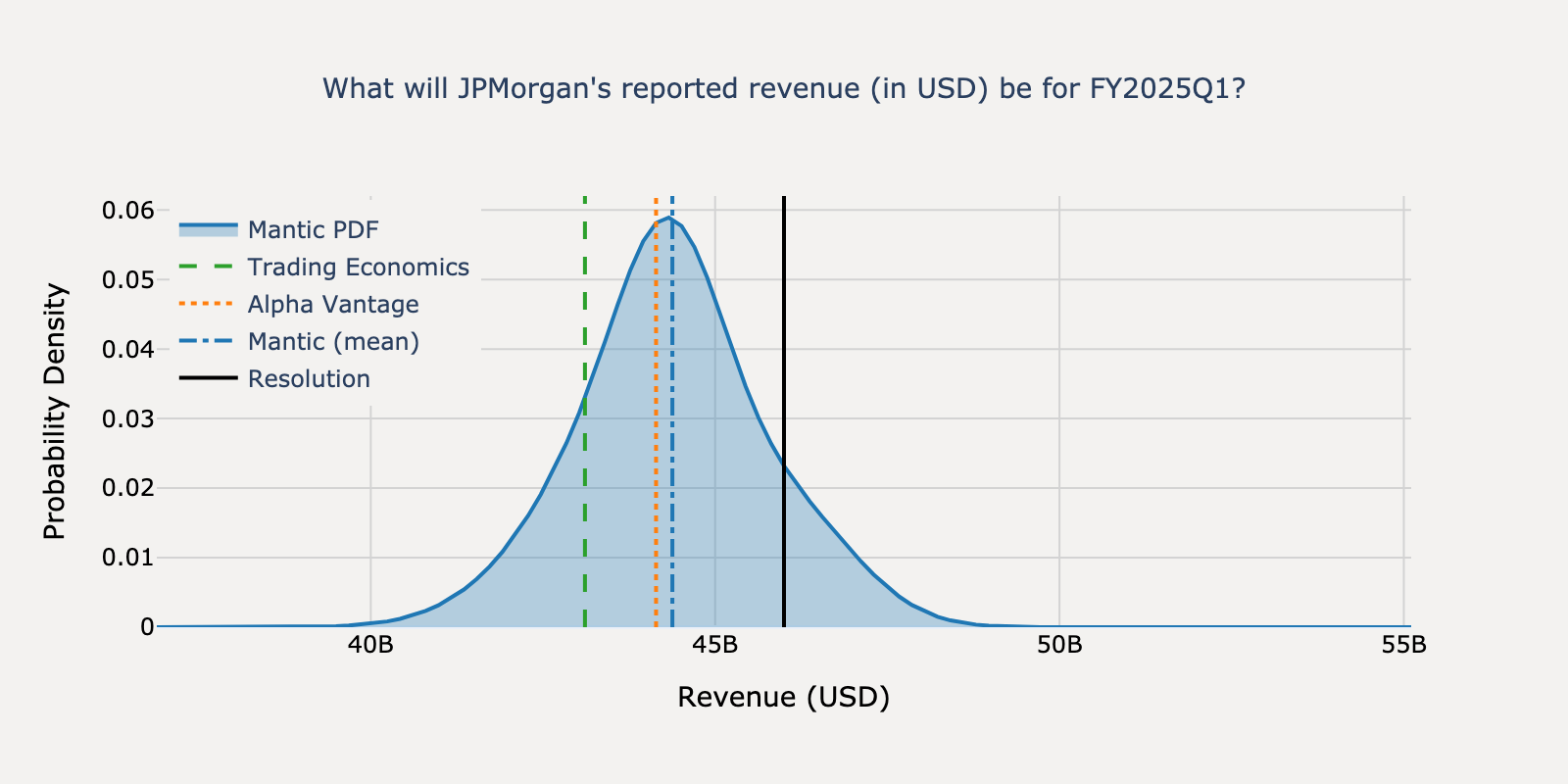

JPMorgan - Q2 2025

Actual Resolution: $45.68B

Mantic

$44.12BBEST

TE Consensus

$43.81B

AV Consensus

$43.98B

Absolute Percentage Errors

Mantic

3.43%

TE Consensus

4.09%

AV Consensus

3.71%

View Mantic Prediction Analysis

- My median estimate for JPMorgan's FY2025Q2 revenue is $44.3 billion, with a 50% confidence interval of $43.1 billion to $45.6 billion.

- Analyst consensus estimates reported in various news articles are slightly lower, clustering around $43.98 billion. This represents a decrease from both the $45.3 billion reported in Q1 2025 and the $50.2 billion from Q2 2024.

- The expected year-over-year decline is primarily driven by management's projection of a 'mid-teens' percentage drop in investment banking fees, as stated in May 2025.

- The sequential decline from the previous quarter is partly explained by the absence of a one-time $588 million gain from the First Republic acquisition that was booked in Q1 2025.

- Net Interest Income is expected to face continued pressure from deposit margin compression, while revenue from the volatile Markets and trading division remains the largest source of uncertainty in the forecast.

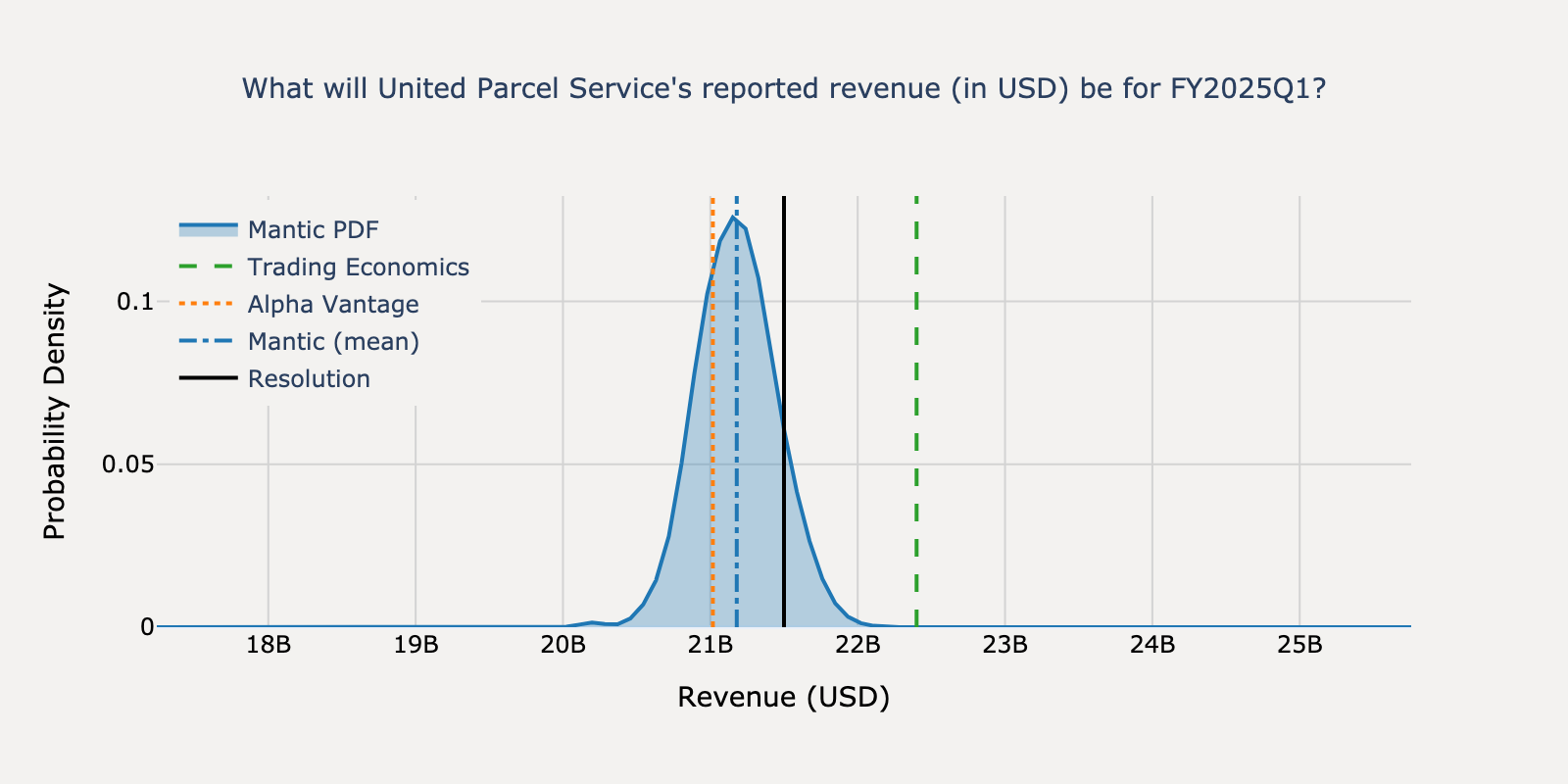

United Parcel Service - Q1 2025

Actual Resolution: $21.50B

Mantic

$21.18BBEST

TE Consensus

$22.40B

AV Consensus

$21.02B

Absolute Percentage Errors

Mantic

1.49%

TE Consensus

4.19%

AV Consensus

2.24%

View Mantic Prediction Analysis

- I estimate United Parcel Service's FY2025Q1 revenue will be $21.3 billion, with a 50% confidence interval of $21.0 billion to $21.9 billion.

- Analyst consensus estimates for Q1 revenue are between $21.02 billion and $21.25 billion. This contrasts with company guidance from January 2025 which suggested a year-over-year revenue increase of nearly 1% from the Q1 2024 baseline of $21.7 billion.

- A significant headwind is the divestiture of the Coyote logistics business, which is expected to reduce year-over-year revenue by approximately $500 million. The company also guided for a 4% decline in consolidated average daily volume for the quarter.

- Offsetting headwinds include a 5.9% general rate increase implemented for 2025 and growth from a new contract as the primary air cargo provider for the USPS. These factors are expected to increase revenue per piece.

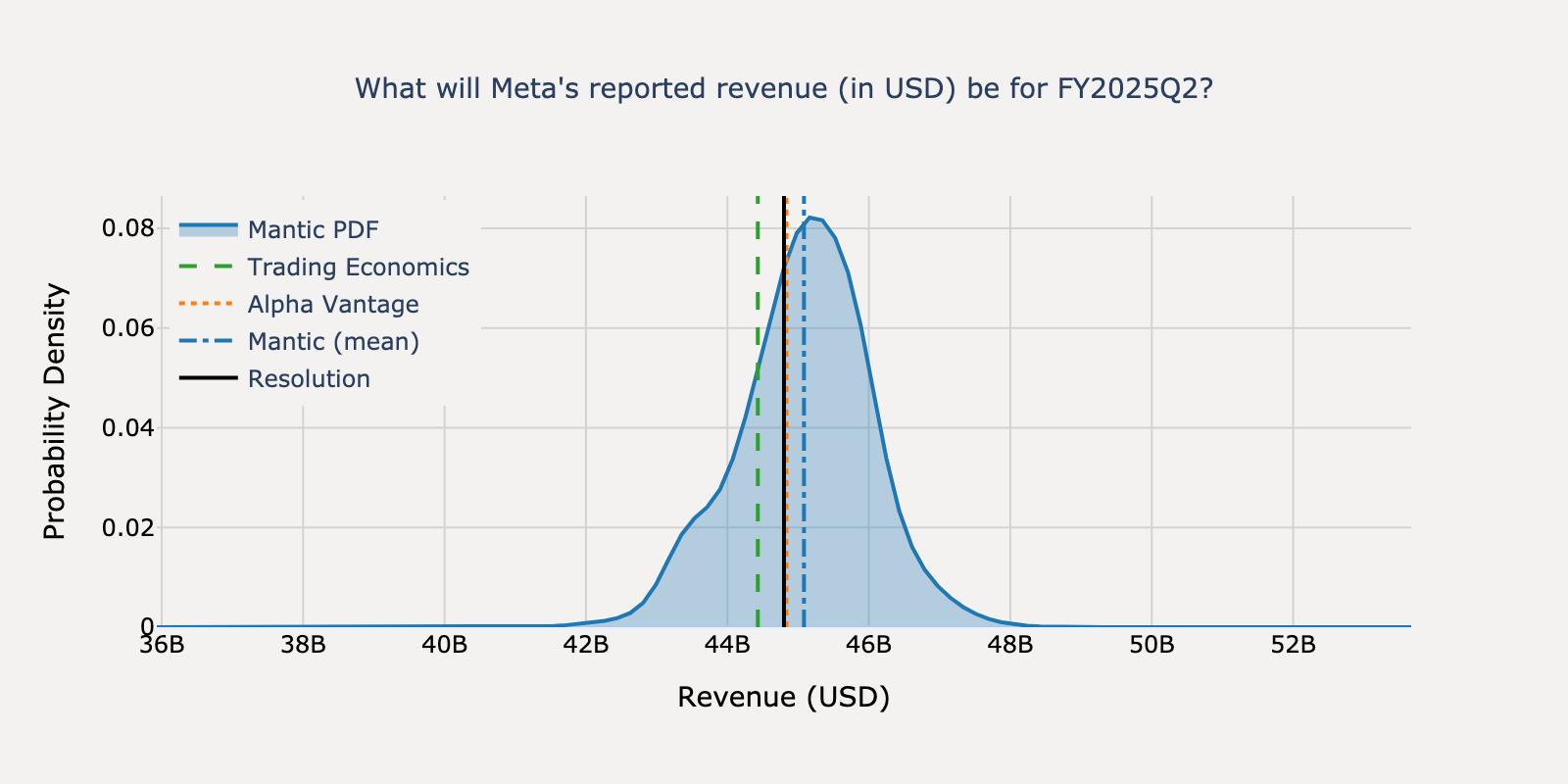

Meta - Q2 2025

Actual Resolution: $44.80B

Mantic

$45.08B

TE Consensus

$44.43B

AV Consensus

$44.84BBEST

Absolute Percentage Errors

Mantic

0.63%

TE Consensus

0.83%

AV Consensus

0.08%

View Mantic Prediction Analysis

- I estimate Meta's FY2025Q2 revenue will be $45.0 billion, with a 50% confidence interval of $44.1 billion to $45.6 billion.

- Meta's official guidance for Q2 revenue is between $42.5 billion and $45.5 billion. Multiple analyst reports project revenue at the high end of this range, around $45.2 billion to $45.5 billion.

- Strong advertising performance underpins this forecast. In the prior quarter, the average price per ad increased 10% year-over-year, and the adoption of AI-driven ad tools has improved conversion rates.

- A notable headwind is reduced ad spending from certain Asia-Pacific exporters. Significant financial impacts from European regulatory changes are not expected to materialize until Q3 2025.

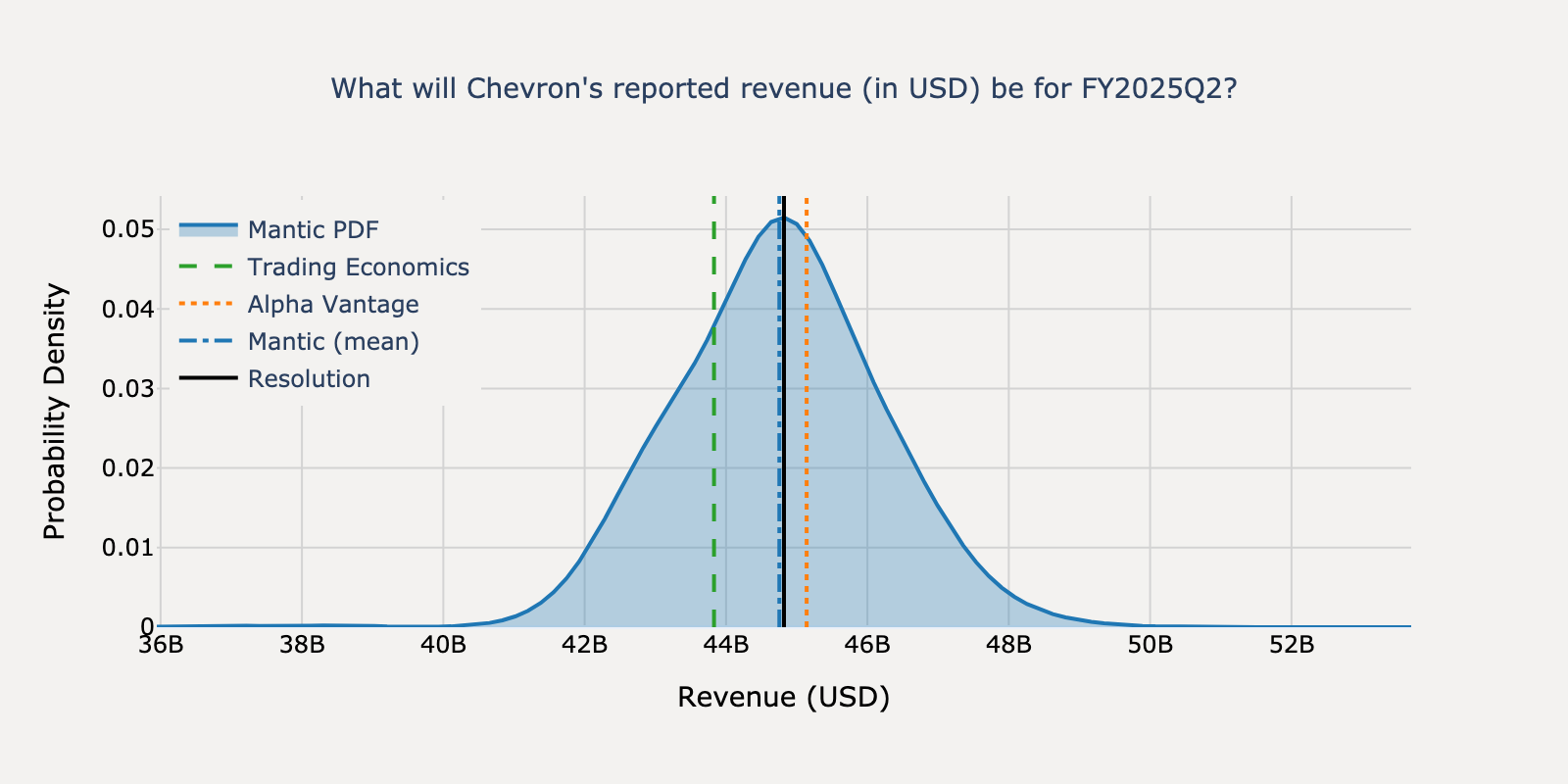

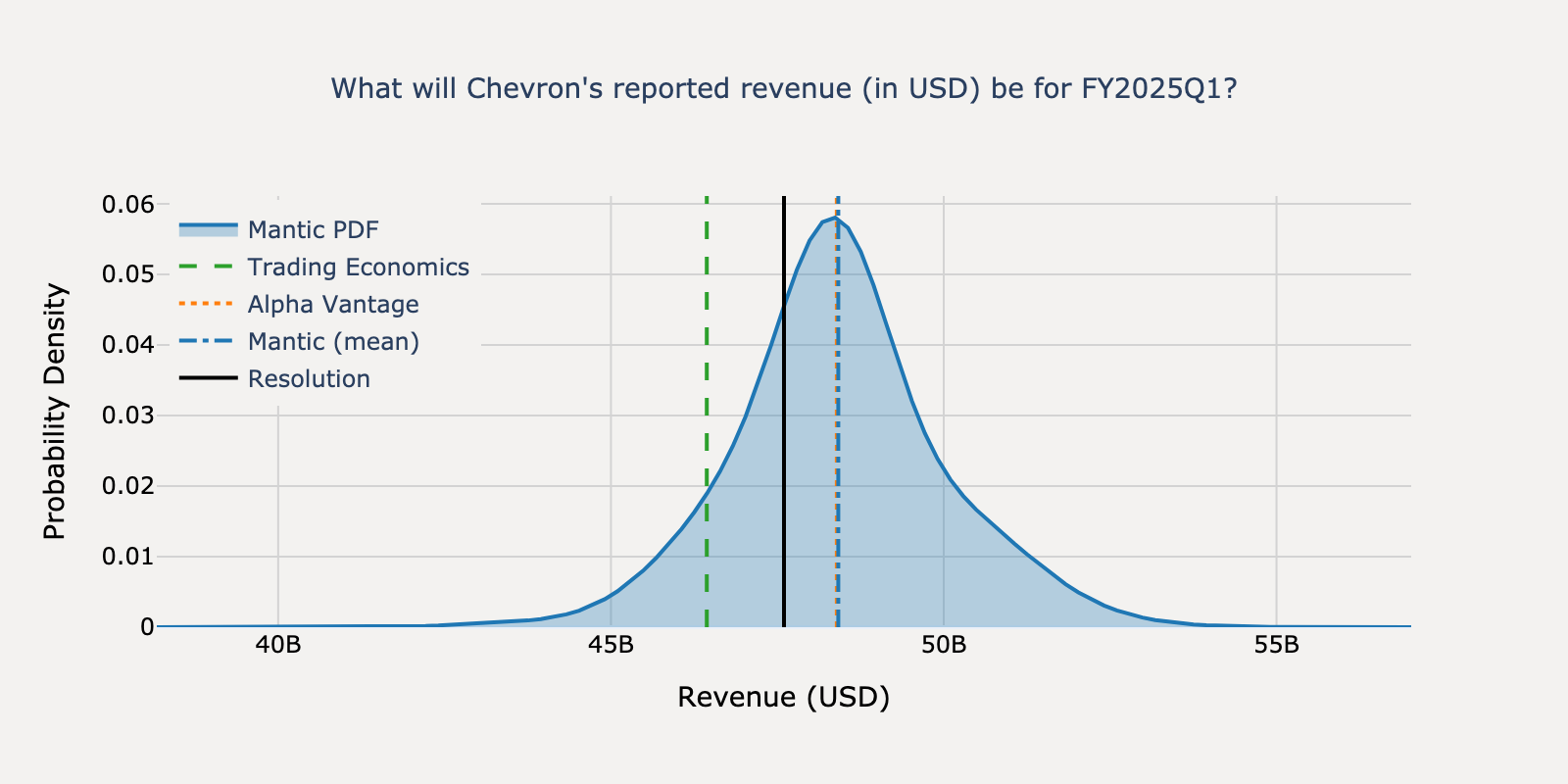

Chevron - Q2 2025

Actual Resolution: $44.82B

Mantic

$44.75BBEST

TE Consensus

$43.83B

AV Consensus

$45.14B

Absolute Percentage Errors

Mantic

0.15%

TE Consensus

2.21%

AV Consensus

0.71%

View Mantic Prediction Analysis

- Our median forecast for Chevron's FY2025Q2 revenue is $44.8 billion, with a 50% confidence interval of $43.7 billion to $46.2 billion.

- Financial analyst consensus estimates for FY2025Q2 revenue are tightly clustered between $44.6 billion and $45.0 billion.

- The forecast implies a year-over-year revenue decline of approximately 13% from $51.2 billion in FY2024Q2, driven primarily by lower average oil and gas prices.

- This expected decline from weaker commodity prices is partly offset by modest production volume growth from operations in the Permian Basin and the Gulf of Mexico.

- The recent closure of the Hess acquisition occurred after the end of the second quarter and therefore will not impact Chevron's reported revenue for this period.

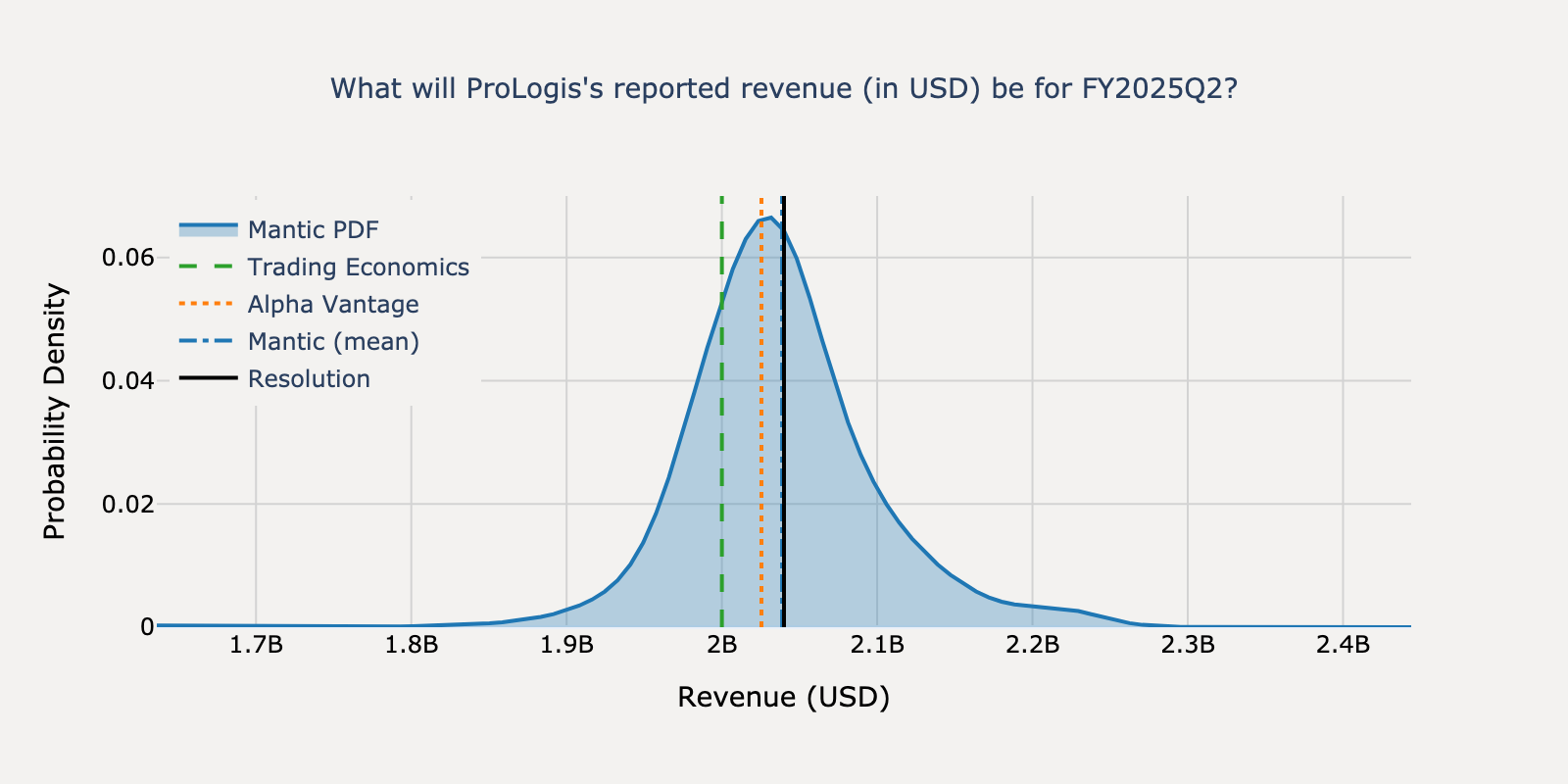

ProLogis - Q2 2025

Actual Resolution: $2.04B

Mantic

$2.04BBEST

TE Consensus

$2.00B

AV Consensus

$2.03B

Absolute Percentage Errors

Mantic

0.06%

TE Consensus

1.96%

AV Consensus

0.71%

View Mantic Prediction Analysis

- I estimate ProLogis's reported revenue for FY2025Q2 will be $2.03 billion, with a 50% confidence interval of $1.99 billion to $2.08 billion.

- This forecast is consistent with multiple analyst consensus estimates for Q2, which range from $2.01 billion to $2.03 billion. The company reported revenue of approximately $1.99 billion in Q1 2025.

- The primary driver of revenue growth is the re-leasing of properties at significantly higher market rates. In its Q1 2025 report, ProLogis noted a 53.7% increase in net effective rent for leases that commenced during that quarter.

- A modest downside risk exists due to economic uncertainty from new tariff policies announced in April 2025. In the Q1 earnings call, management noted this had caused a slowdown in customer leasing decisions.

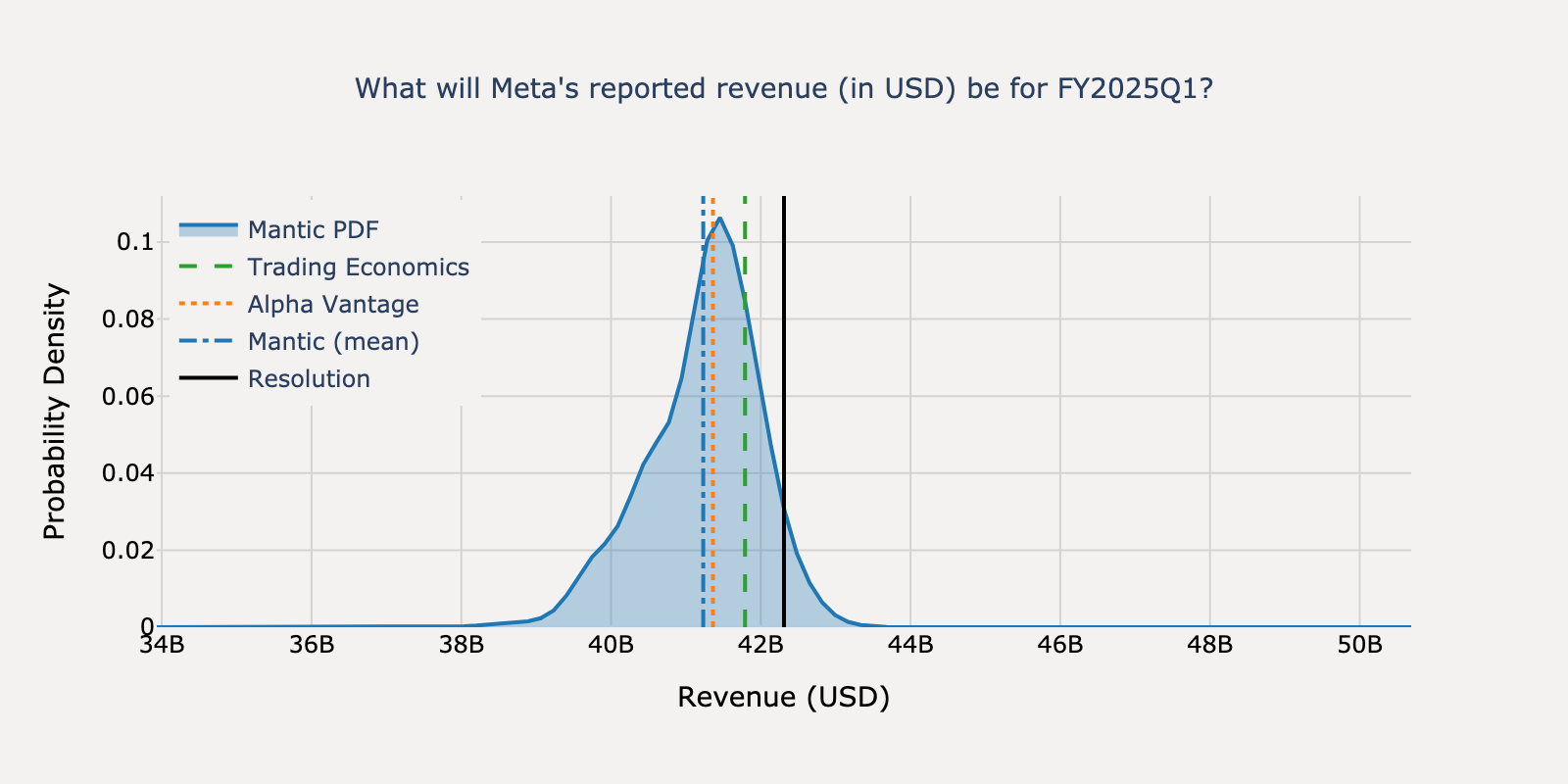

Meta - Q1 2025

Actual Resolution: $42.31B

Mantic

$41.23B

TE Consensus

$41.79BBEST

AV Consensus

$41.36B

Absolute Percentage Errors

Mantic

2.55%

TE Consensus

1.23%

AV Consensus

2.24%

View Mantic Prediction Analysis

- My median estimate for Meta's FY2025Q1 revenue is $41.4 billion, with a 50% confidence interval spanning from $40.8 billion to $42.1 billion.

- The forecast is anchored by Meta's official guidance, which projected Q1 revenue in the range of $39.5 billion to $41.8 billion.

- Wall Street analyst consensus estimates are clustered near the high end of the official guidance, at approximately $41.3 billion to $41.4 billion.

- A potential pullback in advertising from China-based retailers is a notable risk, but its impact is considered more likely to materialize in Q2 2025 rather than the already-completed Q1.

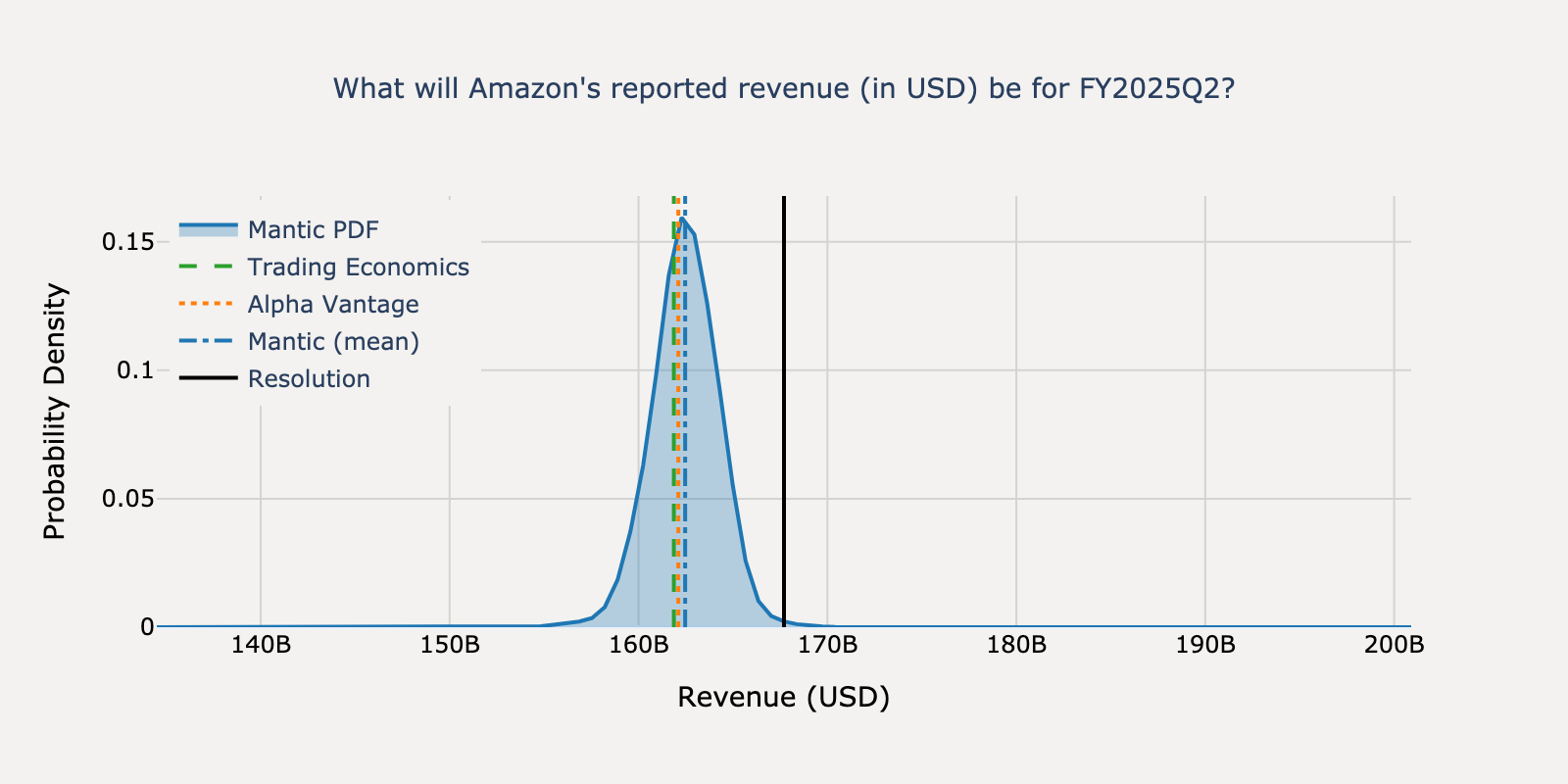

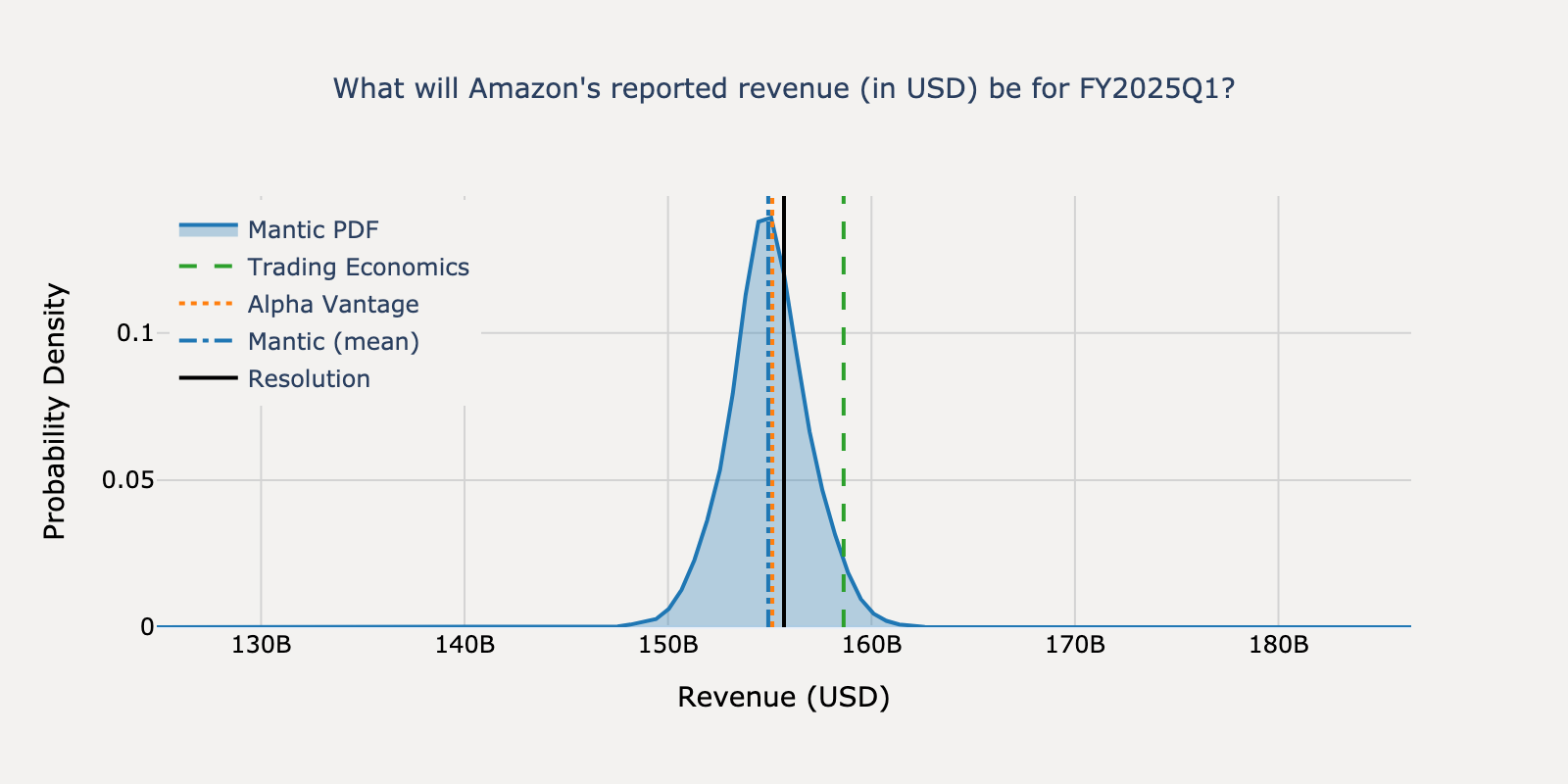

Amazon - Q2 2025

Actual Resolution: $167.70B

Mantic

$162.47BBEST

TE Consensus

$161.87B

AV Consensus

$162.11B

Absolute Percentage Errors

Mantic

3.12%

TE Consensus

3.48%

AV Consensus

3.34%

View Mantic Prediction Analysis

- I estimate Amazon's FY2025Q2 revenue will be $163 billion, with a 50% confidence interval of $161 billion to $164 billion.

- Amazon's official guidance for Q2 2025 revenue is between $159 billion and $164 billion. Wall Street consensus estimates are centered around $162 billion.

- Growth is primarily driven by Amazon Web Services (AWS) and advertising. Analysts forecast AWS revenue grew approximately 17% year-over-year, supported by strong demand for AI services.

- Favorable foreign exchange rates present a potential upside. A Bank of America Securities report suggested this could provide a 130-basis-point tailwind, pushing revenue toward the high end of the guidance range.

- Amazon's major Prime Day sales event occurred in July 2025 and its financial impact will be reported in Q3 2025, not the Q2 period being announced.

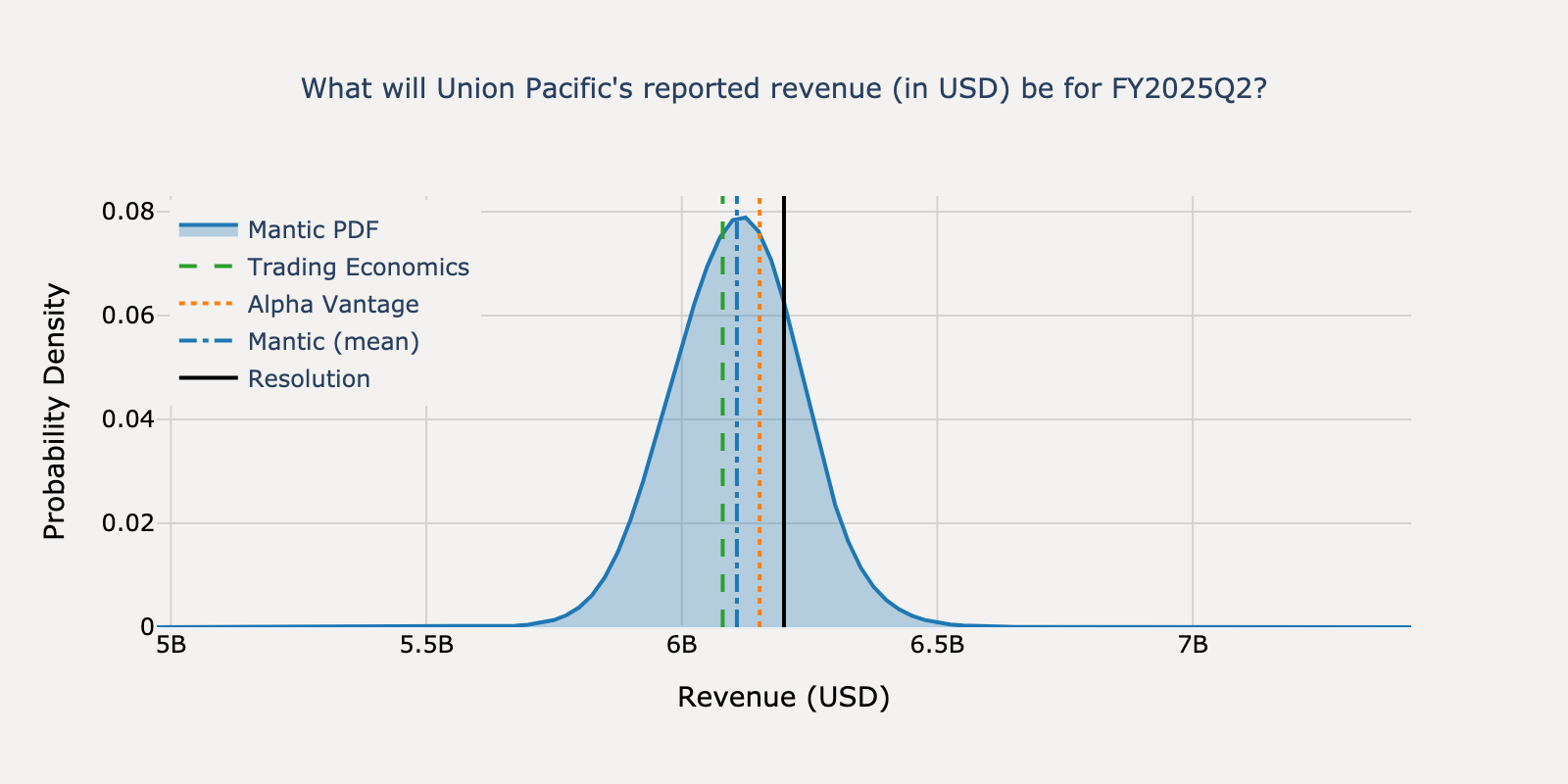

Union Pacific - Q2 2025

Actual Resolution: $6.20B

Mantic

$6.11B

TE Consensus

$6.08B

AV Consensus

$6.15BBEST

Absolute Percentage Errors

Mantic

1.49%

TE Consensus

1.94%

AV Consensus

0.77%

View Mantic Prediction Analysis

- Our central estimate for Union Pacific's FY2025Q2 revenue is $6.1 billion. The 50% confidence interval for this forecast is $6.0 billion to $6.21 billion.

- Analyst consensus projects revenue near $6.11 billion, a 1.7% year-over-year increase. This figure is consistent with Union Pacific's recent performance, as quarterly revenues have remained stable between $6.0 billion and $6.12 billion since early 2024.

- Positive volume growth supports this forecast. Management stated in the Q1 2025 earnings call that carloads at the start of the second quarter were up over 7% year-over-year.

- Revenue growth from higher volumes is likely to be moderated by an unfavorable business mix, with strong growth in lower-revenue intermodal shipments, and a year-over-year decline in fuel surcharge revenues.

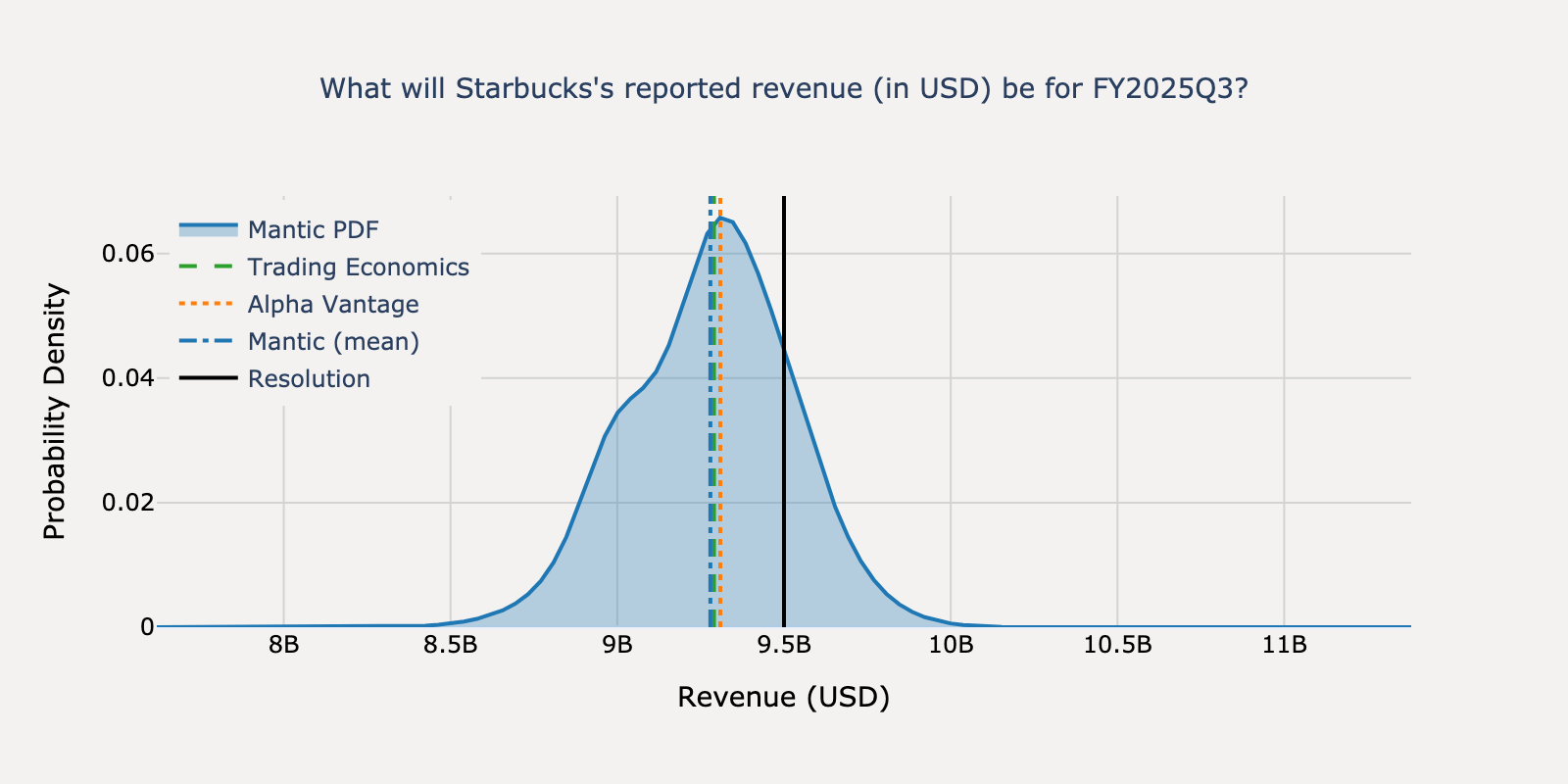

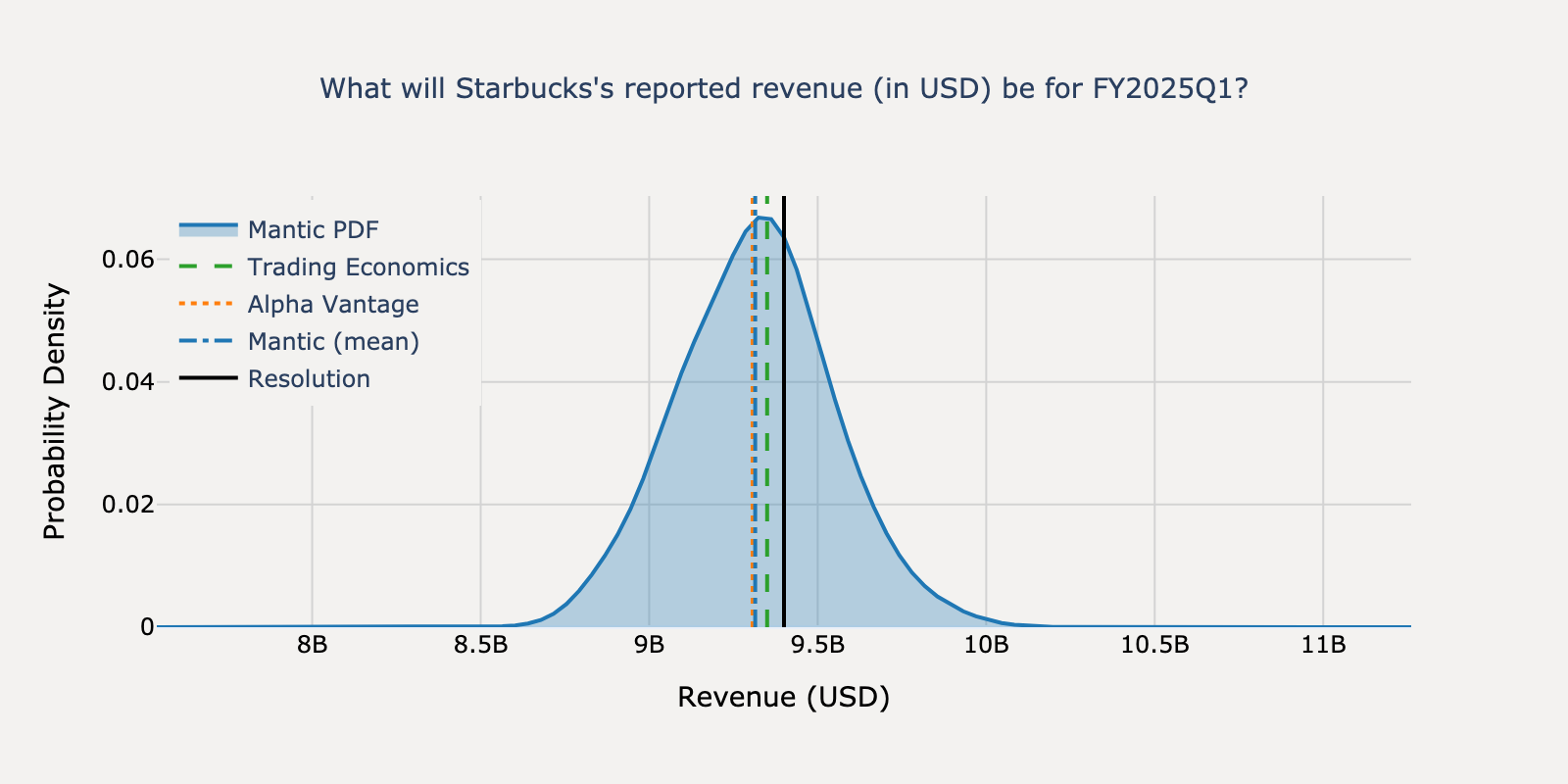

Starbucks - Q2 2025

Actual Resolution: $9.50B

Mantic

$9.28B

TE Consensus

$9.29B

AV Consensus

$9.31BBEST

Absolute Percentage Errors

Mantic

2.32%

TE Consensus

2.21%

AV Consensus

2.01%

View Mantic Prediction Analysis

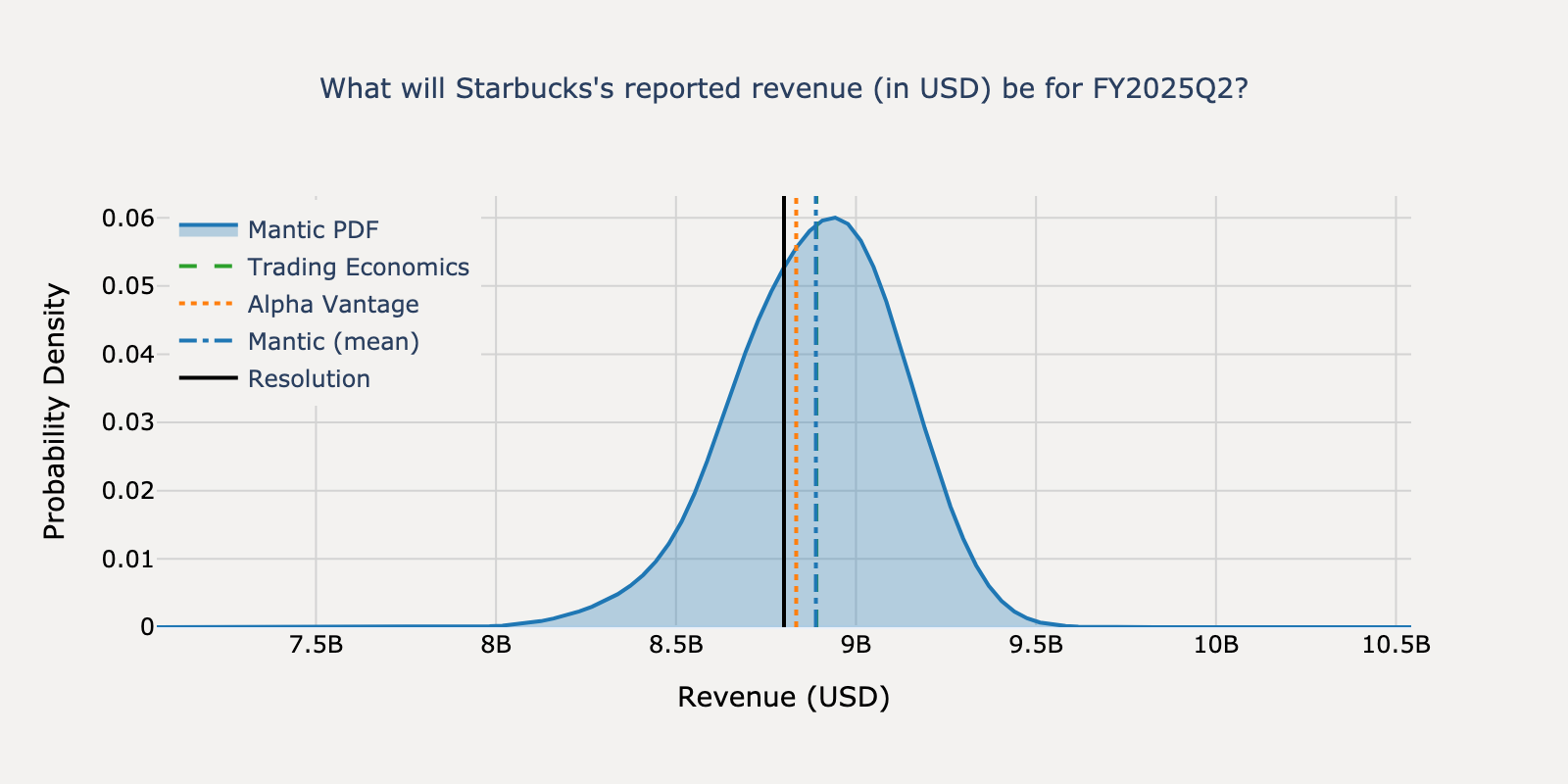

- We estimate Starbucks's revenue for the third quarter of fiscal year 2025 will be $9.26 billion, with a 50% confidence interval of $9.02 billion to $9.48 billion.

- Our median forecast is slightly below the analyst consensus of $9.29 billion. It represents a sequential increase from the $8.76 billion in revenue reported for the prior quarter, FY2025Q2.

- Revenue growth is primarily supported by a 5% year-over-year increase in global store count. Management also anticipates performance will improve in the second half of the fiscal year due to new marketing and operational initiatives.

- Persistent weakness in U.S. comparable store sales, which declined by 2% in the prior quarter, presents a significant headwind to growth.

- Intensified competition in China, the company's second-largest market, has prompted targeted price reductions, which may restrain revenue growth.

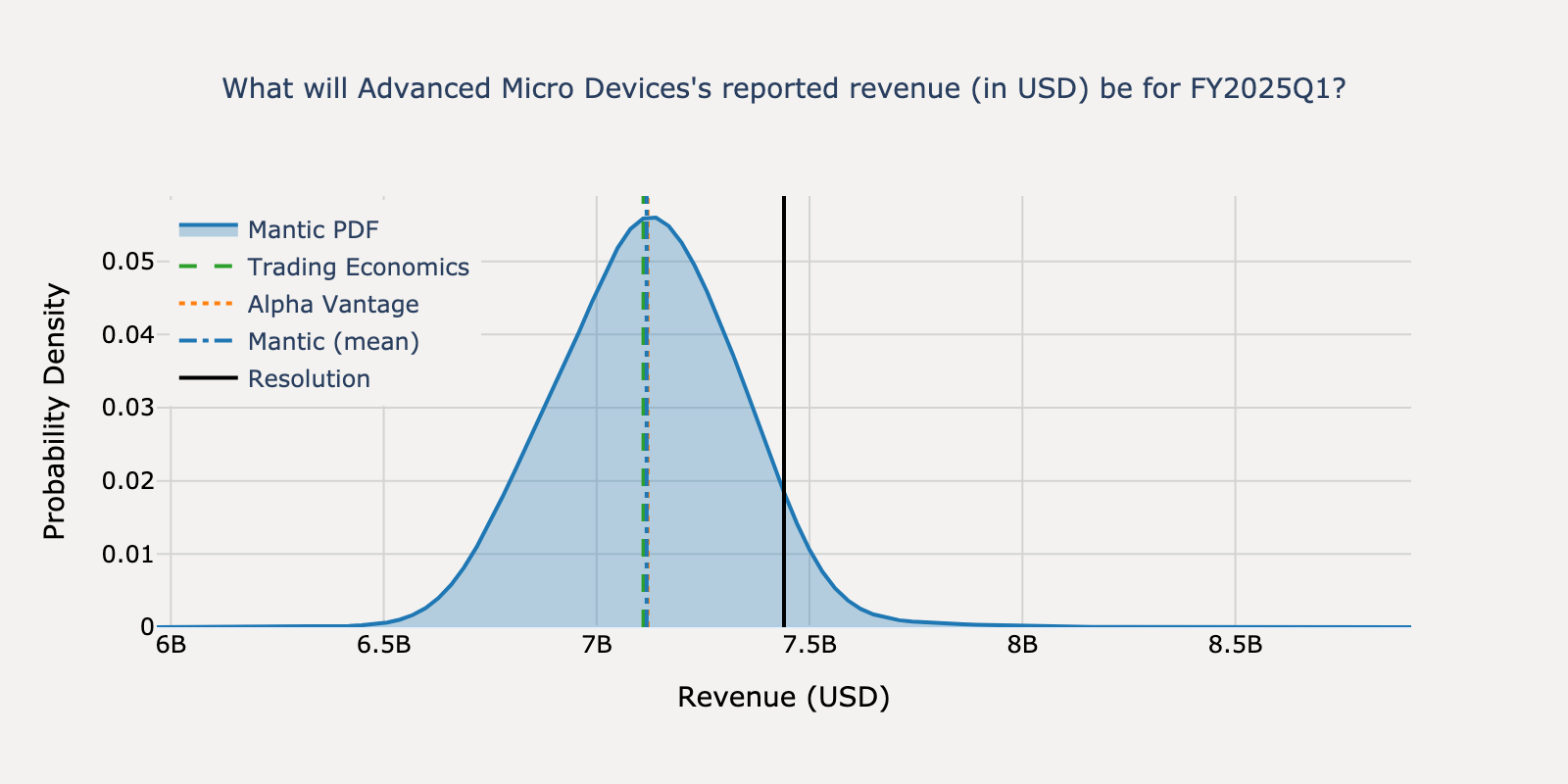

Advanced Micro Devices - Q1 2025

Actual Resolution: $7.44B

Mantic

$7.12B

TE Consensus

$7.11B

AV Consensus

$7.12BBEST

Absolute Percentage Errors

Mantic

4.34%

TE Consensus

4.44%

AV Consensus

4.31%

View Mantic Prediction Analysis

- My median estimate for AMD's FY2025Q1 revenue is $7.15 billion, with a 50% confidence interval of $6.99 billion to $7.32 billion.

- This forecast is primarily anchored by AMD's official guidance from its Q4 2024 earnings call, which projected Q1 2025 revenue of approximately $7.1 billion, plus or minus $300 million.

- Wall Street analyst consensus aligns with this guidance, with multiple sources citing an average revenue estimate of approximately $7.12 billion.

- The expected 30% year-over-year growth is driven by strong demand in the Data Center segment, fueled by AI accelerators, and a recovery in the Client segment.

- This growth is expected to be partially offset by significant declines in the Gaming segment and a modest decline in the Embedded business, according to company guidance.

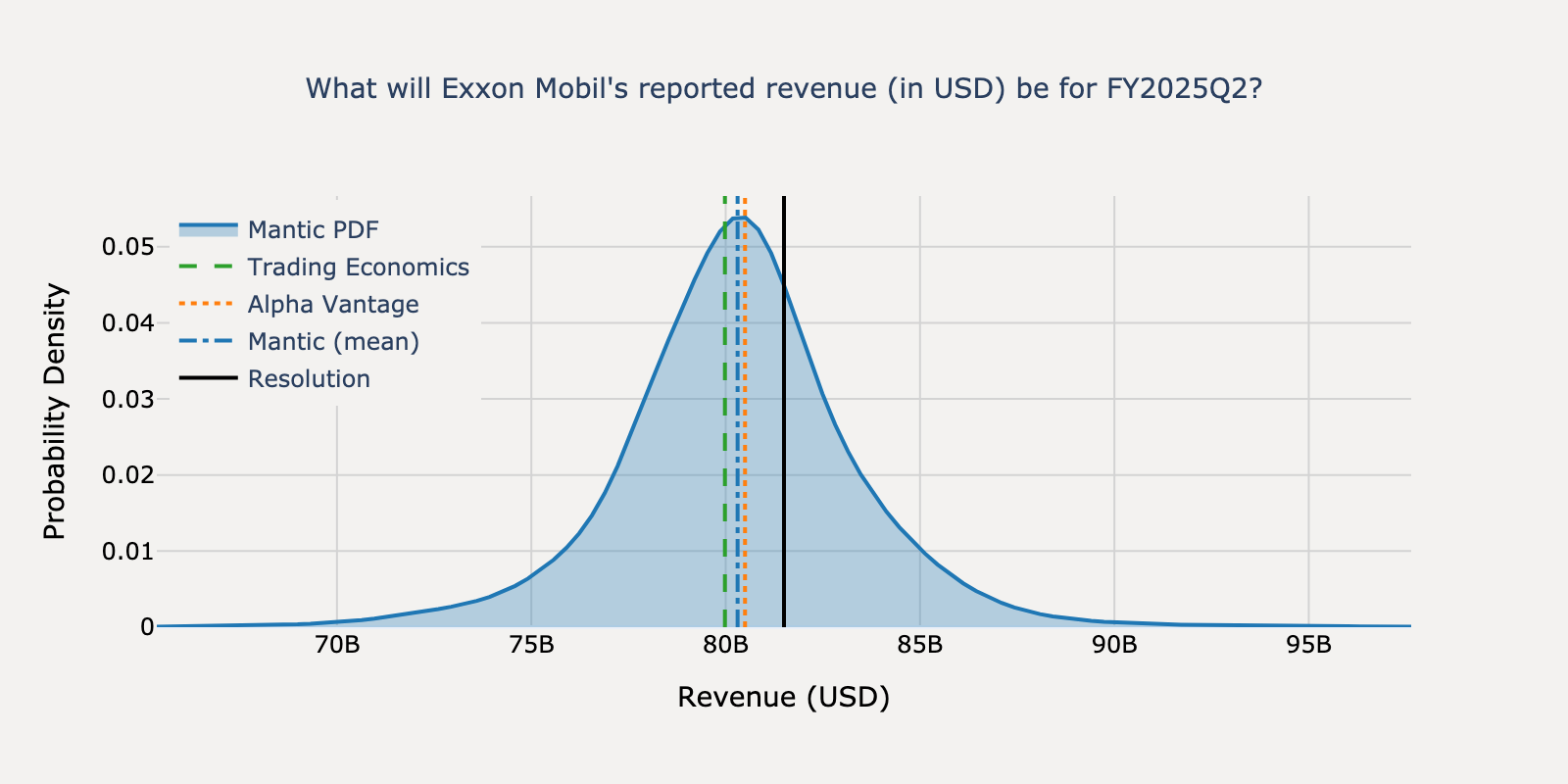

Exxon Mobil - Q2 2025

Actual Resolution: $81.50B

Mantic

$80.31B

TE Consensus

$79.98B

AV Consensus

$80.50BBEST

Absolute Percentage Errors

Mantic

1.46%

TE Consensus

1.87%

AV Consensus

1.23%

View Mantic Prediction Analysis

- I estimate Exxon Mobil's FY2025Q2 revenue will be $80.5 billion, with a 50% confidence interval of $78.5 billion to $82.6 billion.

- The expected year-over-year revenue decline is primarily driven by weaker energy prices. The average oil price in Q2 2025 was about 21% lower than in Q2 2024, according to information gathered.

- Exxon Mobil's management has guided that lower oil and gas prices are expected to reduce Q2 earnings by approximately $1.5 billion relative to the first quarter of 2025.

- This price-driven decline is partially offset by higher production volumes from major assets in Guyana and the Permian Basin, along with an anticipated positive contribution from improved refining margins.

- My central estimate aligns with analyst consensus, which projects revenue between $80.3 billion and $80.5 billion, based on several financial news reports.

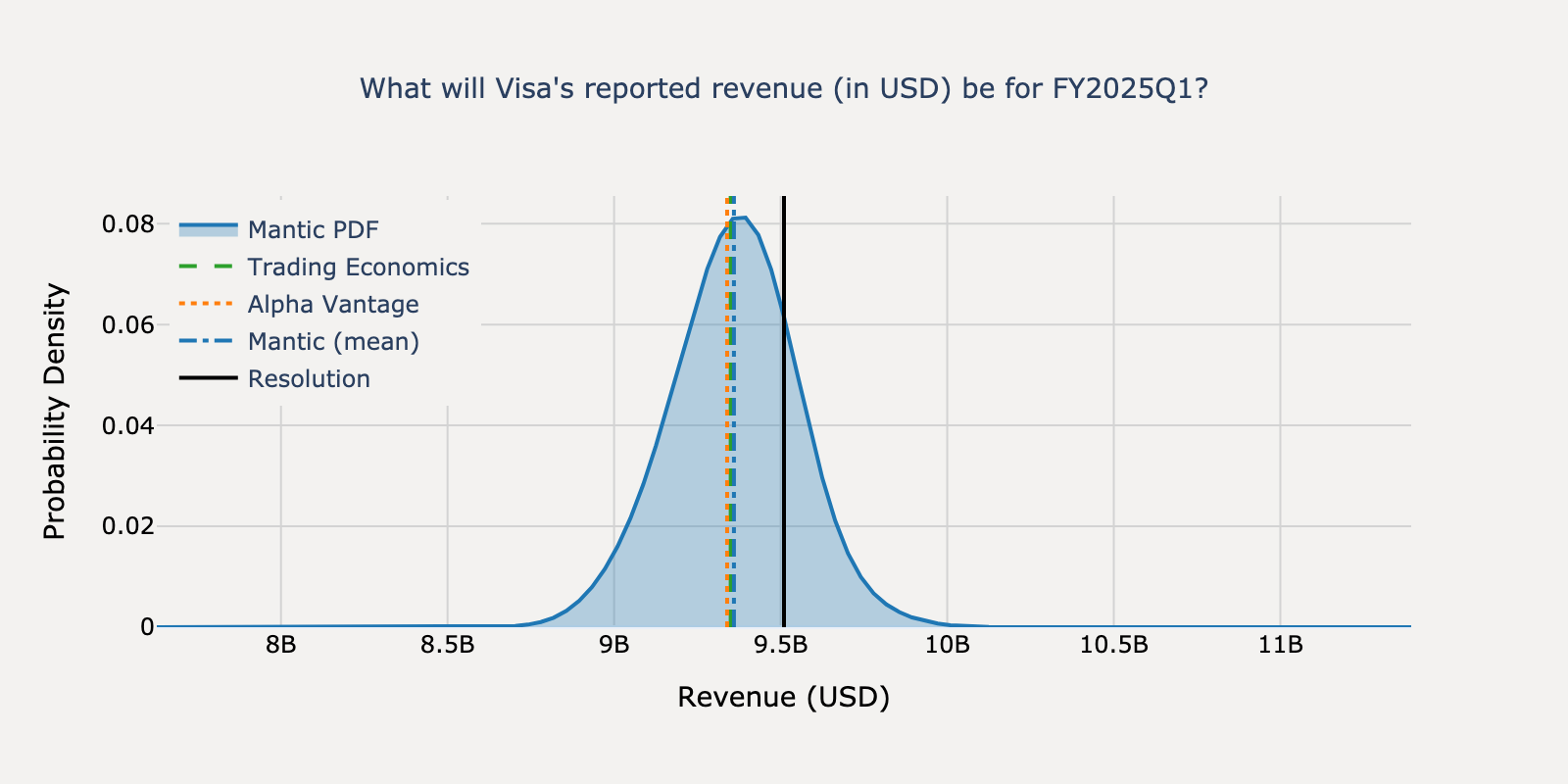

Visa - Q4 2024

Actual Resolution: $9.51B

Mantic

$9.36BBEST

TE Consensus

$9.35B

AV Consensus

$9.34B

Absolute Percentage Errors

Mantic

1.58%

TE Consensus

1.68%

AV Consensus

1.79%

View Mantic Prediction Analysis

- I estimate Visa's reported revenue for FY2025Q1 will be $9.55 billion, with a 50% confidence interval of $9.37 billion to $9.75 billion.

- This forecast is anchored by Visa's guidance for "high single-digit net revenue growth" from the $8.78 billion reported in the prior year's corresponding quarter (FY2024Q1).

- Strong U.S. consumer spending during the quarter supports this outlook. Data from December 2024 shows a 4.6% year-over-year increase in retail sales and a continued rise in credit card debt balances.

- A key headwind is the growth of client incentives, which are deducted from revenue. According to SEC filings, these incentives grew faster than gross revenue in the preceding quarter.

- A slowdown in the Asia-Pacific region, highlighted in the Q3 2024 earnings call, may also temper growth in otherwise strong international transaction revenues.

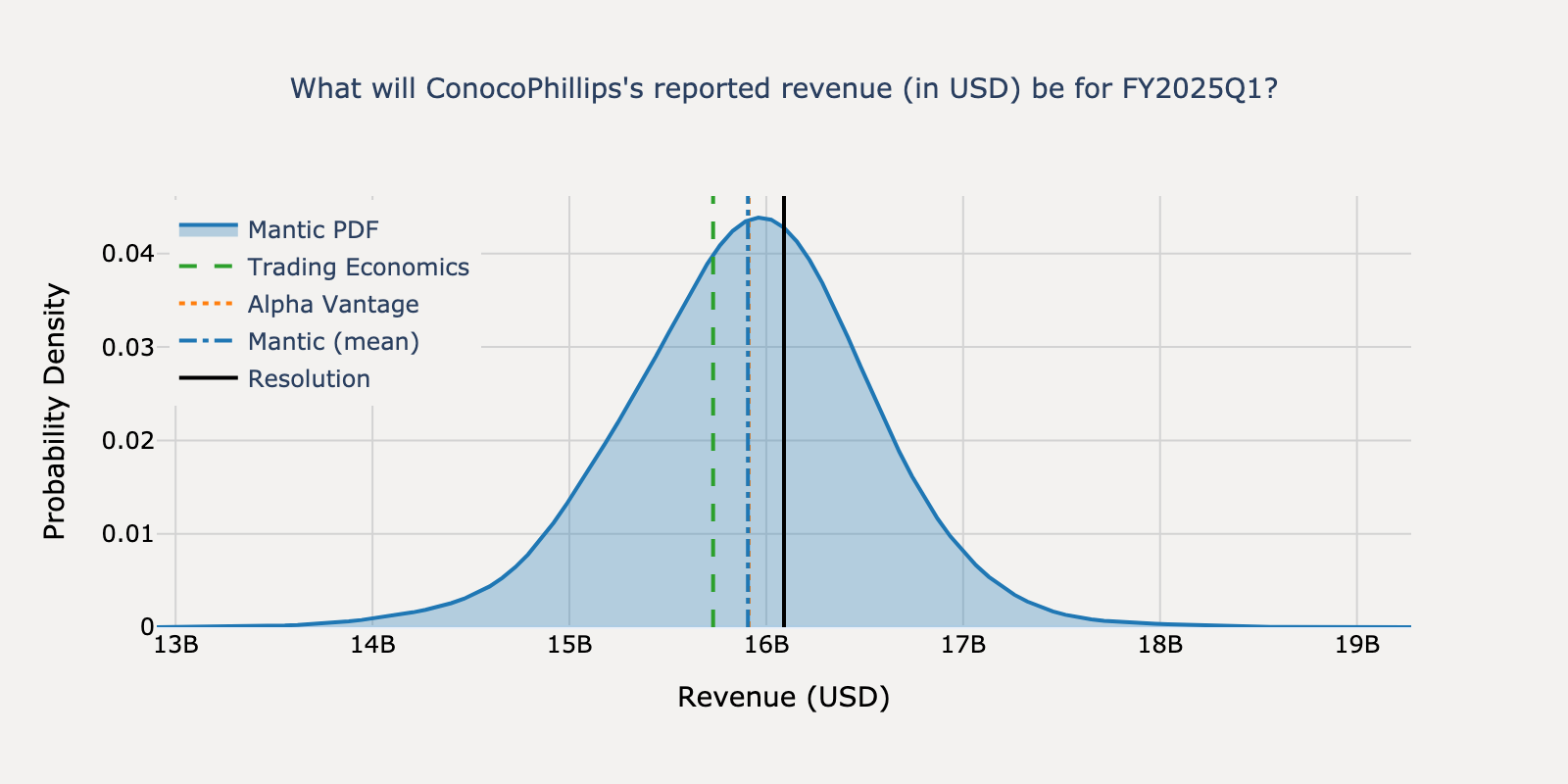

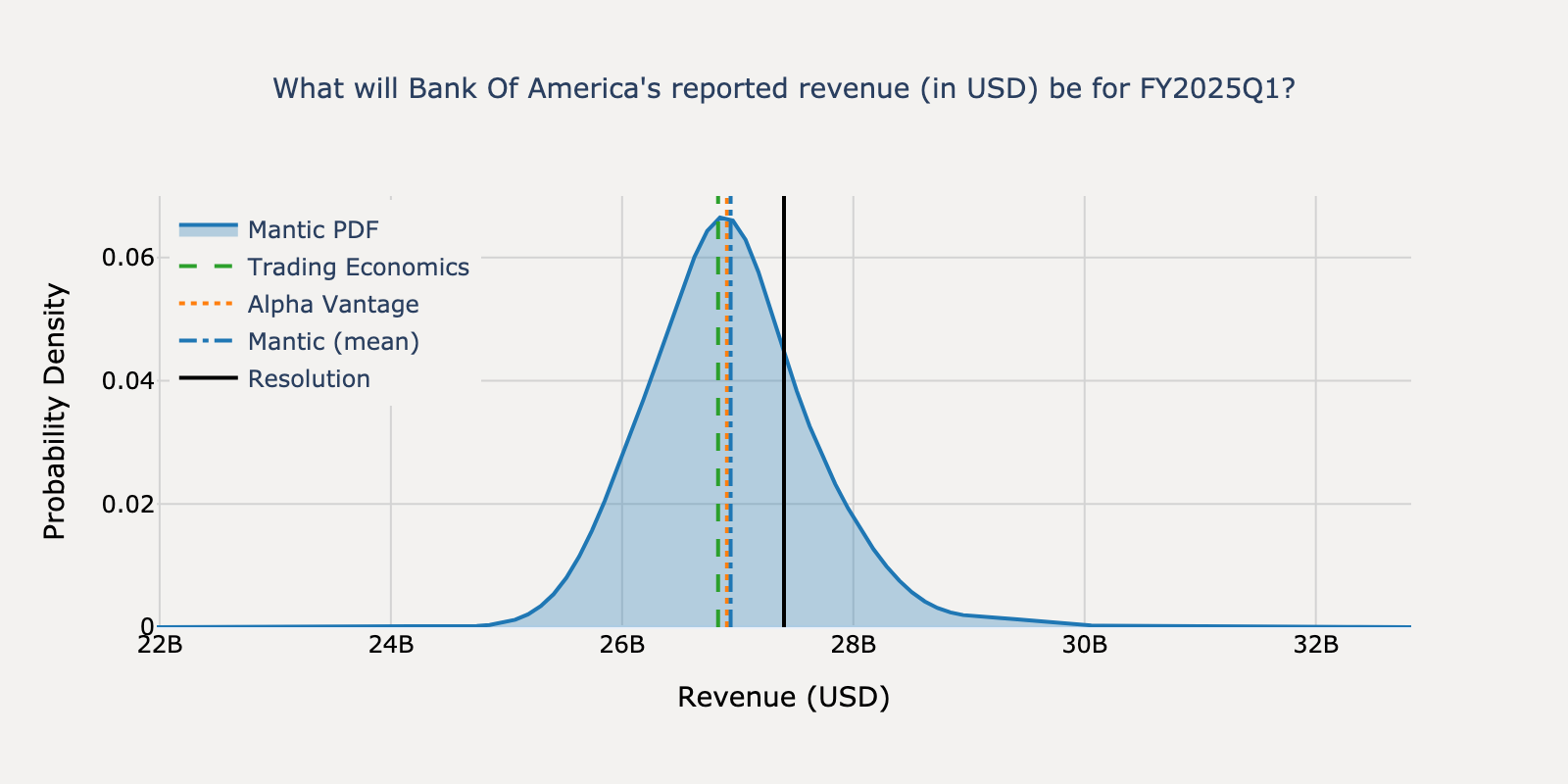

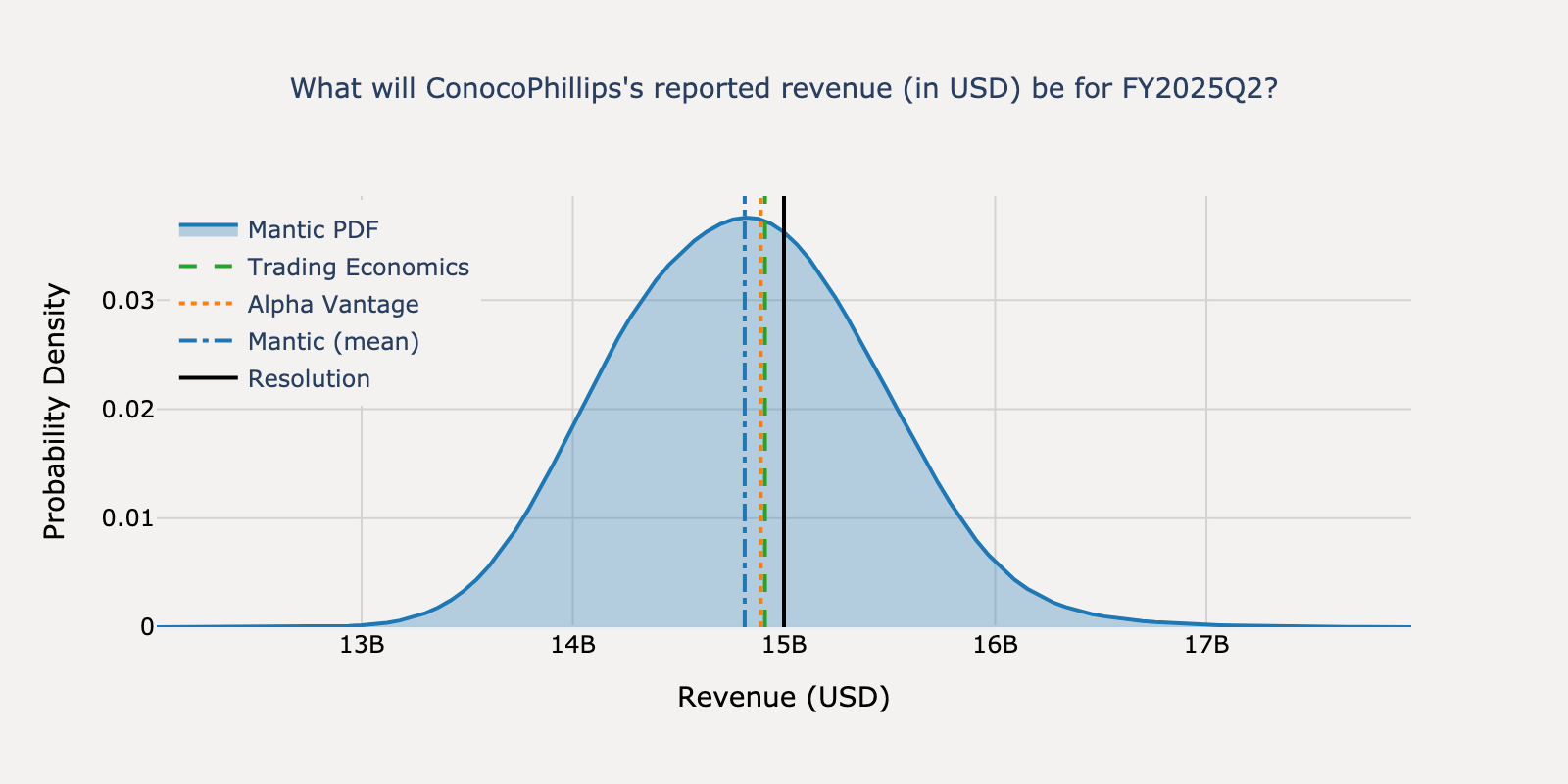

ConocoPhillips - Q1 2025

Actual Resolution: $16.09B

Mantic

$15.91B

TE Consensus

$15.73B

AV Consensus

$15.91BBEST

Absolute Percentage Errors

Mantic

1.14%

TE Consensus

2.24%

AV Consensus

1.12%

View Mantic Prediction Analysis

- I estimate ConocoPhillips's revenue for FY2025Q1 will be $15.9 billion, with a 50% confidence interval of $15.3 billion to $16.4 billion.

- Analyst revenue forecasts for Q1 2025 are tightly clustered between $15.74 billion and $16.33 billion, supporting a central estimate near $16 billion.

- A primary driver for revenue is the increased production volume from the full-quarter contribution of the Marathon Oil acquisition, with company guidance for Q1 at 2.34 to 2.38 million barrels of oil equivalent per day.

- This increase in production volume is expected to be partially offset by softer commodity prices, as West Texas Intermediate (WTI) crude prices fell during the quarter following OPEC+ supply increases.

- One report noted that ConocoPhillips's earnings announcement is later than its historical average, a factor that academic research suggests can be correlated with the release of negative financial news.

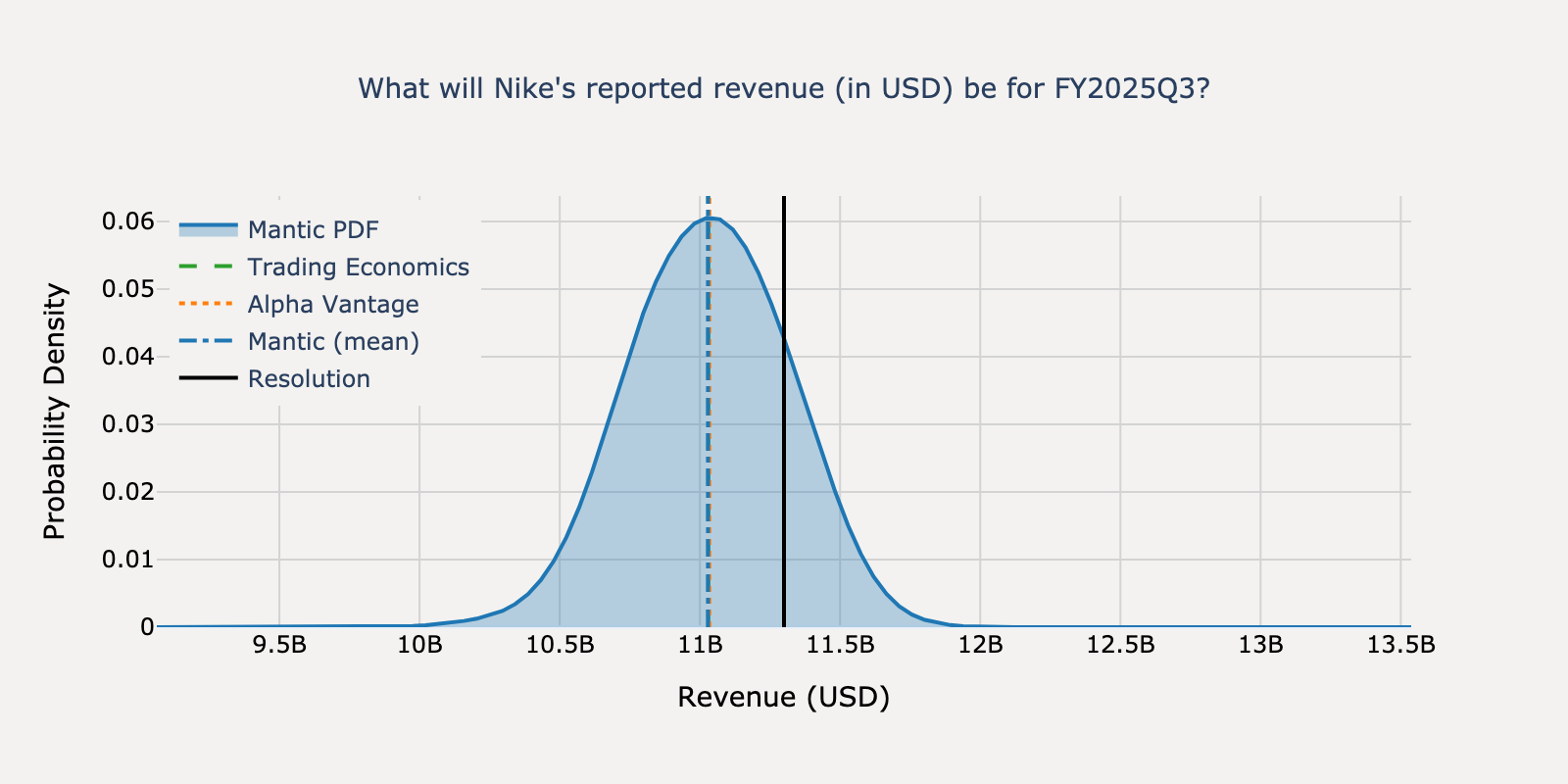

Nike - Q4 2024

Actual Resolution: $11.30B

Mantic

$11.03B

TE Consensus

$11.03B

AV Consensus

$11.03BBEST

Absolute Percentage Errors

Mantic

2.40%

TE Consensus

2.39%

AV Consensus

2.36%

View Mantic Prediction Analysis

- I estimate Nike's reported revenue for FY2025Q3 will be $11.1 billion, with a 50% confidence interval of $10.8 billion to $11.3 billion.

- This forecast is anchored on Nike management's guidance for a 'low double-digit' year-over-year revenue decline, which is the most influential single data point.

- Wall Street analyst consensus aligns with this view, with multiple independent reports projecting revenue between $11.0 billion and $11.15 billion.

- The expected decline is driven by a strategic reduction in the supply of key lifestyle products, increased promotions to clear inventory, and continued soft demand in Greater China and EMEA.

- A minor positive impact is expected from the timing of Cyber Week sales falling within the third quarter, though this will not offset the broader negative trends.

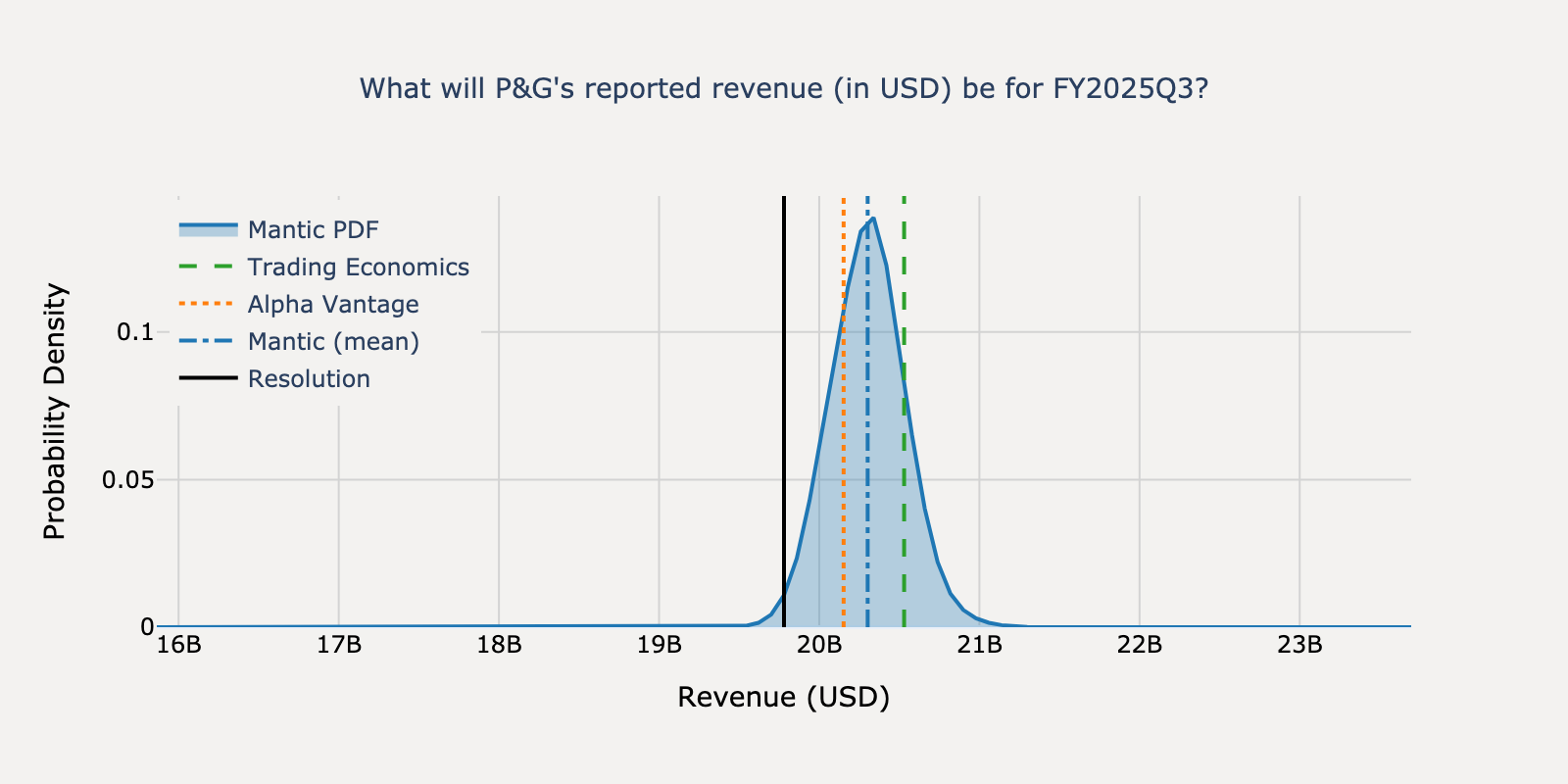

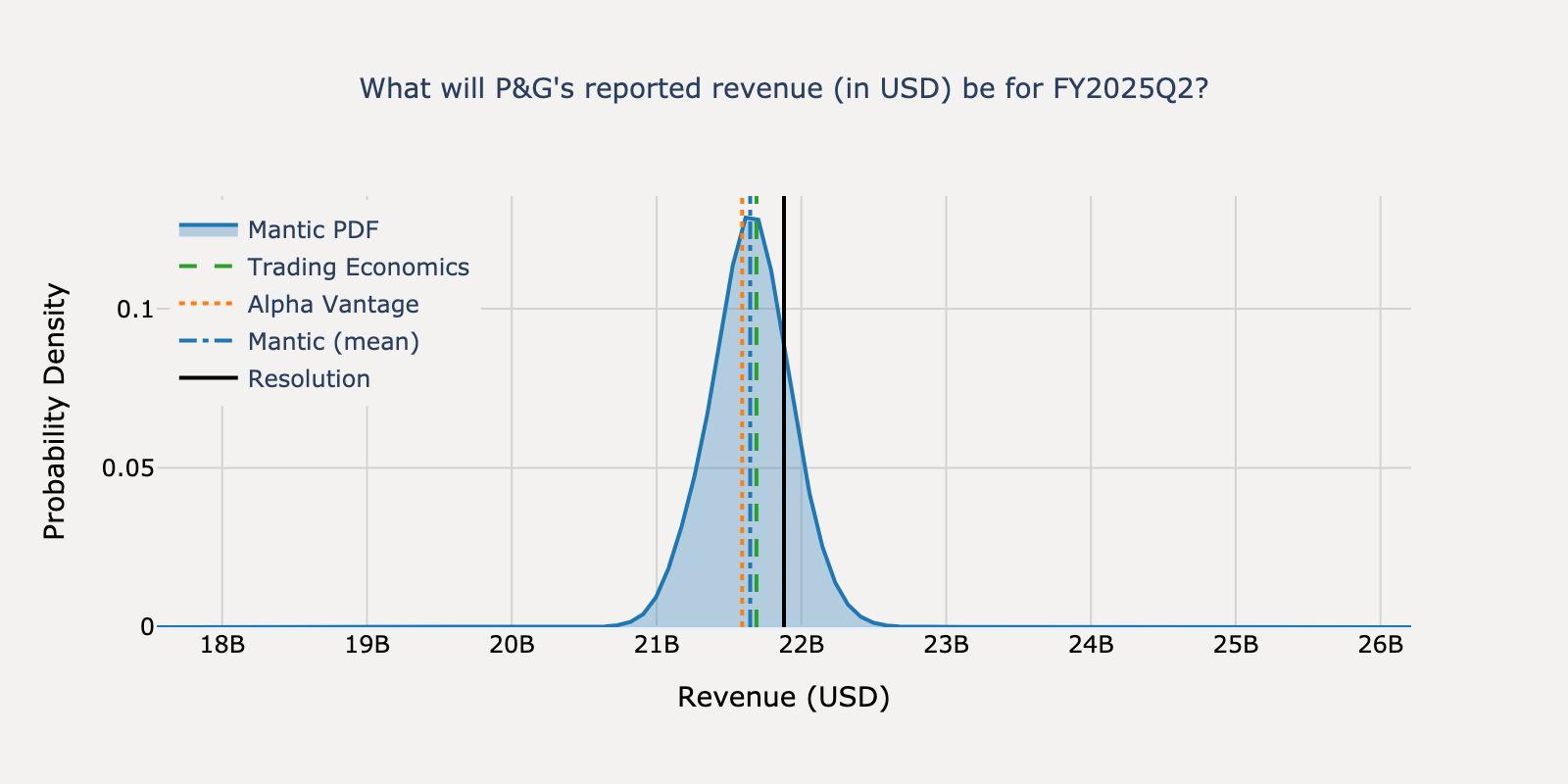

P&G - Q1 2025

Actual Resolution: $19.78B

Mantic

$20.30B

TE Consensus

$20.53B

AV Consensus

$20.15BBEST

Absolute Percentage Errors

Mantic

2.64%

TE Consensus

3.79%

AV Consensus

1.88%

View Mantic Prediction Analysis

- I estimate P&G's revenue for the third quarter of fiscal year 2025 will be $20.3 billion, with a 50% confidence interval of $20.1 billion to $20.7 billion.

- This estimate is consistent with Wall Street analyst consensus, which projects revenue in a range between $20.15 billion and $20.42 billion.

- Company management guided for an acceleration in organic sales growth in the second half of fiscal 2025, which provides a basis for modest growth over the prior year's third-quarter revenue.

- Identified headwinds to revenue growth include soft market conditions in Greater China, adverse foreign exchange rates, and the divestiture of the company's business in Argentina.

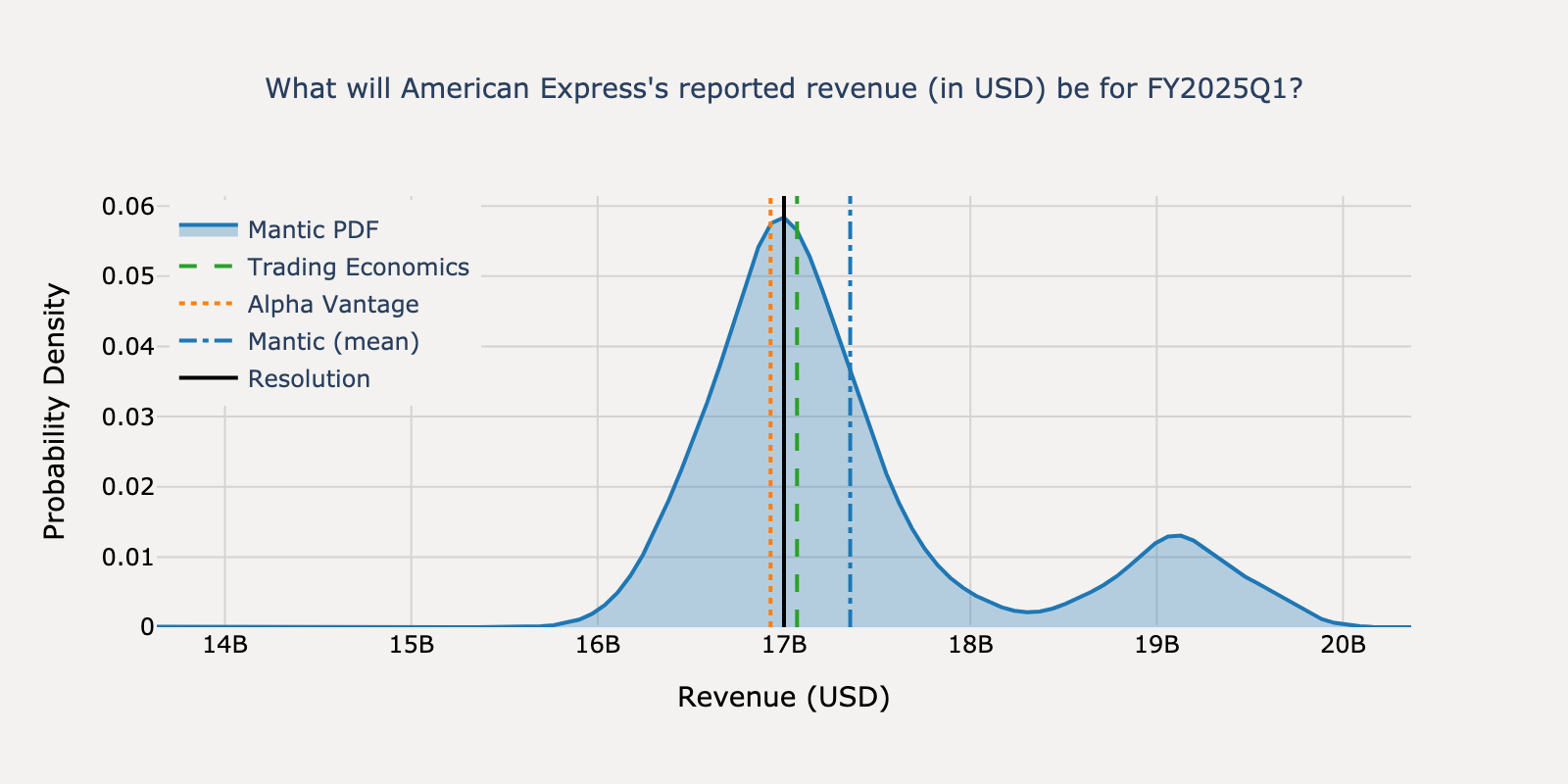

American Express - Q1 2025

Actual Resolution: $17.00B

Mantic

$17.36B

TE Consensus

$17.07BBEST

AV Consensus

$16.93B

Absolute Percentage Errors

Mantic

2.09%

TE Consensus

0.41%

AV Consensus

0.42%

View Mantic Prediction Analysis

- I estimate American Express's FY2025Q1 revenue will be approximately $17.0 billion, a figure that is in line with analyst consensus.

- The forecast is supported by resilient spending from American Express's affluent customer base; Bank of America data shows this group has durable spending habits, and partner Delta Air Lines reported double-digit spending growth on co-branded cards in Q1.

- Strong growth from recurring revenue streams provides a solid foundation. The company guided for mid-to-high teens growth in net card fees and for net interest income to outpace loan growth in 2025.

- This outlook is tempered by a contracting US economy, which shrank at a 0.6% annualized rate in Q1 2025, and by a difficult year-over-year growth comparison as Q1 2024 was a leap year.

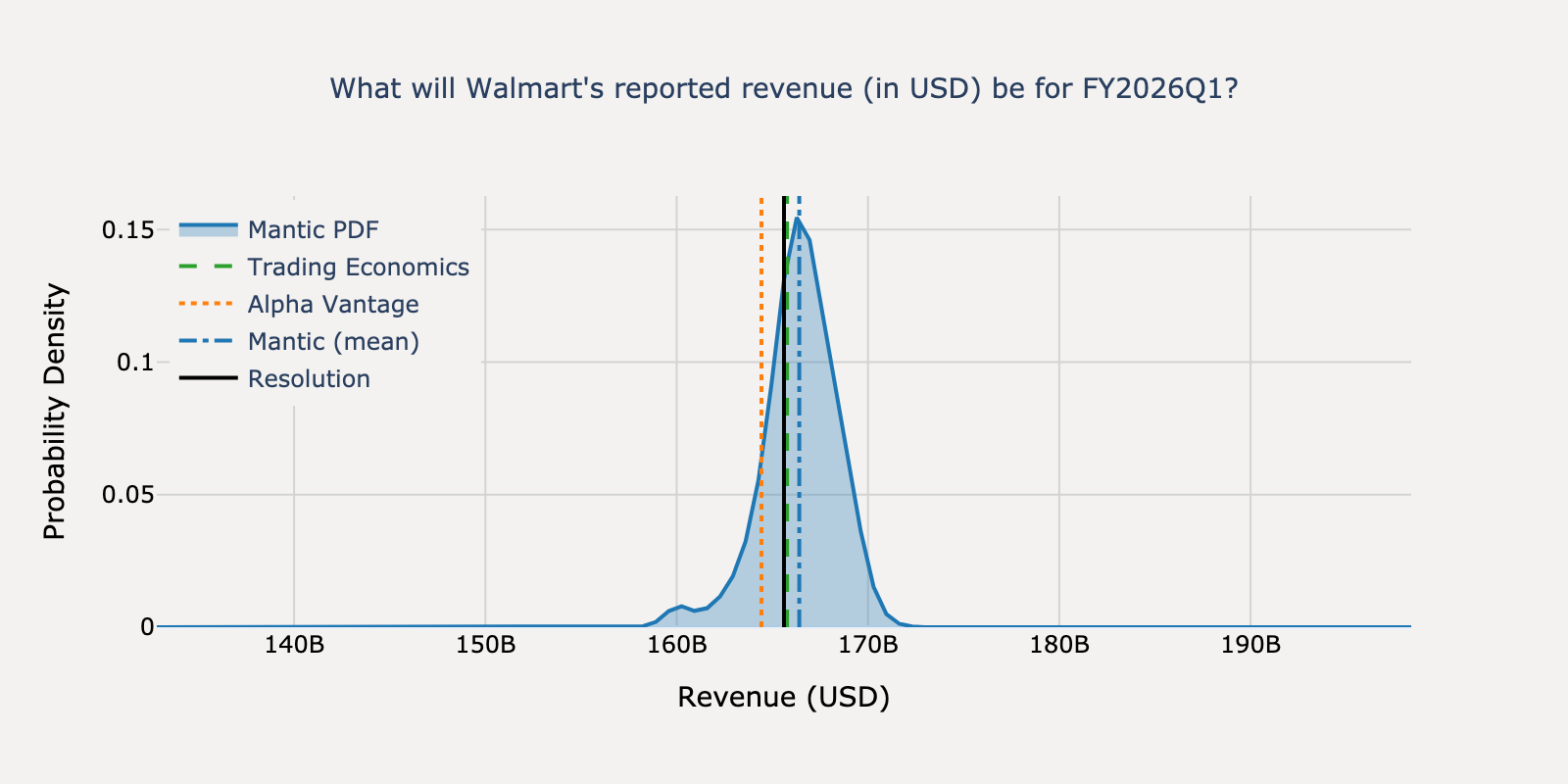

Walmart - Q1 2025

Actual Resolution: $165.61B

Mantic

$166.41B

TE Consensus

$165.77BBEST

AV Consensus

$164.43B

Absolute Percentage Errors

Mantic

0.48%

TE Consensus

0.10%

AV Consensus

0.71%

View Mantic Prediction Analysis

- I estimate Walmart's reported revenue for FY2026Q1 will be approximately $167 billion, with a 50% confidence interval of $165 billion to $168 billion.

- This forecast is anchored by Walmart's guidance for 3-4% constant-currency sales growth, which is driven by strong momentum in its e-commerce, advertising, and grocery businesses.

- This growth will be tempered by known headwinds. The final reported figure will be negatively impacted by unfavorable foreign exchange rates and a one-percentage-point drag from lapping the prior year's leap day.

- My estimate is slightly above the analyst consensus range of $165.7 billion to $166 billion. I give less weight to a lower projection of ~$160 billion, cited in one source, as it appears inconsistent with more recent company guidance and business momentum.

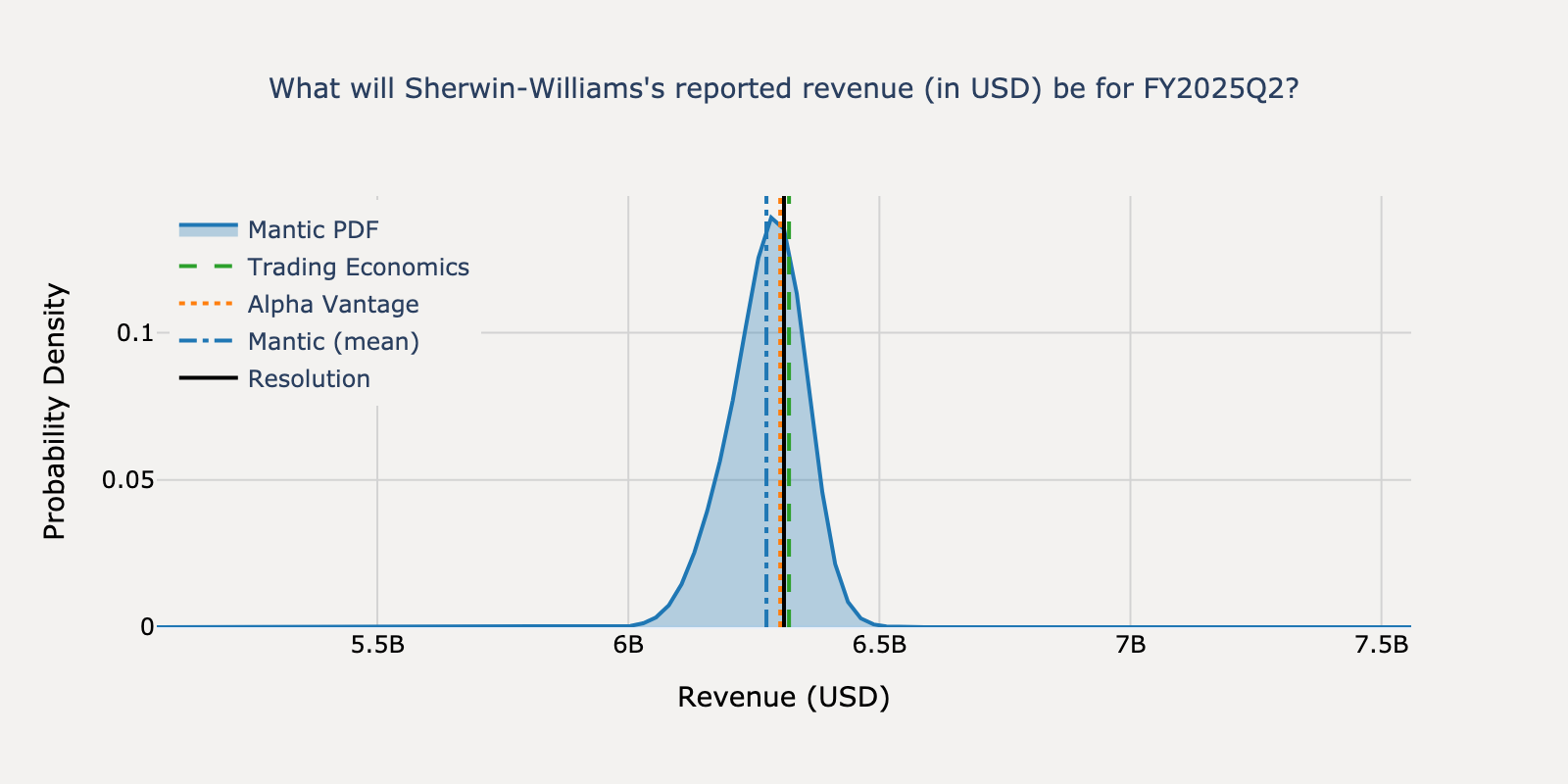

Sherwin-Williams - Q2 2025

Actual Resolution: $6.31B

Mantic

$6.28B

TE Consensus

$6.32B

AV Consensus

$6.30BBEST

Absolute Percentage Errors

Mantic

0.55%

TE Consensus

0.16%

AV Consensus

0.12%

View Mantic Prediction Analysis

- I estimate Sherwin-Williams's revenue for FY2025Q2 will be $6.28 billion. My 50% confidence interval for this figure is $6.17 billion to $6.33 billion.

- My forecast is centered near the analyst consensus of approximately $6.30 billion. This figure is consistent with company guidance from its Q1 2025 earnings call for "flattish" year-over-year sales for the seasonally strong second quarter.

- Resilience in the Paint Stores Group supports the forecast. In Q1 2025, this segment saw continued market share gains in residential repaint and strong growth in the Protective & Marine division.

- Persistent softness in the do-it-yourself (DIY) market and "choppy" demand in some industrial coatings markets present headwinds. Macroeconomic data from the first half of 2025 also indicates a weak housing market, with declining existing home sales.

Starbucks - Q4 2024

Actual Resolution: $9.40B

Mantic

$9.31B

TE Consensus

$9.35BBEST

AV Consensus

$9.31B

Absolute Percentage Errors

Mantic

0.91%

TE Consensus

0.53%

AV Consensus

0.99%

View Mantic Prediction Analysis

- My median forecast for Starbucks's FY2025Q1 revenue is $9.32 billion, which aligns with the analyst consensus estimate of $9.33 billion.

- The forecast reflects an expected 1% year-over-year revenue decline, primarily driven by negative comparable store sales. Analysts project a global decrease of 4.8%, citing reduced customer traffic and a strategic pullback in promotional discounts.

- Performance in China, the company's second-largest market, remains a significant headwind due to intense competition and cautious consumer spending, which led to a 14% comparable sales decline in the prior quarter.

- This decline is partially offset by revenue from new store openings, as the company added over 1,400 net new company-operated stores in the last fiscal year, and by the seasonal strength of the holiday period.

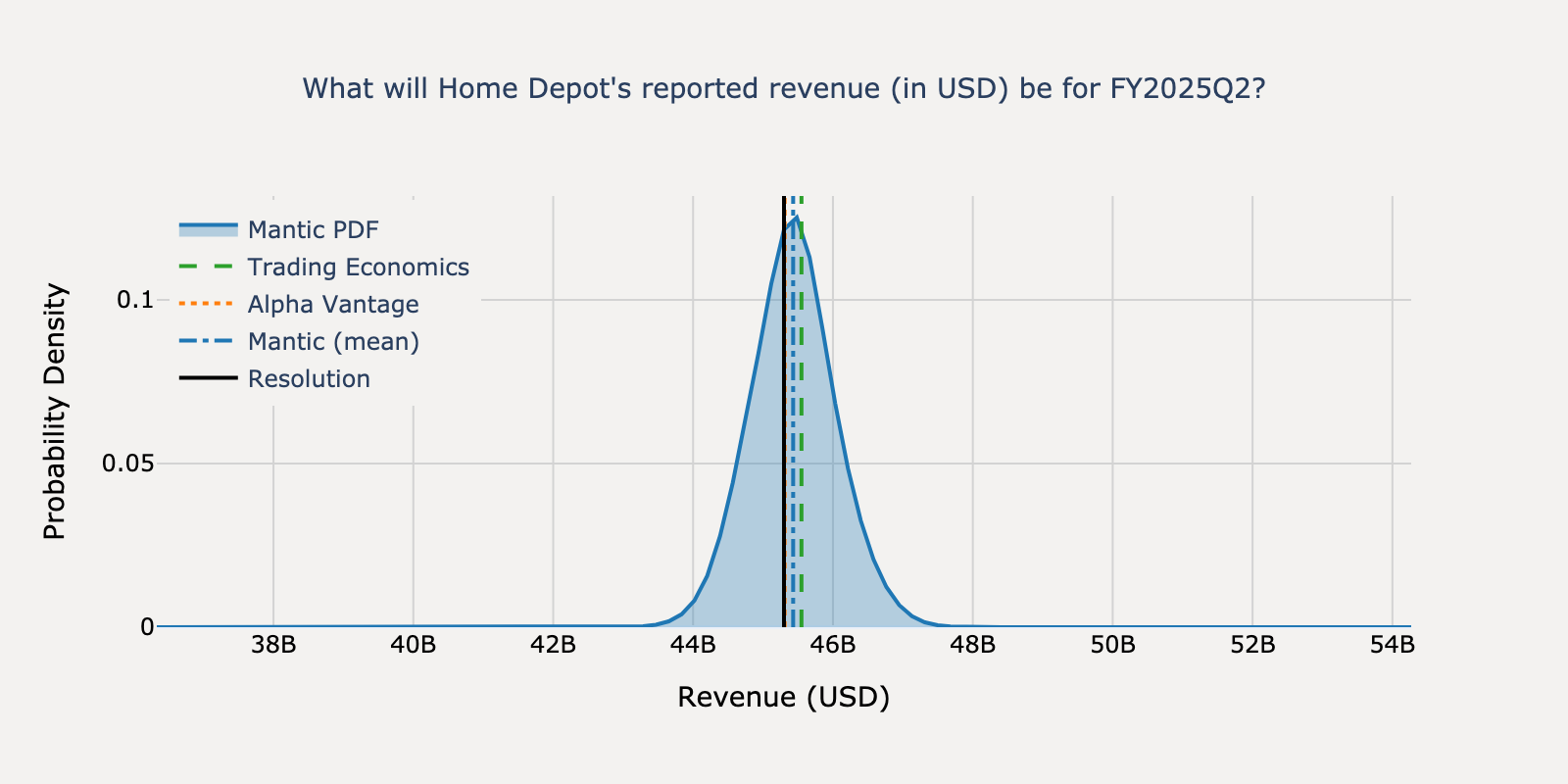

Home Depot - Q2 2025

Actual Resolution: $45.30B

Mantic

$45.43B

TE Consensus

$45.55B

AV Consensus

$45.31BBEST

Absolute Percentage Errors

Mantic

0.29%

TE Consensus

0.55%

AV Consensus

0.02%

View Mantic Prediction Analysis

- I estimate Home Depot's reported revenue for FY2025Q2 will be $45.3 billion, with a 50% confidence interval of $44.7 billion to $45.7 billion.

- Analyst consensus estimates from multiple sources place expected revenue in a tight range of $45.3 billion to $45.5 billion, representing approximately 5% year-over-year growth from $43.2 billion in FY2024Q2.

- Revenue growth is supported by contributions from the recent acquisition of SRS Distribution and continued strength in sales to Professional (Pro) customers.

- Headwinds include persistent softness in large, discretionary home improvement projects, which is linked to high interest rates and cautious consumer spending on big-ticket items.

- Alternative data on store foot traffic was mixed during the quarter, with some sources indicating declines while company commentary noted an improvement in trends in July.

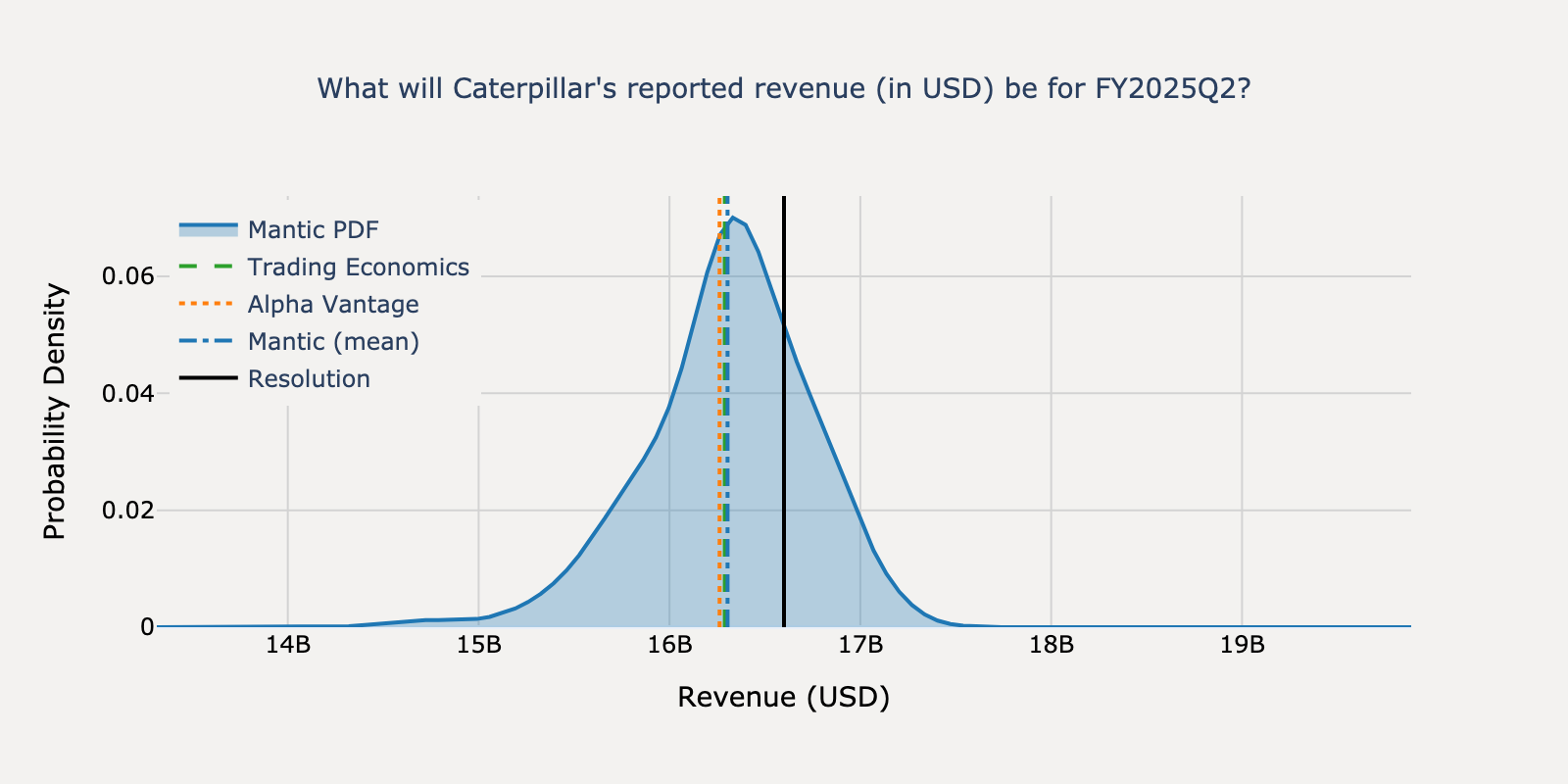

Caterpillar - Q2 2025

Actual Resolution: $16.60B

Mantic

$16.30BBEST

TE Consensus

$16.29B

AV Consensus

$16.26B

Absolute Percentage Errors

Mantic

1.78%

TE Consensus

1.87%

AV Consensus

2.03%

View Mantic Prediction Analysis

- My median forecast for Caterpillar's FY2025Q2 revenue is $16.2 billion, with a 50% confidence interval of $15.8 billion to $16.5 billion.

- Wall Street analyst consensus projects revenue between $16.14 billion and $16.35 billion. This represents a slight decrease from the $16.69 billion reported in Q2 2024.

- Caterpillar's management guided for Q2 sales to be 'similar' to the prior year, based on the Q1 2025 earnings call. This guidance suggests some upside potential to the analyst consensus.

- Weaker sales are expected in the Construction and Resource Industries segments. This is primarily due to unfavorable price realization, as noted in the company's Q1 2025 report.

- Revenue is supported by the Energy & Transportation segment, which is seeing strong demand from data centers and the oil and gas sector. The company also entered the quarter with a record order backlog of $35 billion.

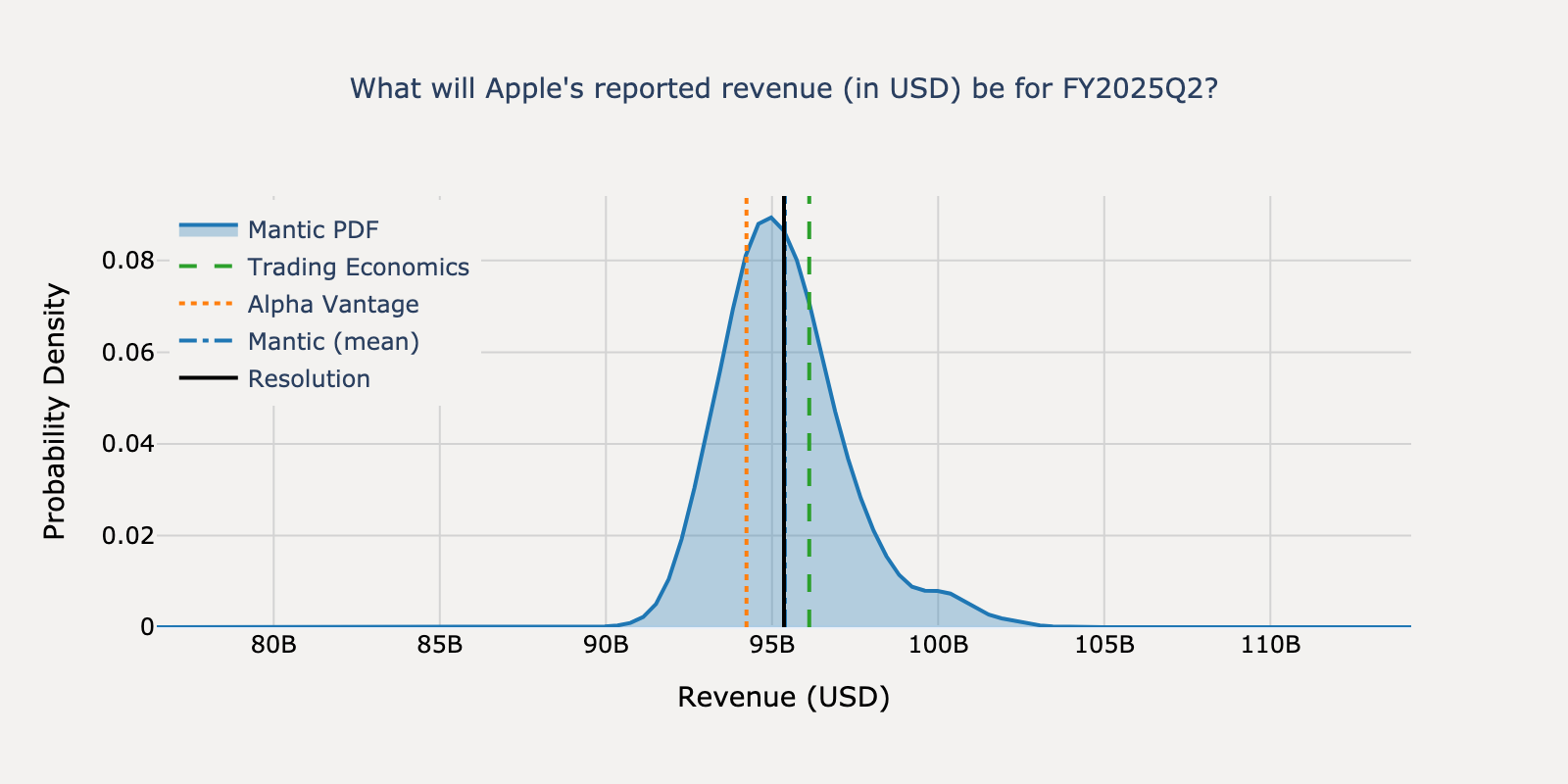

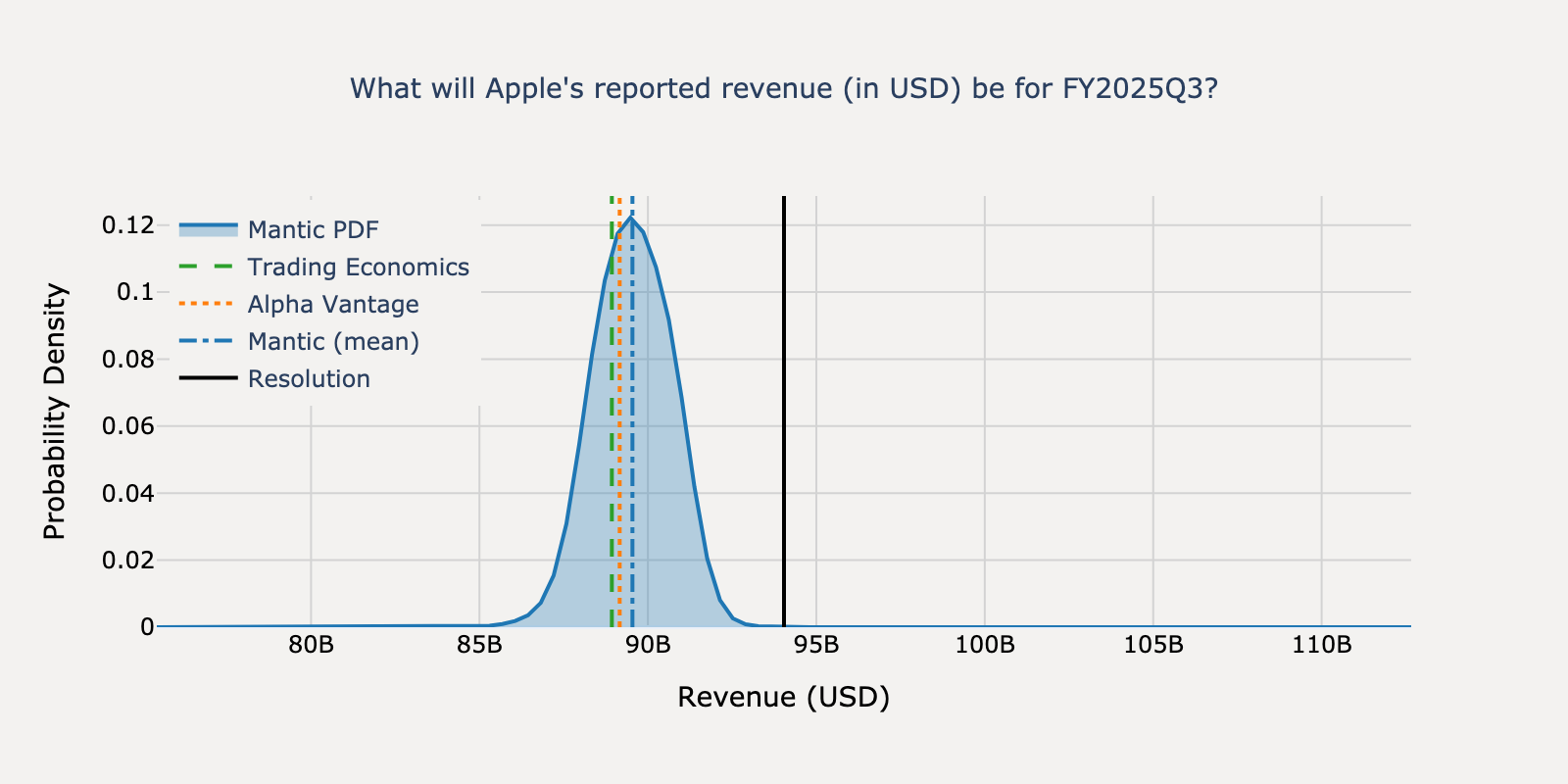

Apple - Q1 2025

Actual Resolution: $95.36B

Mantic

$95.39BBEST

TE Consensus

$96.12B

AV Consensus

$94.23B

Absolute Percentage Errors

Mantic

0.03%

TE Consensus

0.80%

AV Consensus

1.18%

View Mantic Prediction Analysis

- My median estimate for Apple's FY2025Q2 revenue is $99.4 billion, representing approximately 9.5% year-over-year growth from $90.75 billion in FY2024Q2.

- This forecast assumes a larger-than-consensus impact from demand being pulled forward into March due to tariff uncertainty. This pull-forward effect was cited by analysts at JP Morgan and Morgan Stanley as a key factor for the quarter.

- Apple's Services division is expected to report growth significantly above the 11-12% analyst consensus. App Store data for the quarter supports this, indicating revenue growth closer to 15% year-over-year.

- While competitive pressures in China remain a headwind, its impact is viewed as being more than offset by strong demand in other regions, tailwinds from recent product launches, and a more favorable foreign exchange environment than previously guided.

Visa - Q1 2025

Actual Resolution: $9.60B

Mantic

$9.60BBEST

TE Consensus

$9.54B

AV Consensus

$9.55B

Absolute Percentage Errors

Mantic

0.02%

TE Consensus

0.62%

AV Consensus

0.53%

View Mantic Prediction Analysis

- I forecast Visa's FY2025Q2 revenue will be $9.56 billion, with a 50% confidence interval of $9.44 billion to $9.69 billion.

- This estimate is anchored by Visa's most recent reported net revenue of $9.51 billion for the prior quarter (FY2025Q1) and analyst consensus estimates of $9.55 billion to $9.57 billion for Q2.

- Company guidance from its Q4 2024 earnings call indicated that higher client incentives would be a headwind to net revenue in the first half of fiscal 2025.

- This headwind is partially offset by the easing of currency volatility, which was not expected to be a drag on revenue in Q2 as it had been in prior quarters.

- Underlying business momentum remains strong, with processed transactions growing 11% year-over-year in the prior quarter. However, management stated that the impact of incremental pricing changes will mostly occur after Q2 has ended.

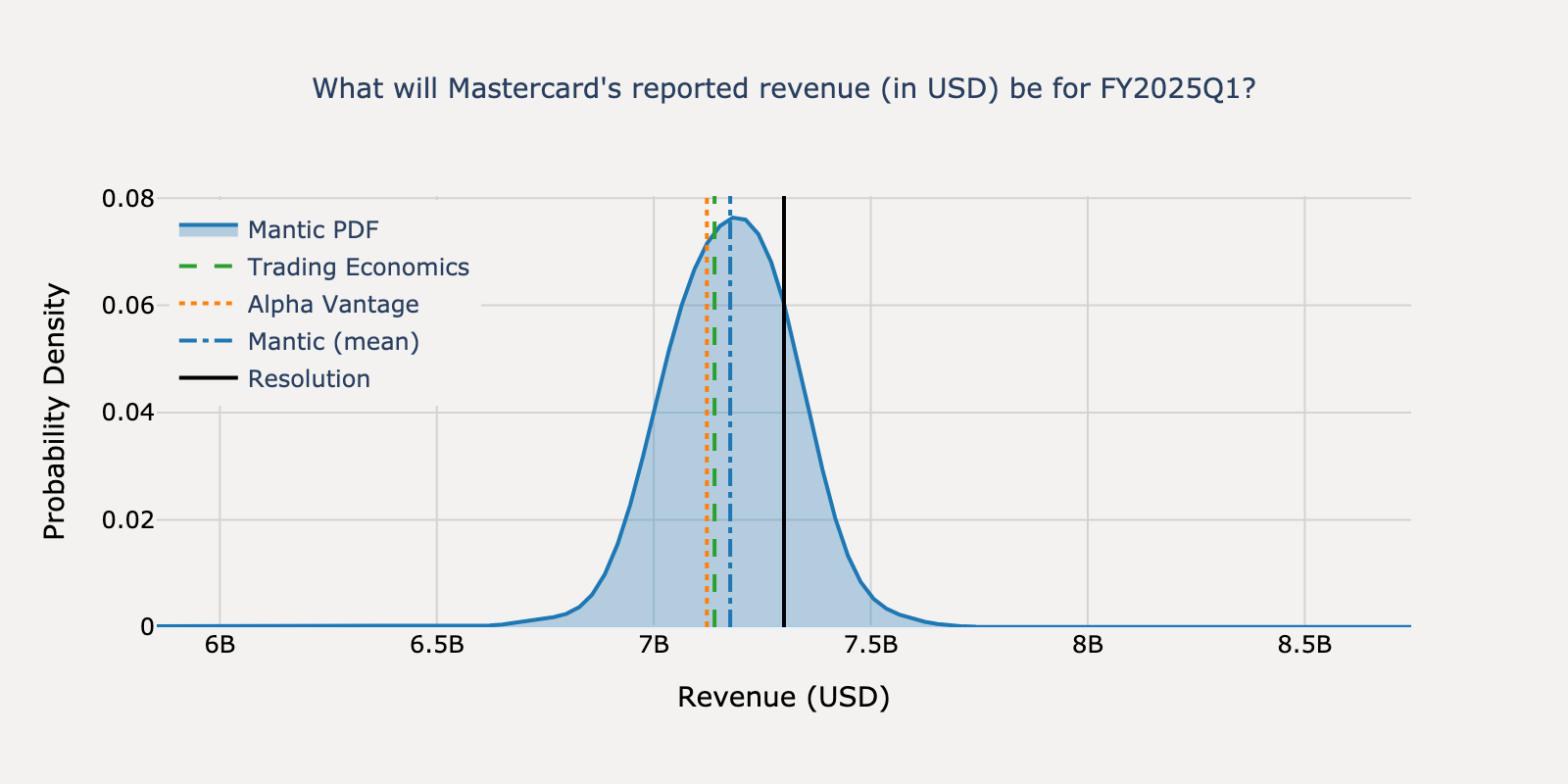

Mastercard - Q1 2025

Actual Resolution: $7.30B

Mantic

$7.18BBEST

TE Consensus

$7.14B

AV Consensus

$7.12B

Absolute Percentage Errors

Mantic

1.70%

TE Consensus

2.19%

AV Consensus

2.43%

View Mantic Prediction Analysis

- My median forecast for Mastercard's FY2025Q1 revenue is $7.16 billion, with a 50% confidence interval of $7.05 billion to $7.30 billion.

- Wall Street analyst consensus forecasts revenue of approximately $7.13 billion, representing roughly 12% year-over-year growth.

- Mastercard has exceeded analyst revenue estimates in each of the past 12 quarters. This informs my expectation for a result at or slightly above the consensus figure.

- Revenue growth is primarily driven by the strong performance of value-added services and continued growth in cross-border transaction volumes.

- Key headwinds tempering the outlook include an anticipated 3-percentage-point negative impact from foreign exchange and rising costs from customer rebates and incentives.

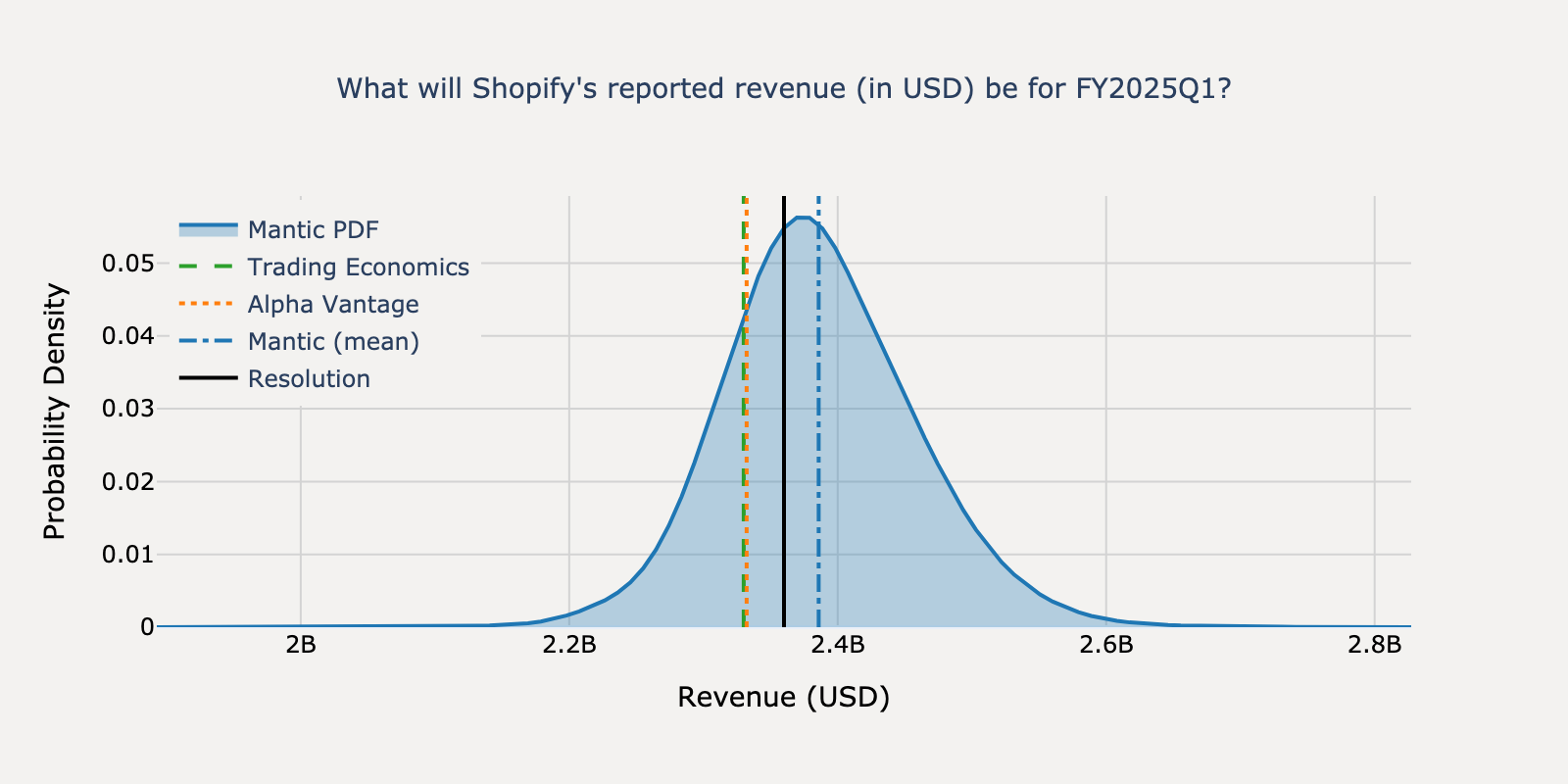

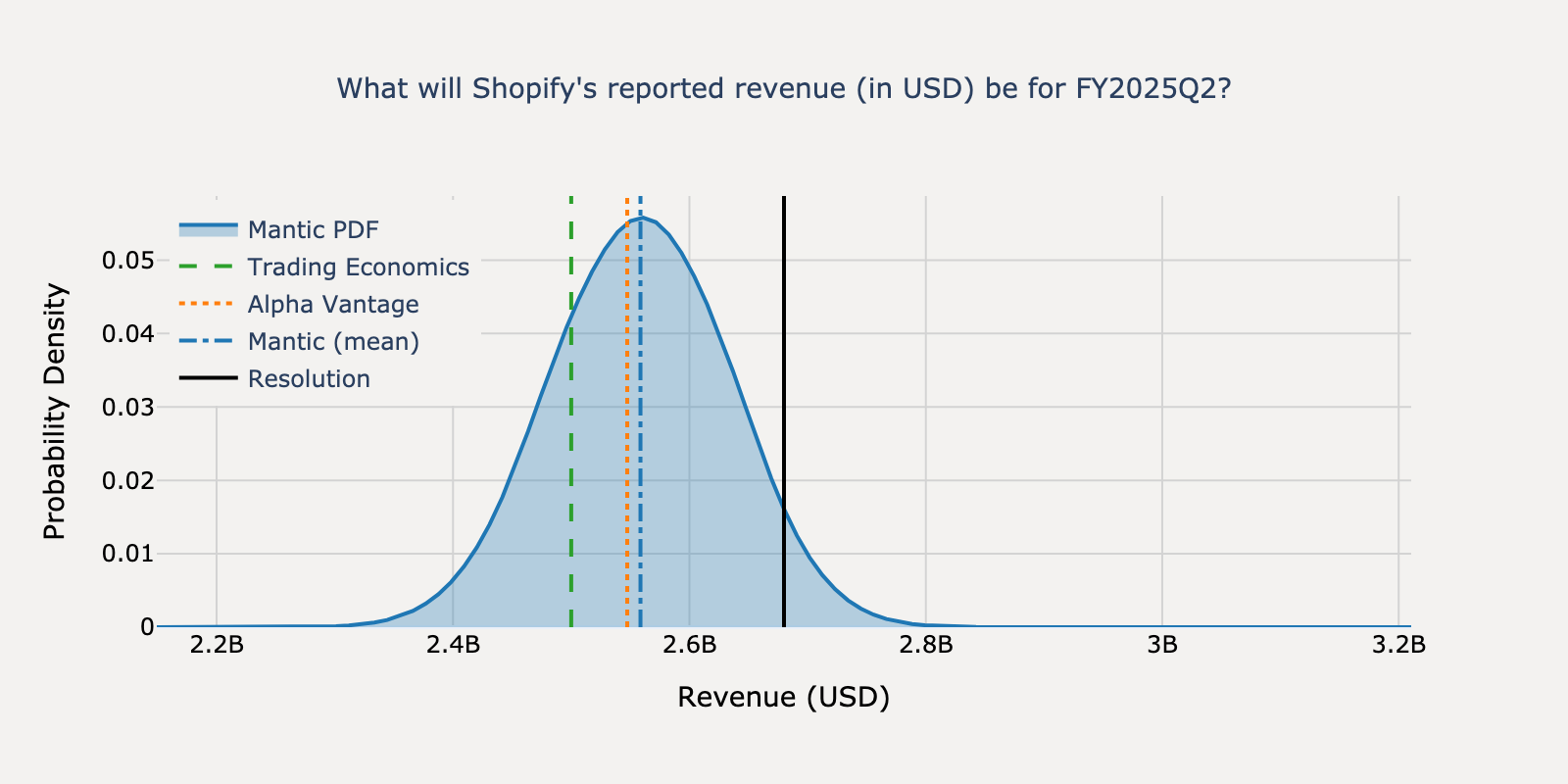

Shopify - Q1 2025

Actual Resolution: $2.36B

Mantic

$2.39BBEST

TE Consensus

$2.33B

AV Consensus

$2.33B

Absolute Percentage Errors

Mantic

1.09%

TE Consensus

1.27%

AV Consensus

1.18%

View Mantic Prediction Analysis

- I estimate Shopify's reported revenue for FY2025Q1 will be $2.39 billion, with a 50% confidence interval of $2.34 billion to $2.47 billion.

- Wall Street analyst consensus for FY2025Q1 revenue clusters between $2.33 billion and $2.37 billion, slightly below my central estimate.

- The forecast reflects strong momentum carrying over from Q4 2024, in which Gross Merchandise Volume (GMV) grew 25.8% year-over-year, though Q1 is seasonally the company's weakest quarter.

- News sources highlight uncertainty from new U.S. tariffs on Chinese goods, but these changes took effect on May 2, 2025, and do not impact results for the first quarter of 2025, which ended March 31, 2025.

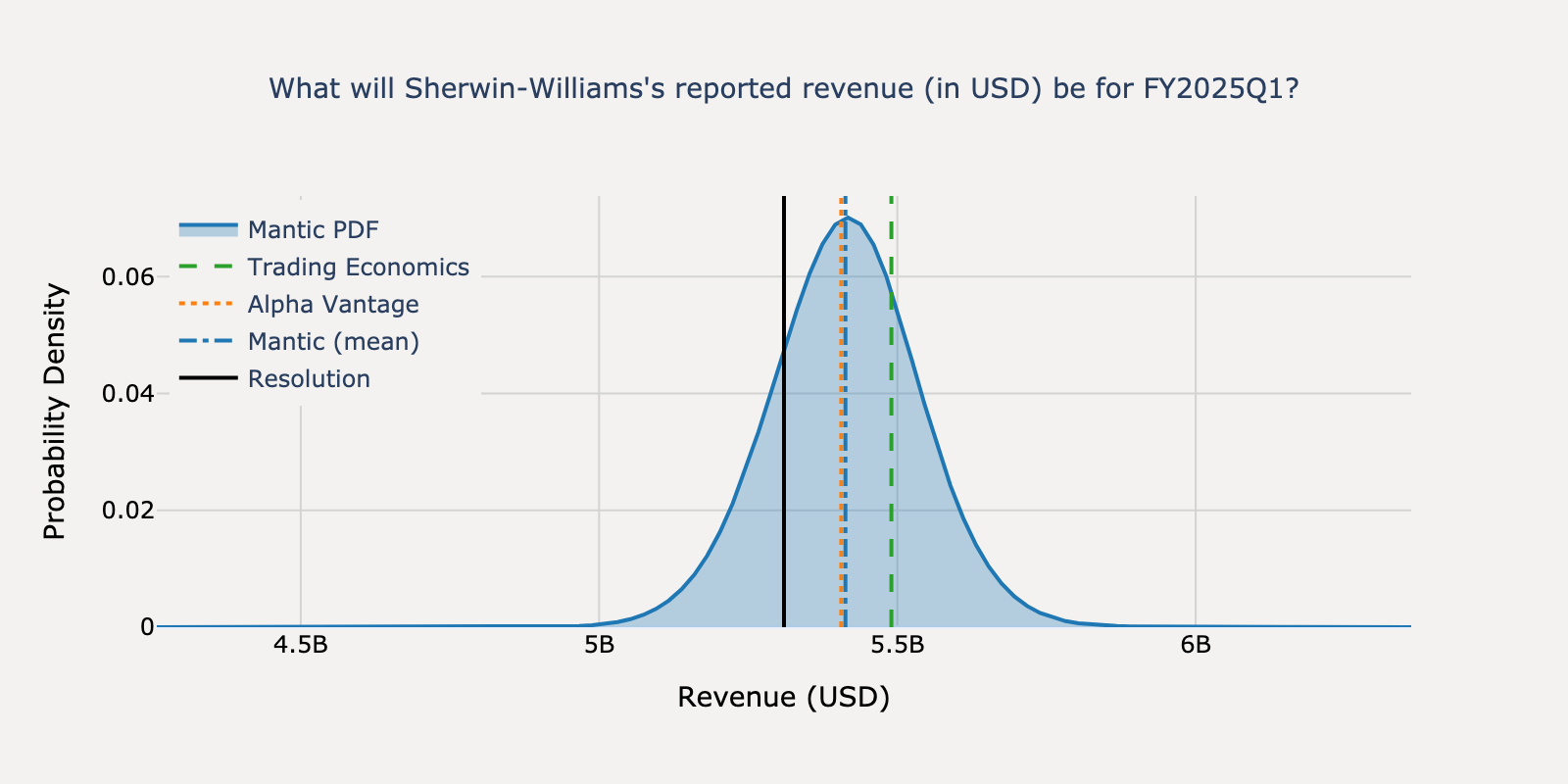

Sherwin-Williams - Q1 2025

Actual Resolution: $5.31B

Mantic

$5.41B

TE Consensus

$5.49B

AV Consensus

$5.41BBEST

Absolute Percentage Errors

Mantic

1.94%

TE Consensus

3.39%

AV Consensus

1.81%

View Mantic Prediction Analysis

- I estimate Sherwin-Williams's reported revenue for FY2025Q1 will be $5.41 billion, with a 50% confidence interval of $5.27 billion to $5.54 billion.

- This forecast is consistent with analyst consensus estimates of approximately $5.42 billion and the company's guidance for first-half 2025 sales to be "up or down low-single digits".

- A price increase in January 2025 and strength in the residential repaint market are expected to support revenue. These tailwinds are counteracted by an estimated 1% headwind from foreign exchange, soft DIY demand, and weakness in the General Industrial division.

- Broader economic indicators from Q1 2025, including negative growth in construction spending and falling housing starts, suggest a challenging demand environment that limits upside potential.

- The announced acquisition of Suvinil will not affect Q1 2025 revenue, as the transaction is not expected to close until the second half of 2025.

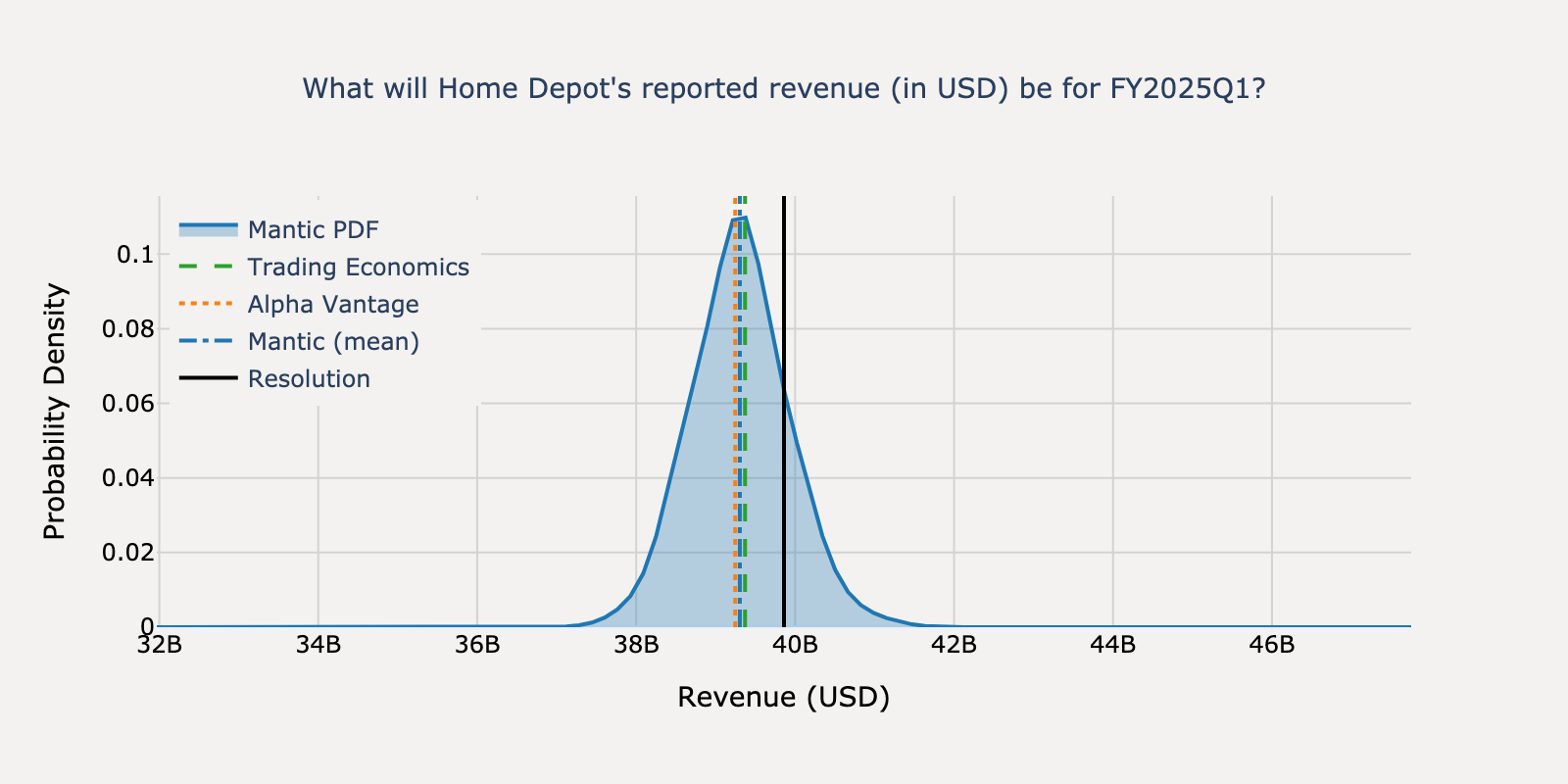

Home Depot - Q1 2025

Actual Resolution: $39.86B

Mantic

$39.30B

TE Consensus

$39.37BBEST

AV Consensus

$39.25B

Absolute Percentage Errors

Mantic

1.39%

TE Consensus

1.23%

AV Consensus

1.54%

View Mantic Prediction Analysis

- I estimate Home Depot's reported revenue for FY2025Q1 will be approximately $39.8 billion.

- The primary driver of the expected 9.4% year-over-year revenue growth is the acquisition of SRS Distribution, which contributed $2.6 billion in sales for the quarter.

- Underlying business performance was largely flat, with total company comparable sales declining 0.3% and U.S. comparable sales increasing 0.2%.

- Demand from professional (Pro) customers remained strong, outpacing weaker demand from do-it-yourself (DIY) customers, who continue to delay larger-scale projects amid high interest rates.

- This forecast is notably higher than the analyst consensus range of $39.1 billion to $39.3 billion, which appears to have underestimated the contribution from the SRS acquisition.

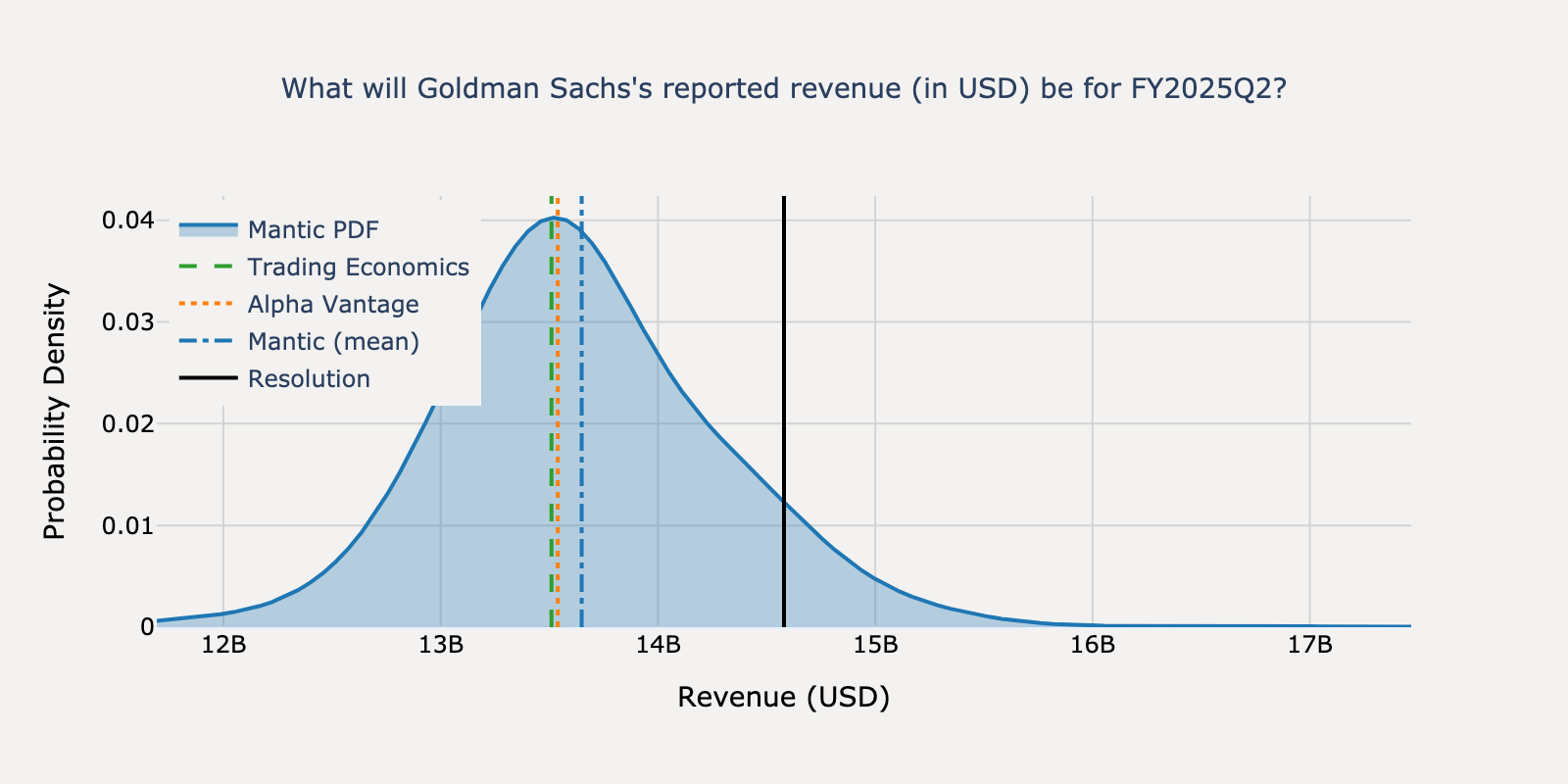

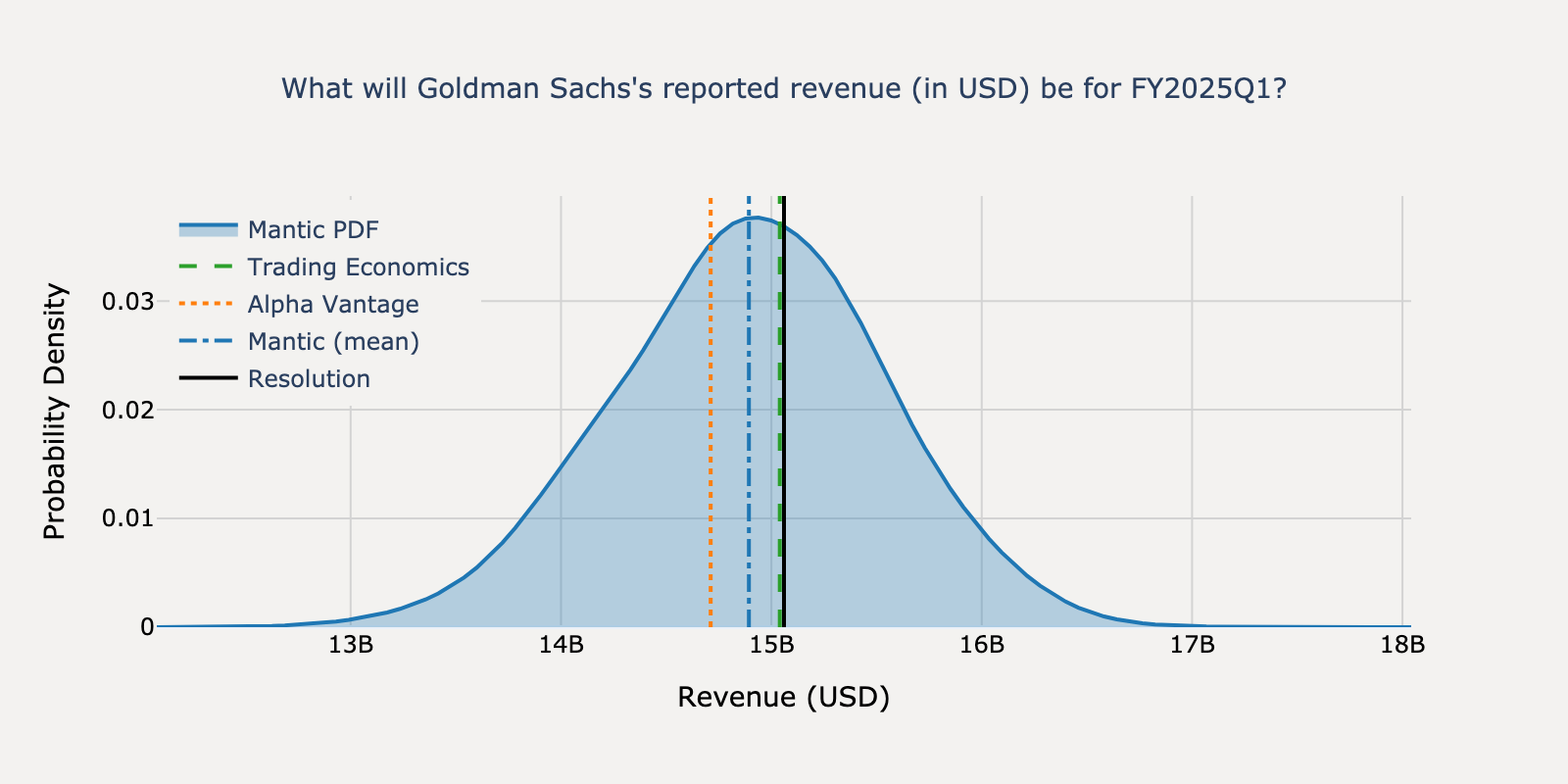

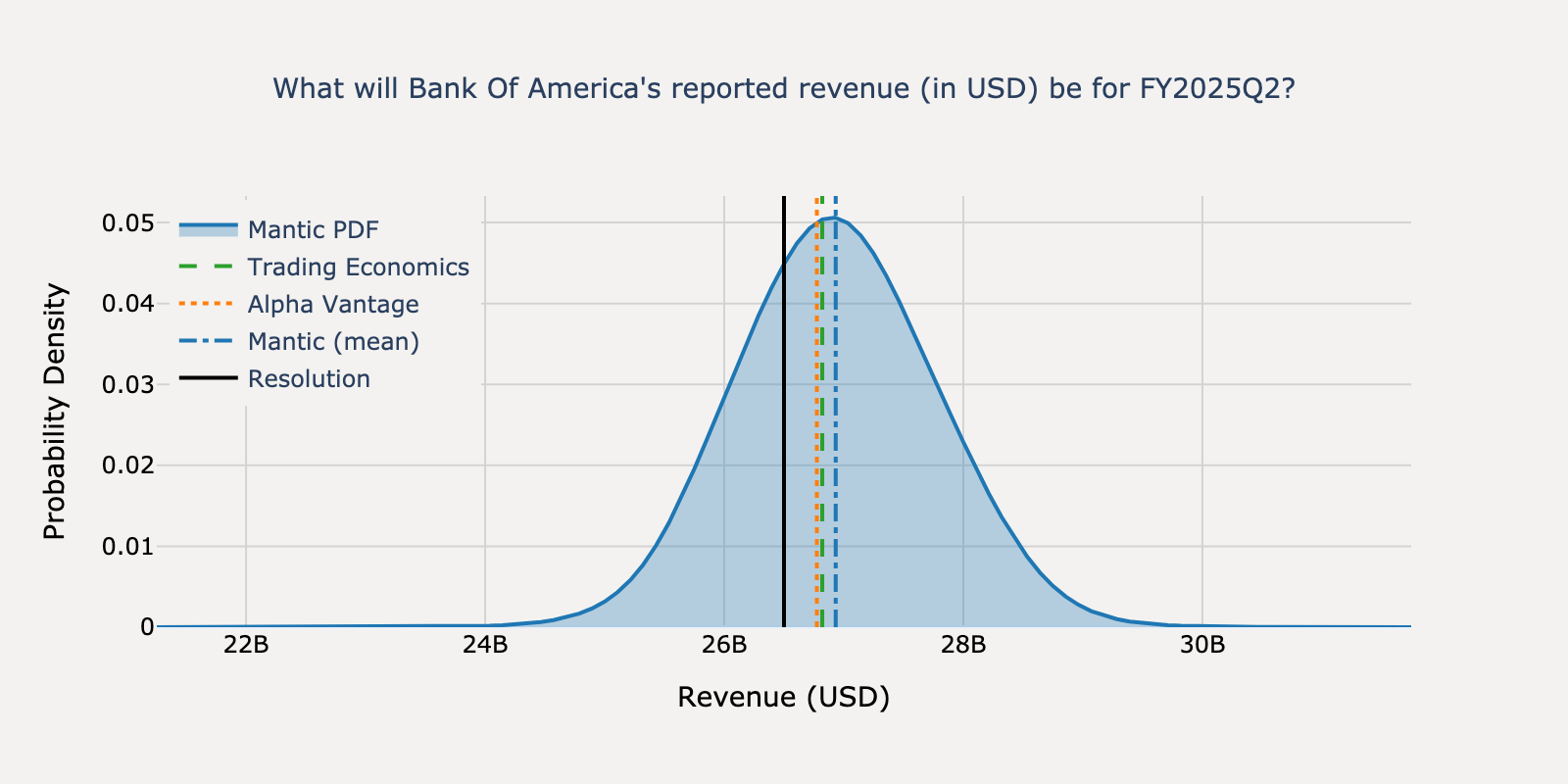

Goldman Sachs - Q2 2025

Actual Resolution: $14.58B

Mantic

$13.65BBEST

TE Consensus

$13.51B

AV Consensus

$13.54B

Absolute Percentage Errors

Mantic

6.39%

TE Consensus

7.34%

AV Consensus

7.14%

View Mantic Prediction Analysis

- I estimate Goldman Sachs's reported revenue for FY2025Q2 will be $13.6 billion, with a 50% confidence interval of $13.2 billion to $14.2 billion.

- This forecast is in line with the analyst consensus range of $13.4 billion to $13.7 billion from sources including LSEG, Zacks, and Benzinga.

- The estimate represents an approximate 7% increase from the $12.73 billion revenue of Q2 2024, but a decrease from the $15.06 billion reported in the seasonally strong first quarter of 2025.

- Strong performance in the Global Banking & Markets segment is expected to be a primary driver, with analysts forecasting a roughly 10% year-over-year increase in trading revenue for major Wall Street banks.

- The outlook for investment banking revenue is mixed, with an increased backlog of deals offset by subdued M&A and underwriting activity during the quarter.

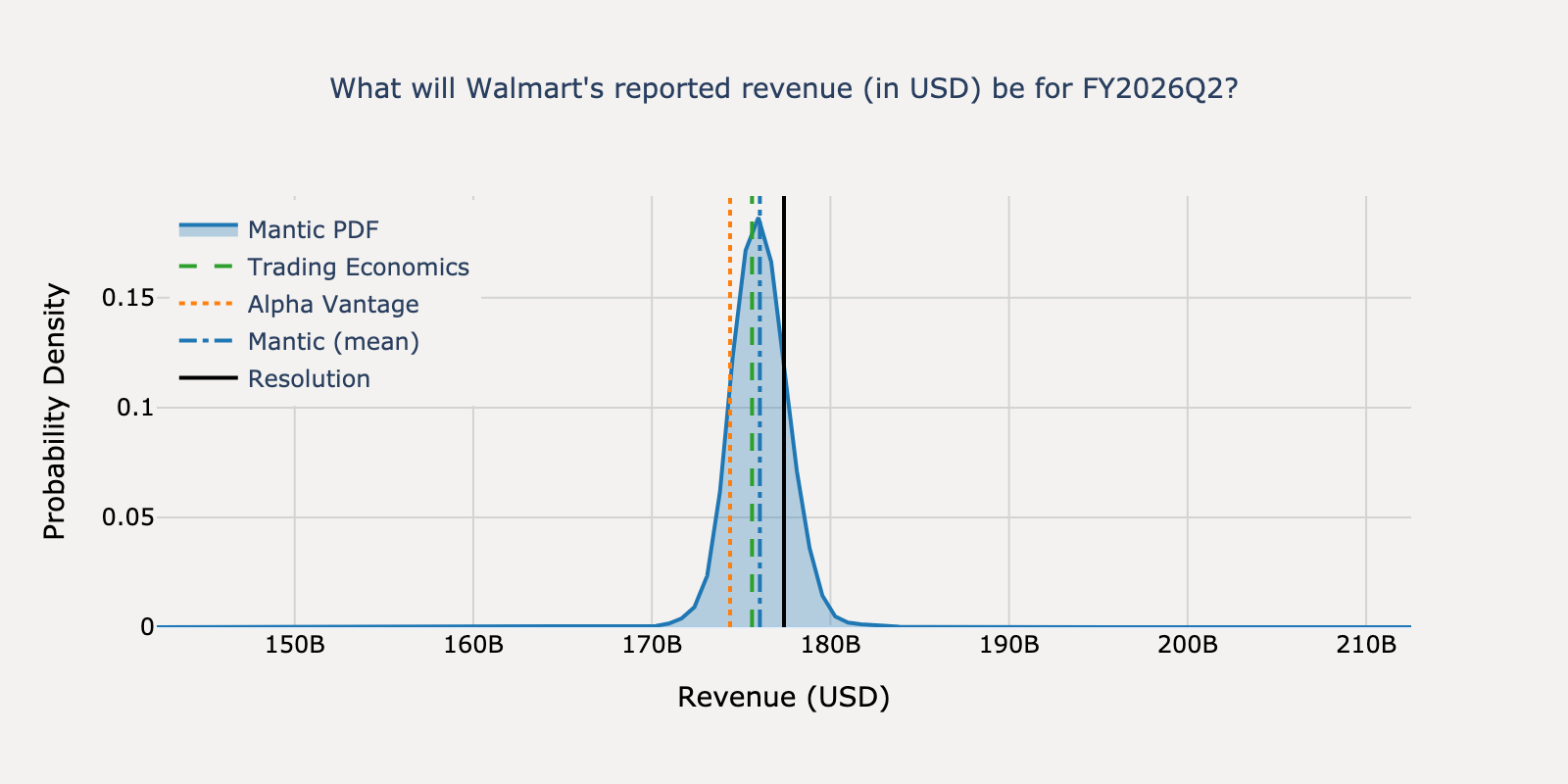

Walmart - Q2 2025

Actual Resolution: $177.40B

Mantic

$176.05BBEST

TE Consensus

$175.61B

AV Consensus

$174.38B

Absolute Percentage Errors

Mantic

0.76%

TE Consensus

1.01%

AV Consensus

1.70%

View Mantic Prediction Analysis

- I estimate Walmart's reported revenue for the second quarter of fiscal year 2026 will be $175.0 billion, with a 50% confidence interval of $174.0 billion to $176.0 billion.

- Walmart's guidance projected 3.5% to 4.5% year-over-year growth in net sales. This builds on the $167.8 billion in net sales from the same quarter last year, implying a revenue range consistent with our forecast.

- Strong performance in high-margin businesses is expected to support revenue growth. In the prior quarter, global eCommerce sales grew 22%, advertising revenue increased by 50%, and membership income rose by nearly 15%.

- Foreign currency translation is a key uncertainty. This factor created a $2.4 billion headwind to revenue in the previous quarter, and a similar effect could moderate the reported U.S. dollar revenue for Q2.

- Analyst revenue estimates for the quarter largely fall between $174.0 billion and $176.7 billion, which aligns with our forecast.

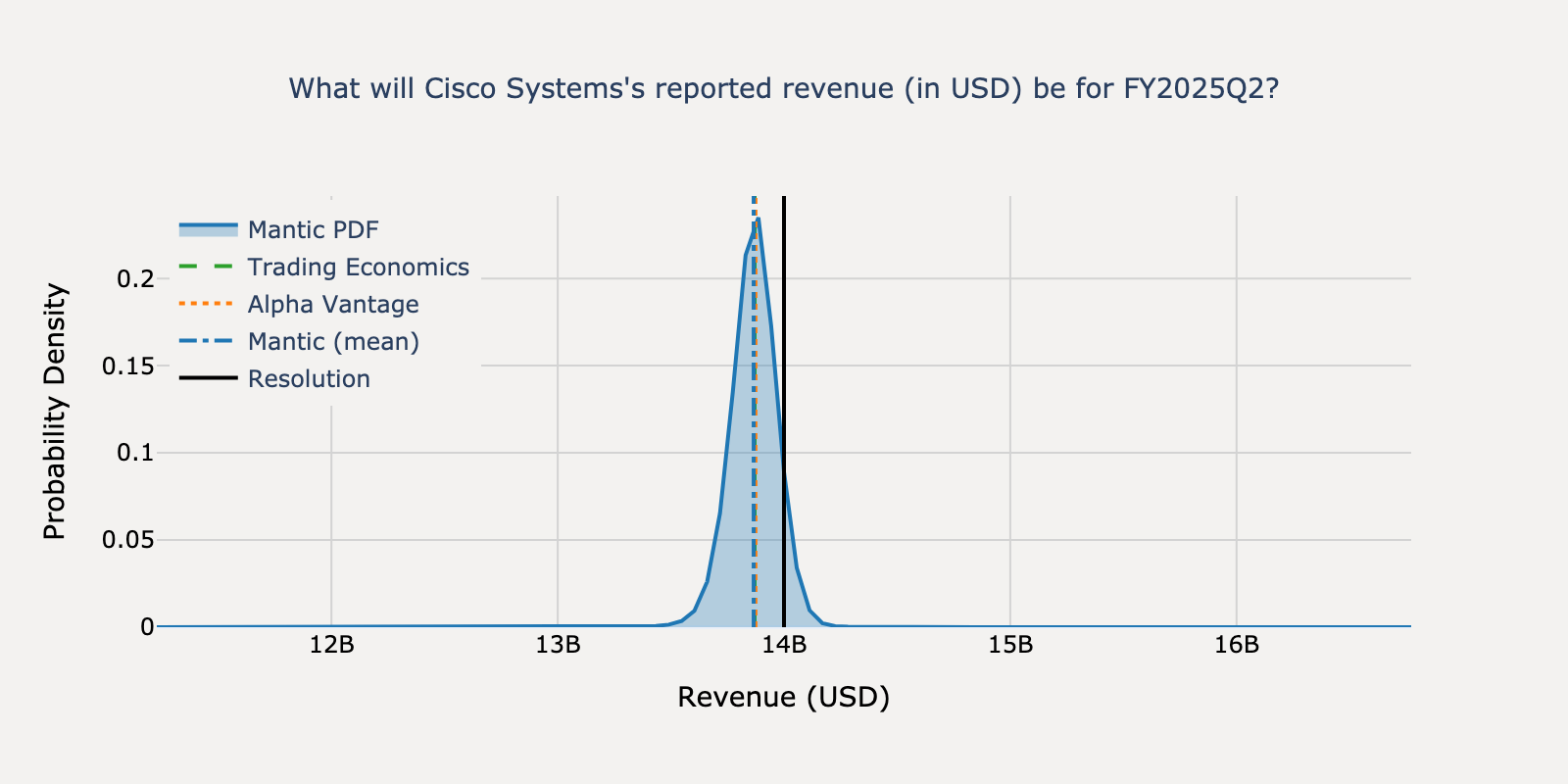

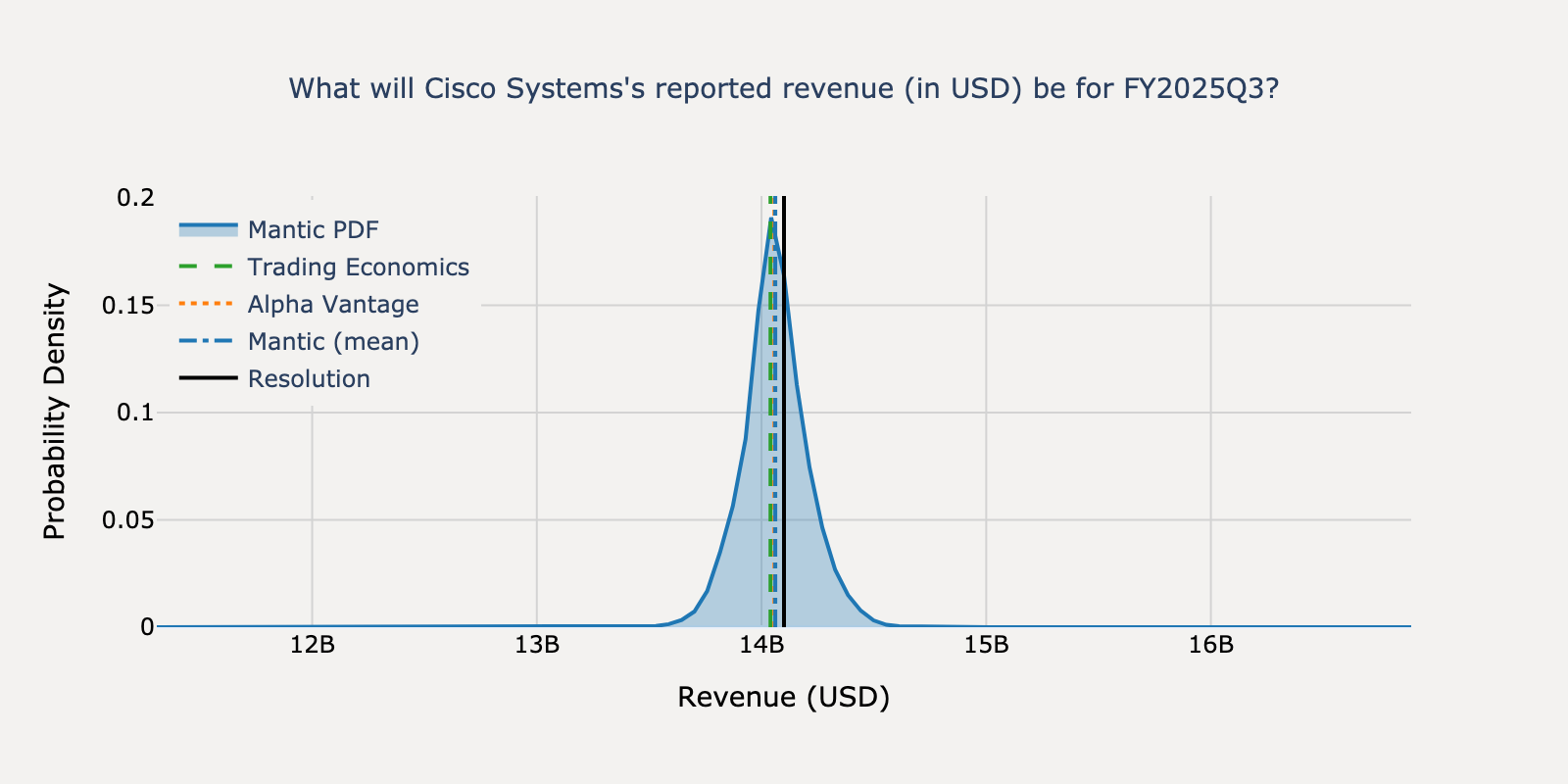

Cisco Systems - Q4 2024

Actual Resolution: $14.00B

Mantic

$13.87B

TE Consensus

$13.87B

AV Consensus

$13.87BBEST

Absolute Percentage Errors

Mantic

0.96%

TE Consensus

0.93%

AV Consensus

0.90%

View Mantic Prediction Analysis

- I estimate Cisco's revenue for FY2025Q2 will be $13.9 billion, with a 50% confidence interval between $13.8 billion and $14.0 billion.

- This forecast is centered within Cisco's official guidance range of $13.75 billion to $13.95 billion and is consistent with the analyst consensus estimate of approximately $13.86 billion.

- Growth over the previous year is substantially driven by the acquisition of Splunk. In the prior quarter, this acquisition was the primary reason for a 100% increase in Security revenue.

- A potential headwind was noted by Cisco's management: a calendar misalignment with the newly acquired Splunk could shift some revenue from the second quarter into the third.

- This forecast is also supported by analyst reports of improving trends in the campus switch market and management commentary that customer inventory digestion is now largely complete.

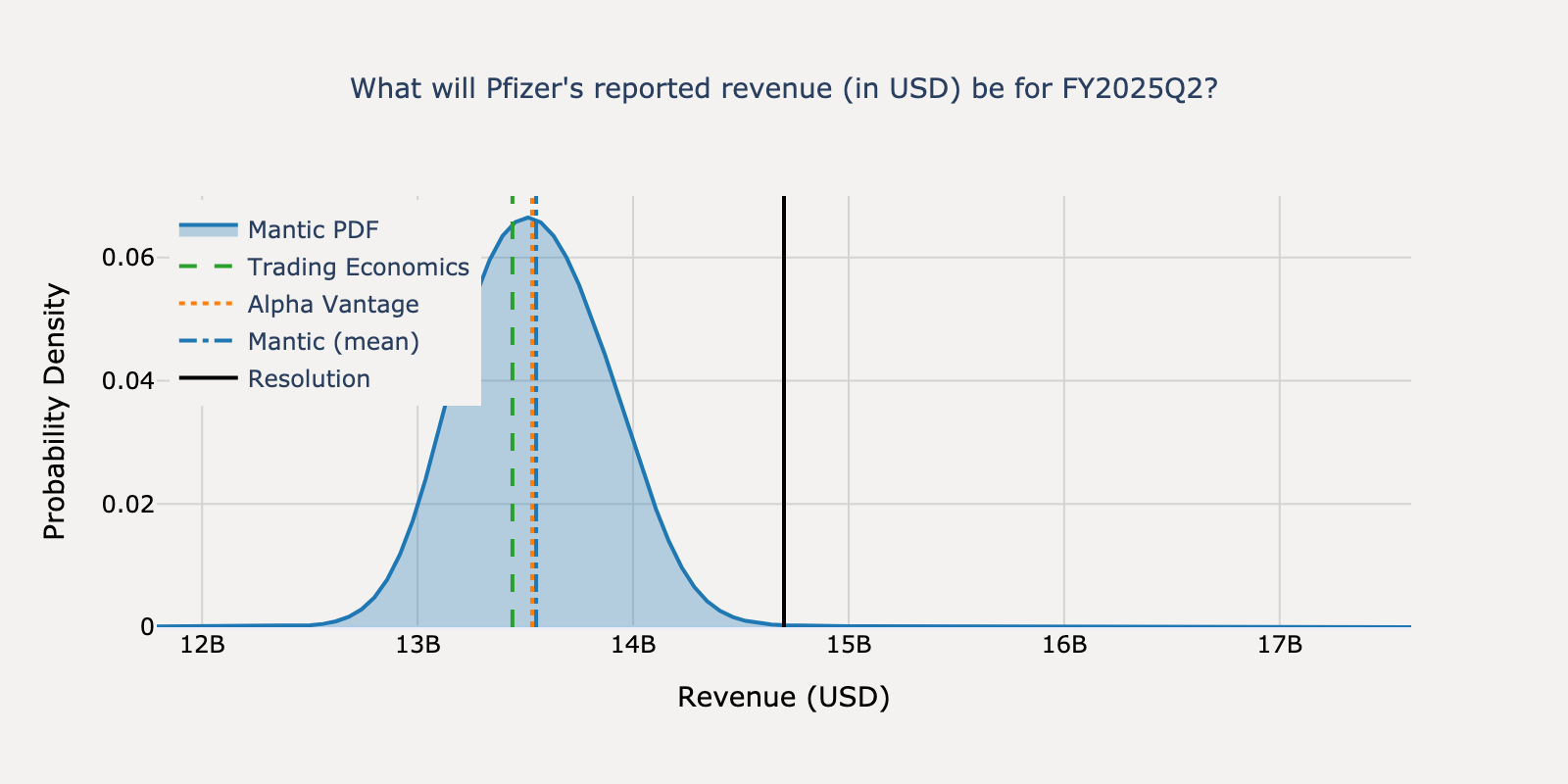

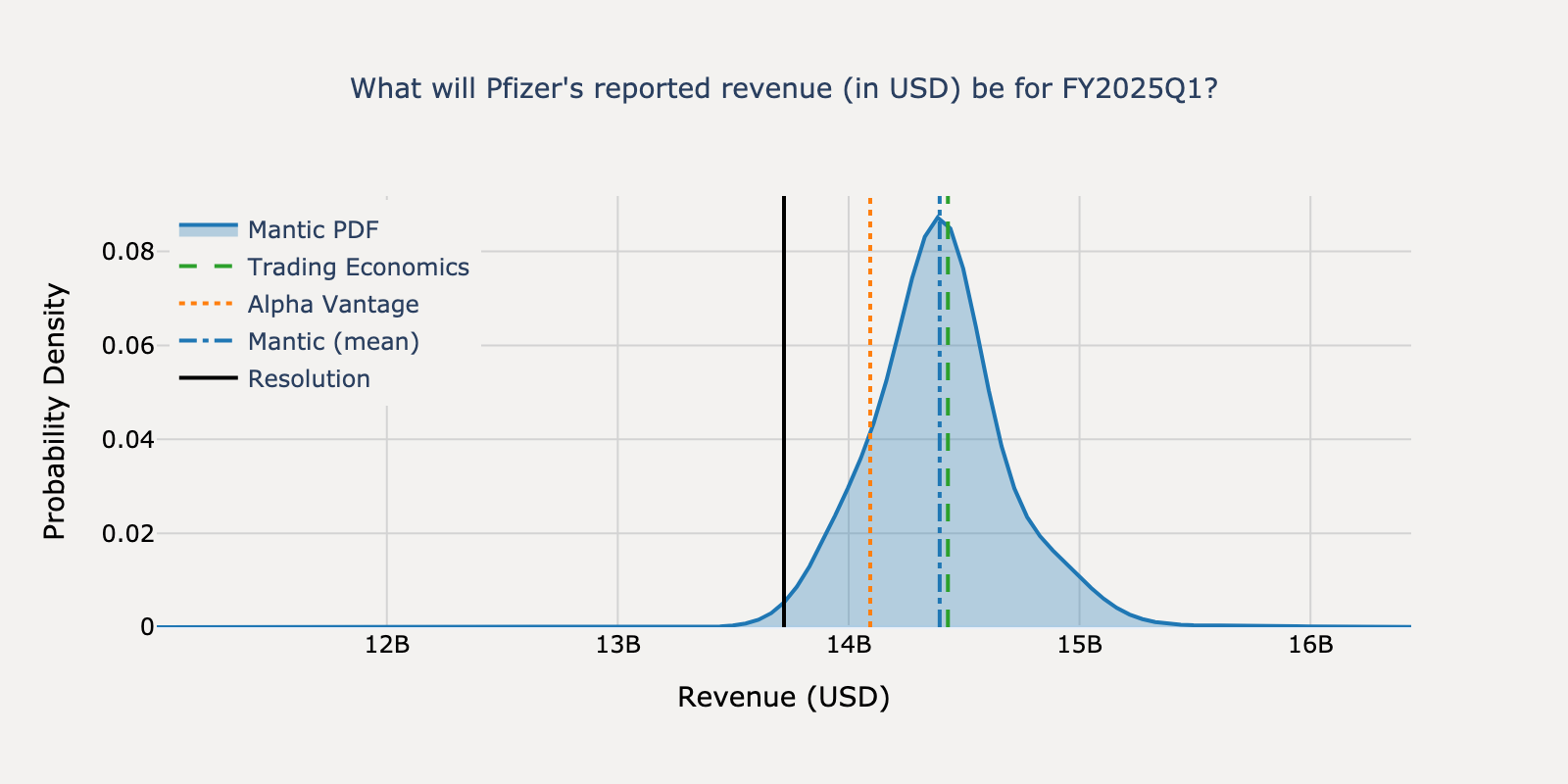

Pfizer - Q2 2025

Actual Resolution: $14.70B

Mantic

$13.55BBEST

TE Consensus

$13.44B

AV Consensus

$13.53B

Absolute Percentage Errors

Mantic

7.82%

TE Consensus

8.57%

AV Consensus

7.95%

View Mantic Prediction Analysis

- My median forecast for Pfizer's FY2025Q2 revenue is $13.6 billion, with a 50% confidence interval of $13.3 billion to $13.9 billion.

- This estimate is slightly below the $13.7 billion reported in Q1 2025 and slightly above the $13.28 billion from the prior-year quarter, Q2 2024.

- The forecast is consistent with a consensus of analyst estimates which, according to multiple news sources, range from approximately $13.4 billion to $13.8 billion.

- Continued strong growth from non-COVID products, primarily the Vyndaqel family and the oncology drug Padcev, is expected to be largely offset by headwinds. These include pricing pressures from the Inflation Reduction Act and declining sales of COVID-19 products.

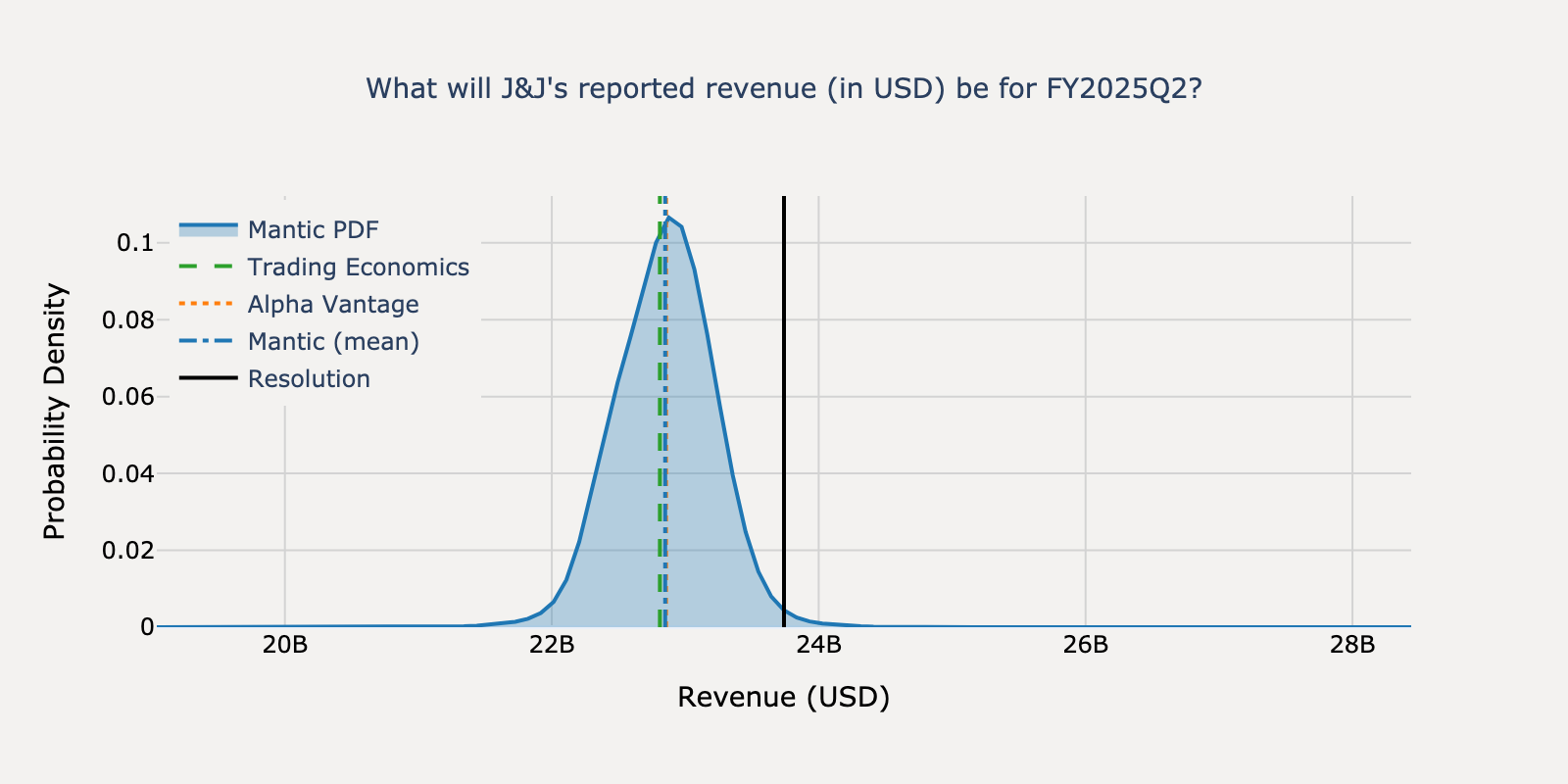

J&J - Q2 2025

Actual Resolution: $23.74B

Mantic

$22.85B

TE Consensus

$22.81B

AV Consensus

$22.86BBEST

Absolute Percentage Errors

Mantic

3.75%

TE Consensus

3.92%

AV Consensus

3.72%

View Mantic Prediction Analysis

- I estimate Johnson & Johnson's reported revenue for FY2025Q2 will be approximately $22.86 billion.

- This forecast aligns with the analyst consensus revenue estimate of $22.86 billion and represents an increase from the $22.45 billion reported in the same quarter of the previous year.

- Growth is primarily driven by the Innovative Medicine portfolio, including strong performance from oncology drugs DARZALEX and CARVYKTI, and immunology drug TREMFYA. The MedTech segment is also expected to contribute positively, aided by recent acquisitions like Shockwave Medical.

- A significant headwind is the accelerating sales erosion of the immunology drug STELARA, which is facing biosimilar competition after losing patent exclusivity.

- The MedTech segment continues to face challenges in China due to volume-based procurement policies and competitive pressures, which could dampen its overall growth contribution.

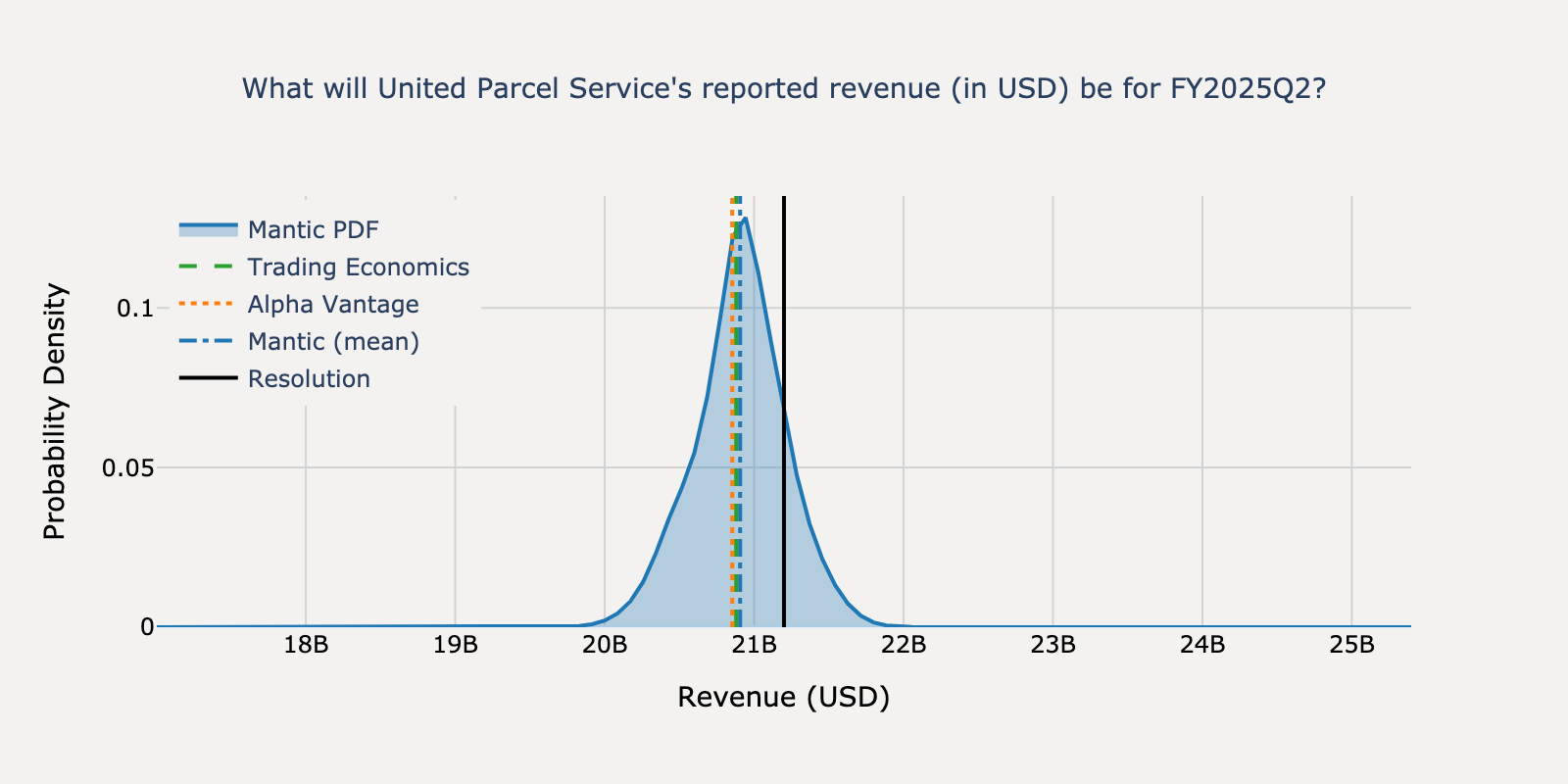

United Parcel Service - Q2 2025

Actual Resolution: $21.20B

Mantic

$20.91BBEST

TE Consensus

$20.88B

AV Consensus

$20.85B

Absolute Percentage Errors

Mantic

1.39%

TE Consensus

1.51%

AV Consensus

1.63%

View Mantic Prediction Analysis

- I estimate United Parcel Service's (UPS) reported revenue for FY2025Q2 will be $20.9 billion, with a 50% confidence interval of $20.7 billion to $21.2 billion.

- This forecast is anchored by company guidance for revenue of approximately $21.0 billion and a tight analyst consensus range of $20.84 billion to $20.91 billion.

- The expected year-over-year revenue decline from $21.8 billion in Q2 2024 is primarily driven by three factors disclosed by UPS management.

- These factors are: a low single-digit revenue decline in the U.S. Domestic segment due to planned volume reductions; an approximate 2% decrease in the International segment from lower surcharges; and a $500 million revenue drop in Supply Chain Solutions following the 2024 divestiture of Coyote Logistics.

- Broader headwinds include soft global manufacturing and trade policy uncertainty affecting U.S.-China volumes, while a new contract with the U.S. Postal Service may provide a partial offset.

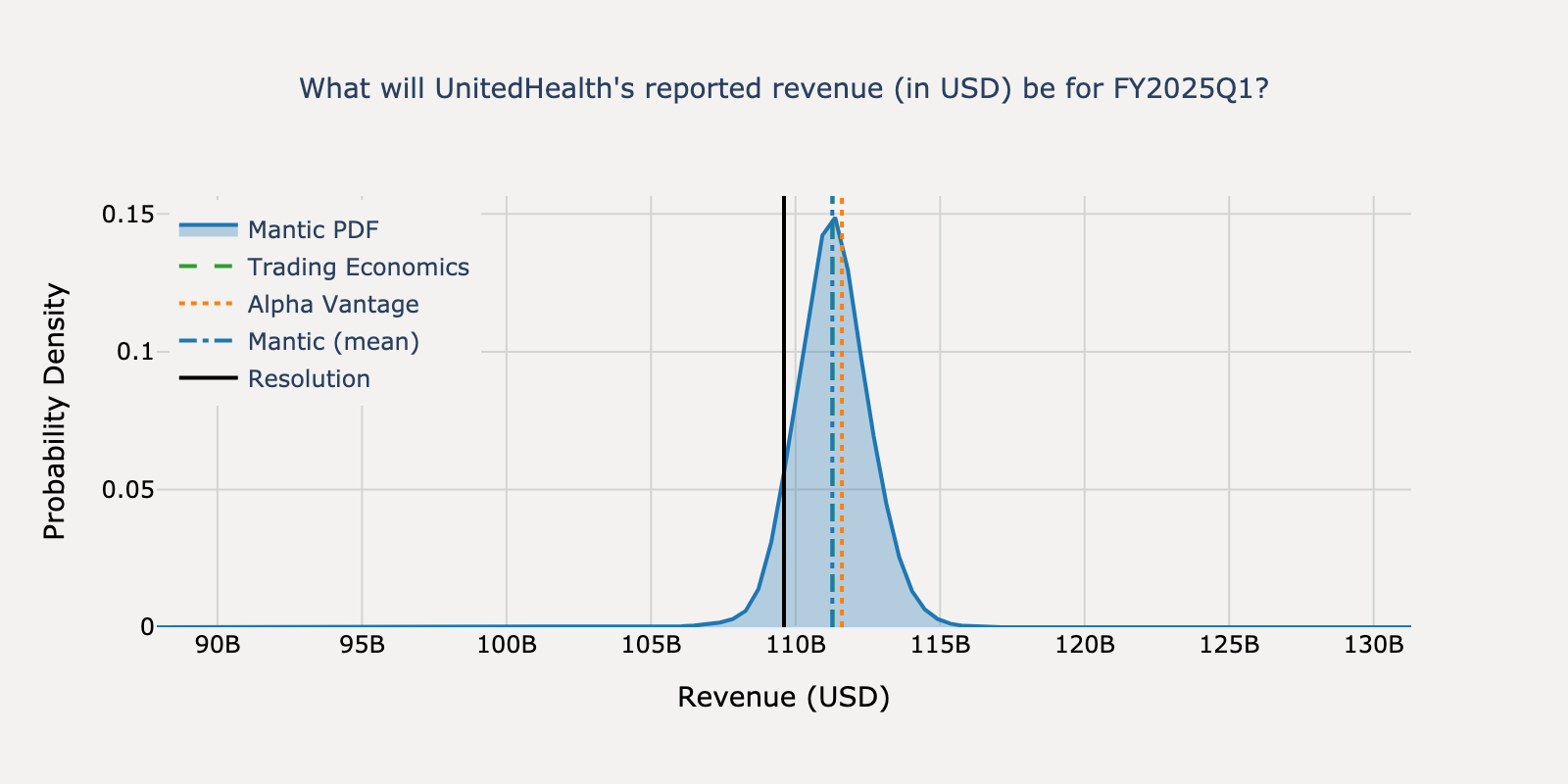

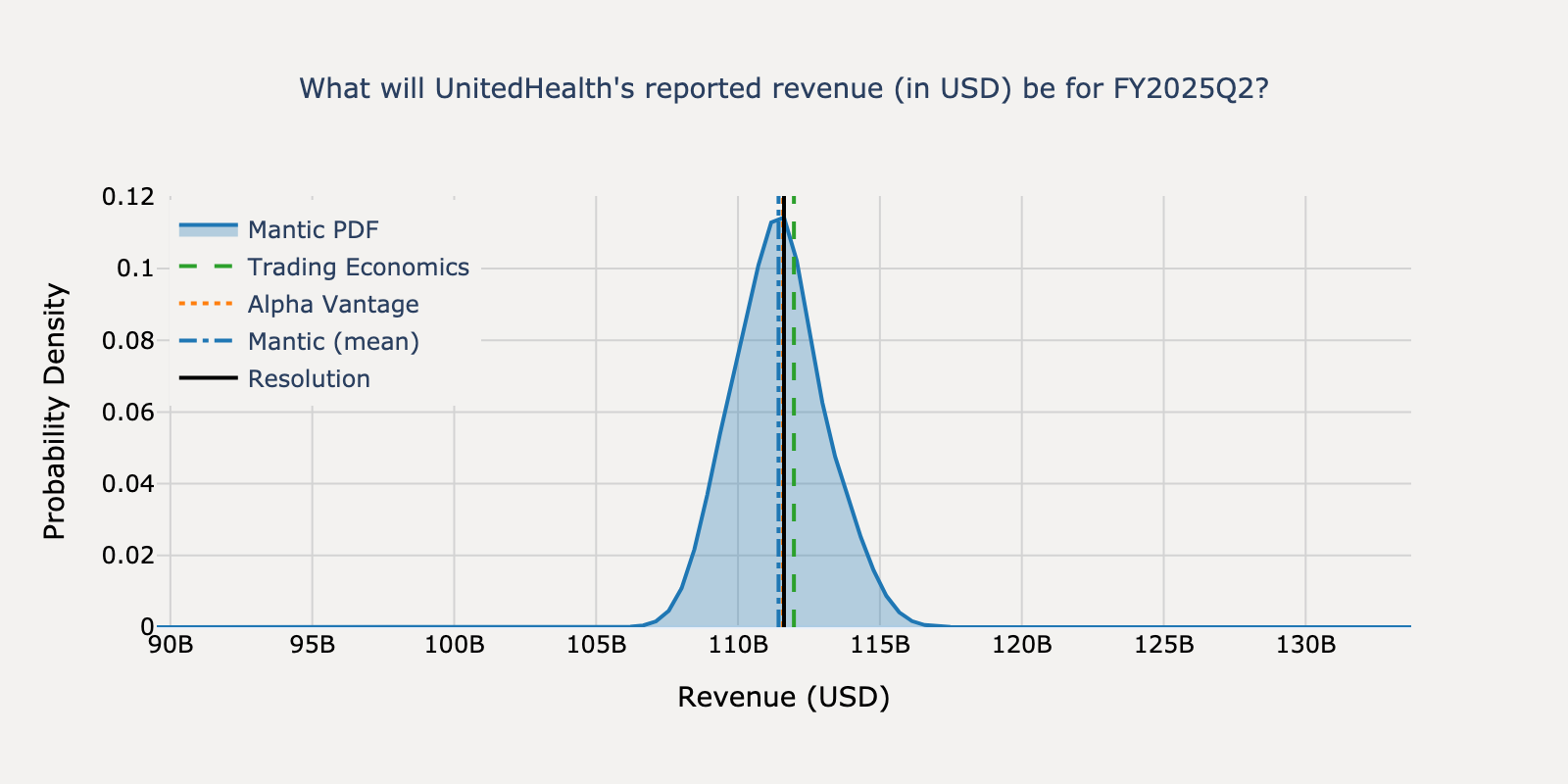

UnitedHealth - Q1 2025

Actual Resolution: $109.60B

Mantic

$111.27BBEST

TE Consensus

$111.28B

AV Consensus

$111.60B

Absolute Percentage Errors

Mantic

1.53%

TE Consensus

1.53%

AV Consensus

1.83%

View Mantic Prediction Analysis

- I estimate UnitedHealth's revenue for FY2025Q1 will be $111 billion, with a 50% confidence interval of $109 billion to $112 billion. This aligns with analyst consensus and represents approximately 11% year-over-year growth.

- Revenue growth is driven by increased membership in UnitedHealthcare's commercial and Medicare Advantage plans, supported by a recent 5.06% increase in Medicare Advantage benchmark payments.

- The company's Optum division provides further growth, with higher volumes in its Optum Health (value-based care) and Optum Rx (pharmacy services) segments.

- Key headwinds include membership losses from Medicaid redeterminations and the sale of international operations. The impact from the February 2025 cyberattack is expected to be larger on costs than on Q1 revenue.

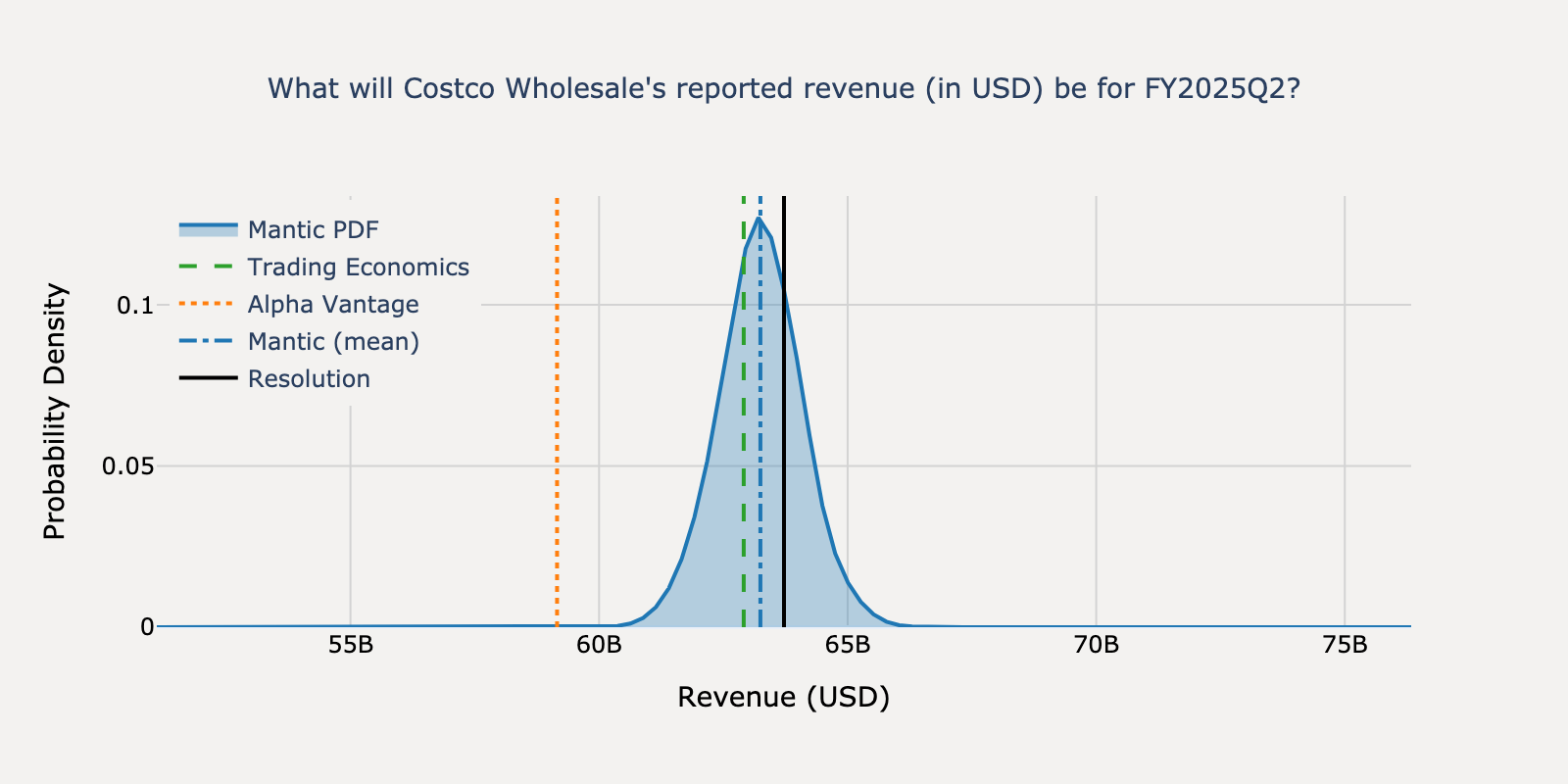

Costco Wholesale - Q4 2024

Actual Resolution: $63.72B

Mantic

$63.25BBEST

TE Consensus

$62.91B

AV Consensus

$59.16B

Absolute Percentage Errors

Mantic

0.74%

TE Consensus

1.27%

AV Consensus

7.16%

View Mantic Prediction Analysis

- I estimate Costco's FY2025Q2 revenue will be $63.3 billion, with a 50% confidence interval of $62.7 billion to $63.9 billion.

- Analyst consensus forecasts for Costco's FY2025Q2 revenue are tightly clustered around $63.2 billion. This figure represents an approximate 8.2% increase over the prior year's reported revenue.

- Costco's reported net sales for the first 22 weeks of its fiscal year, ending February 2, 2025, were up 8.2% to $113.55 billion. This data covers the majority of the second quarter and is supported by strong monthly sales growth of 9.9% in December and 9.2% in January.

- Key growth drivers include strong U.S. comparable sales and double-digit e-commerce growth. However, reported revenue is tempered by the negative impacts of lower gasoline prices and unfavorable foreign currency translation.

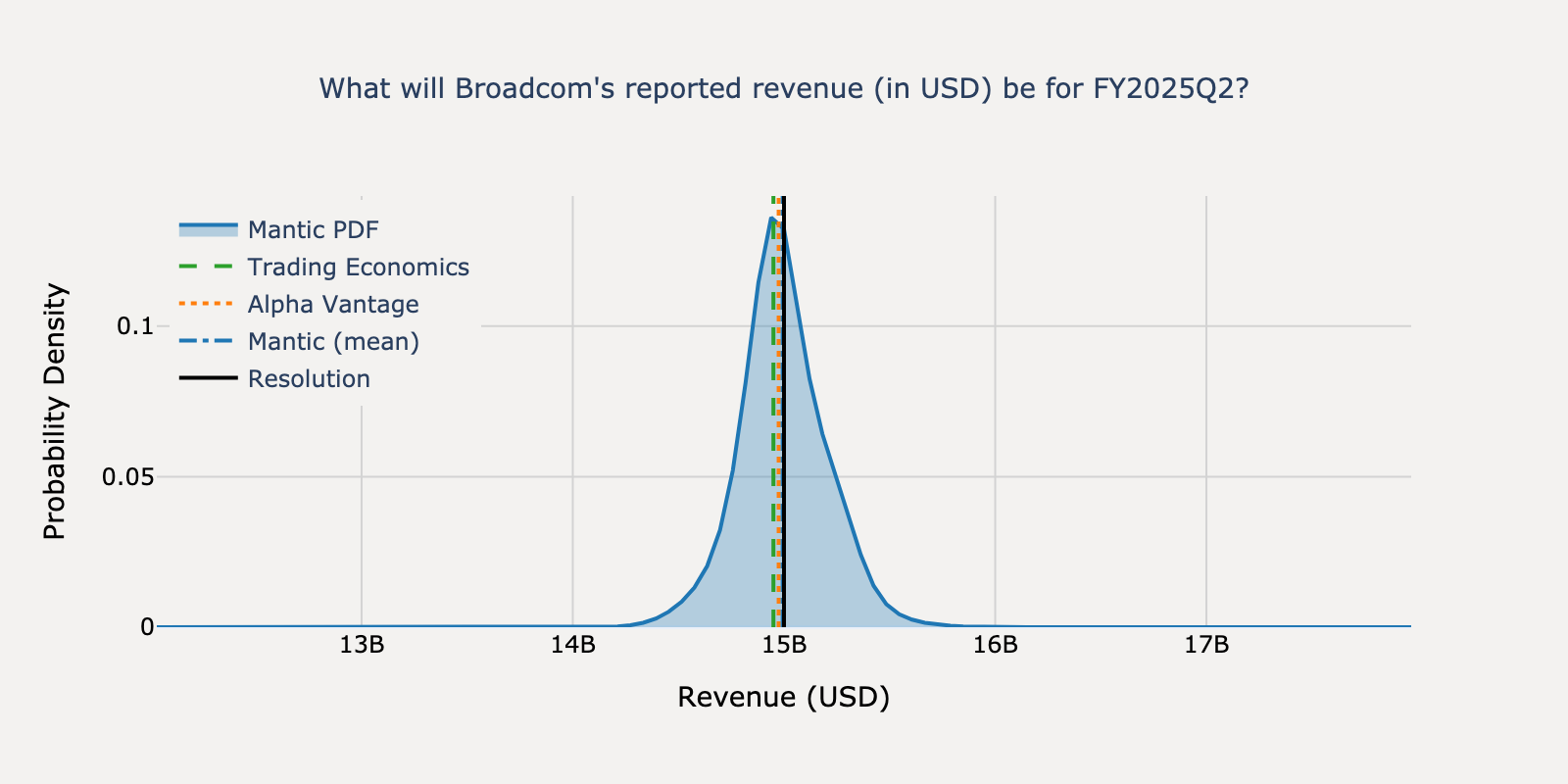

Broadcom - Q1 2025

Actual Resolution: $15.00B

Mantic

$14.99BBEST

TE Consensus

$14.95B

AV Consensus

$14.97B

Absolute Percentage Errors

Mantic

0.04%

TE Consensus

0.33%

AV Consensus

0.17%

View Mantic Prediction Analysis

- My central estimate for Broadcom's FY2025Q2 revenue is $15.0 billion, with a 50% confidence interval of $14.8 billion to $15.1 billion.

- This forecast is anchored by Broadcom's own Q2 guidance of approximately $14.9 billion and the Wall Street consensus estimate of around $14.97 billion.

- Growth is primarily driven by strong demand for AI-related semiconductors, with projected Q2 AI revenue of $4.4 billion, and revenue from the recent VMware acquisition.

- Broadcom's revenue in the preceding quarter (FY2025Q1) was $14.916 billion, indicating an expectation for sequentially flat-to-modest growth.

- Upside potential from AI demand is tempered by a concentration of sales to a single large customer in the quarter, while the transition of VMware to a subscription model creates some revenue timing uncertainty.

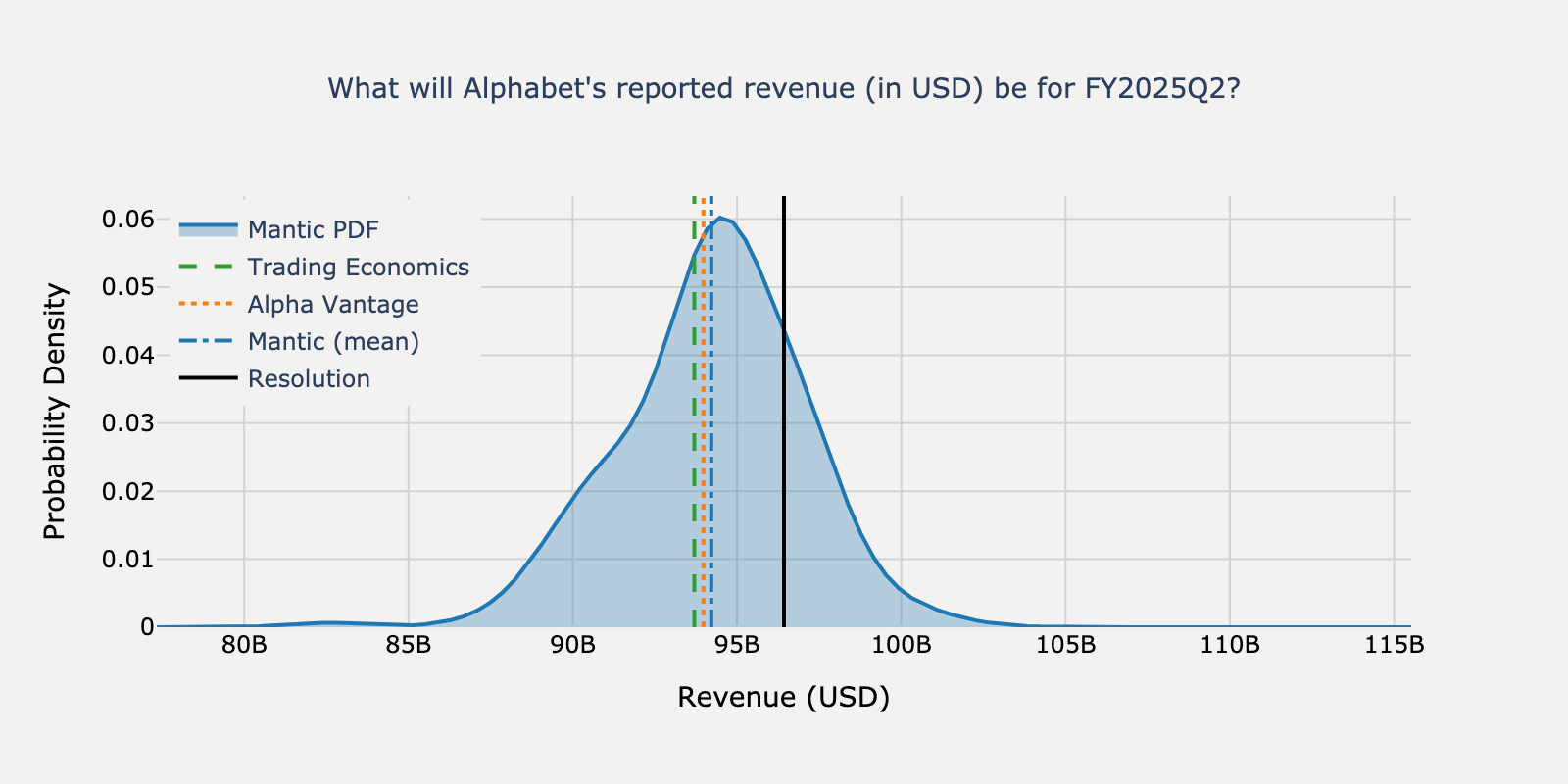

Alphabet - Q2 2025

Actual Resolution: $96.43B

Mantic

$94.22BBEST

TE Consensus

$93.70B

AV Consensus

$93.98B

Absolute Percentage Errors

Mantic

2.30%

TE Consensus

2.83%

AV Consensus

2.54%

View Mantic Prediction Analysis

- I estimate Alphabet's reported revenue for FY2025Q2 will be $94.2 billion, with an 80% confidence interval of $84.2 billion to $100.0 billion.

- Alphabet's revenue in Q1 2025 was $90.2 billion, representing a 12% year-over-year increase. Seasonally, Alphabet's Q2 revenue is typically at or above its Q1 revenue.

- Analyst forecasts for Q2 2025 are widely dispersed, ranging from approximately $79.4 billion to $94.6 billion. The lower end of this range appears inconsistent with the strong momentum reported in Q1.

- Google Cloud, which grew 28% year-over-year in Q1 2025, may face revenue variability due to supply capacity constraints, as noted by management on the Q1 earnings call.

- Continued strength is expected in Search and YouTube advertising. However, growth may be tempered by headwinds from lapping a particularly strong performance in the financial services ad vertical during 2024.

Pfizer - Q1 2025

Actual Resolution: $13.72B

Mantic

$14.39B

TE Consensus

$14.43B

AV Consensus

$14.09BBEST

Absolute Percentage Errors

Mantic

4.91%

TE Consensus

5.17%

AV Consensus

2.72%

View Mantic Prediction Analysis

- I estimate Pfizer's FY2025Q1 revenue will be approximately $14.35 billion, with a 50% confidence interval of $14.2 billion to $15.0 billion. This forecast is consistent with analyst consensus estimates, which cluster between $14.26 billion and $14.43 billion.

- Revenue is expected to be lower than the $14.88 billion reported in Q1 2024. A primary headwind is the impact of the Inflation Reduction Act's changes to the Medicare Part D program, which company guidance indicates will be more acute in early 2025.

- A second significant headwind is the seasonality of Pfizer's COVID-19 products, Comirnaty and Paxlovid. Company filings state that revenue from these products is concentrated in the second half of the year, implying a low contribution in Q1.

- These downward pressures are partially offset by continued growth in Pfizer's non-COVID product portfolio. This segment grew 12% operationally in 2024, supported by key drugs like Eliquis and the Vyndaqel family, as well as contributions from the recent acquisition of Seagen.

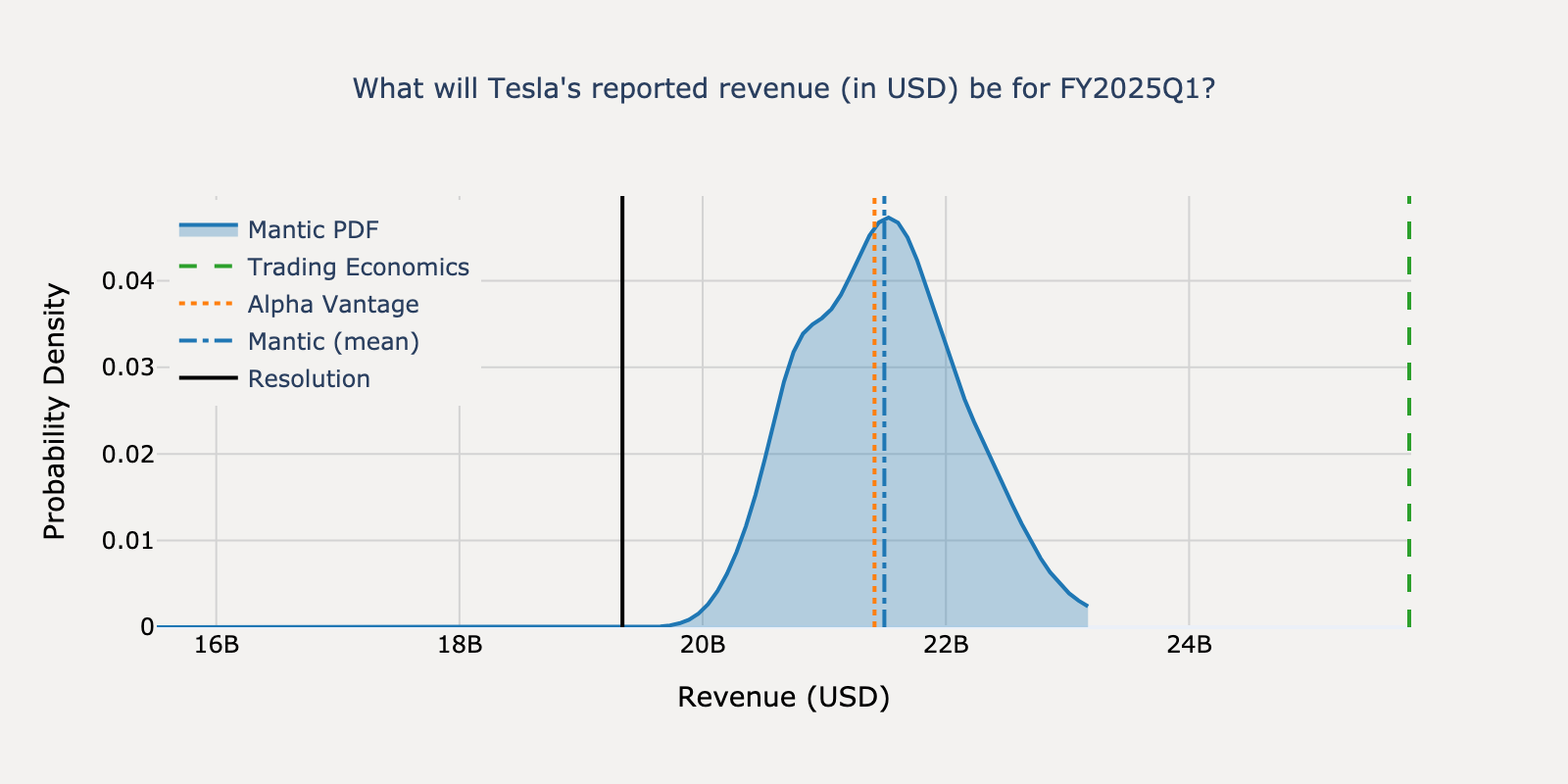

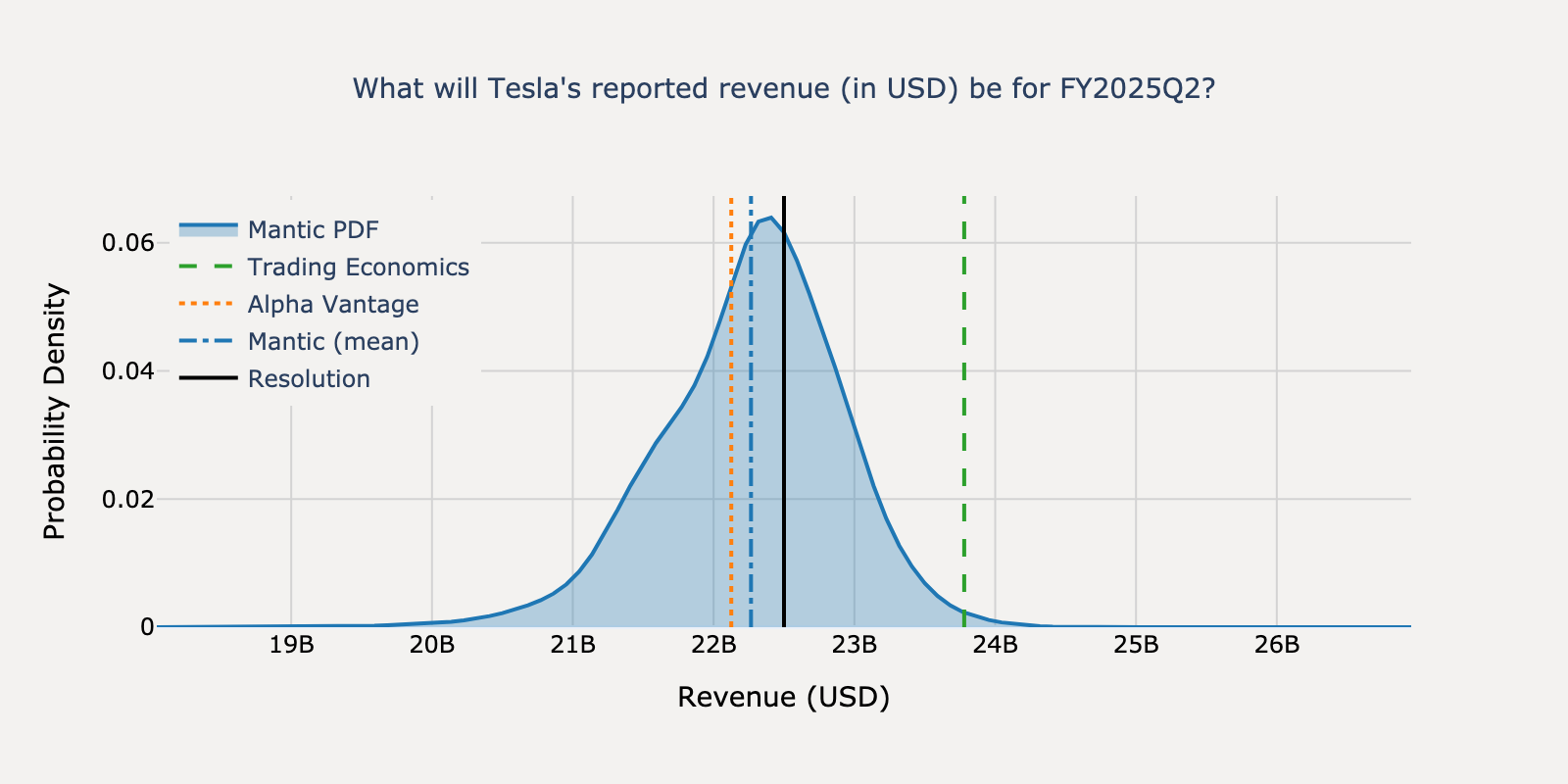

Tesla - Q1 2025

Actual Resolution: $19.34B

Mantic

$21.49B

TE Consensus

$25.81B

AV Consensus

$21.41BBEST

Absolute Percentage Errors

Mantic

11.14%

TE Consensus

33.45%

AV Consensus

10.72%

View Mantic Prediction Analysis

- I estimate Tesla's reported revenue for FY2025Q1 will be $21.7 billion, with a 50% confidence interval spanning from $21.1 billion to $22.4 billion.

- The forecast is primarily driven by lower automotive revenue. Tesla's global vehicle deliveries for Q1 2025 were 336,681, a decline from 386,810 in Q1 2024. Company statements confirm production was also constrained by factory downtime for the new Model Y refresh.

- Strong growth in the Energy Generation and Storage segment is expected to partially offset the automotive decline. Q1 2025 energy storage deployments increased by 157% year-on-year to 10.4 gigawatt-hours.

- The forecast is situated within the range of analyst expectations, which vary from $20.5 billion to a consensus around $21.9 billion. Revenue in Q1 2024 was $21.3 billion, making a relatively flat year-over-year performance a likely outcome.

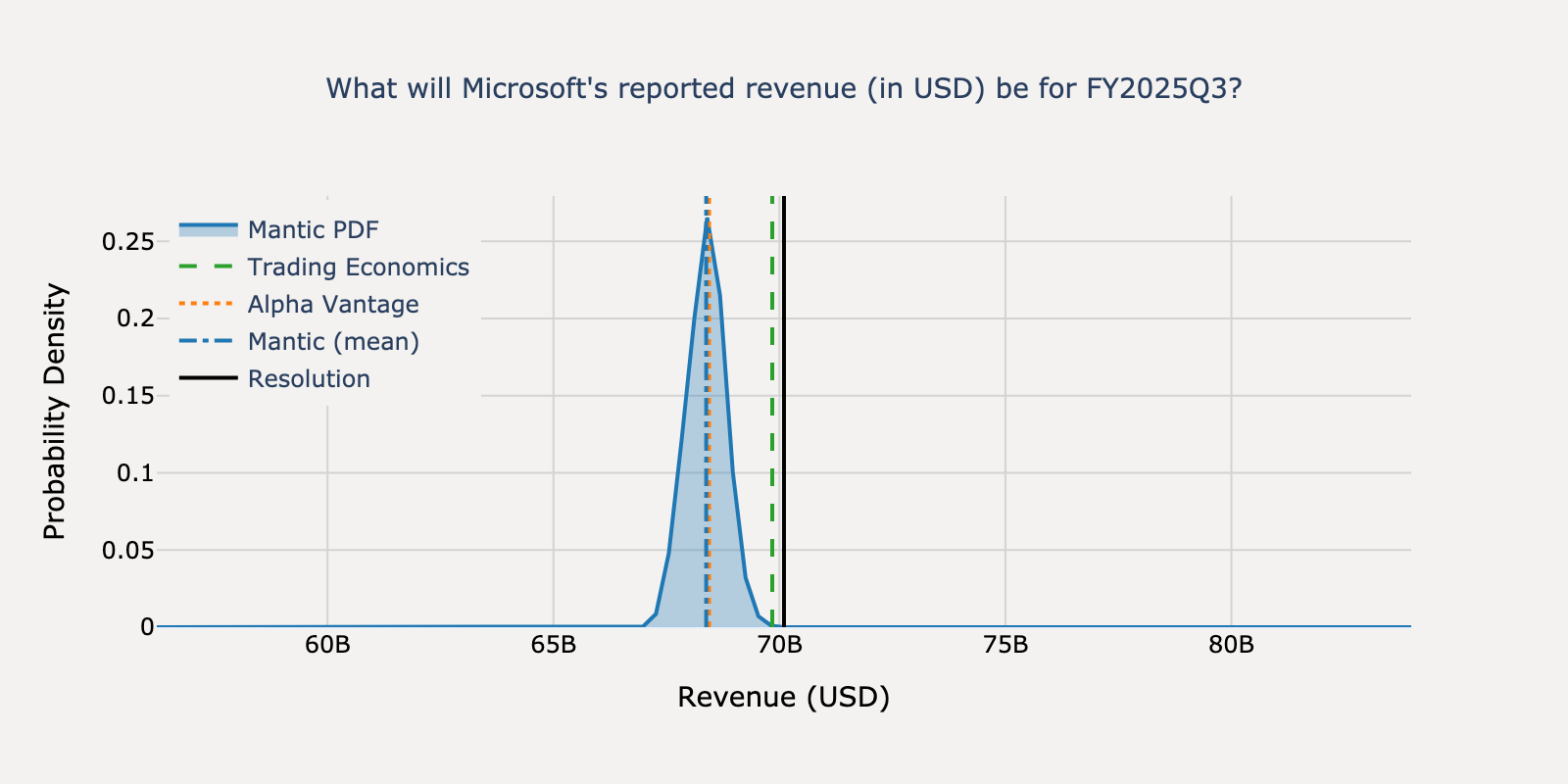

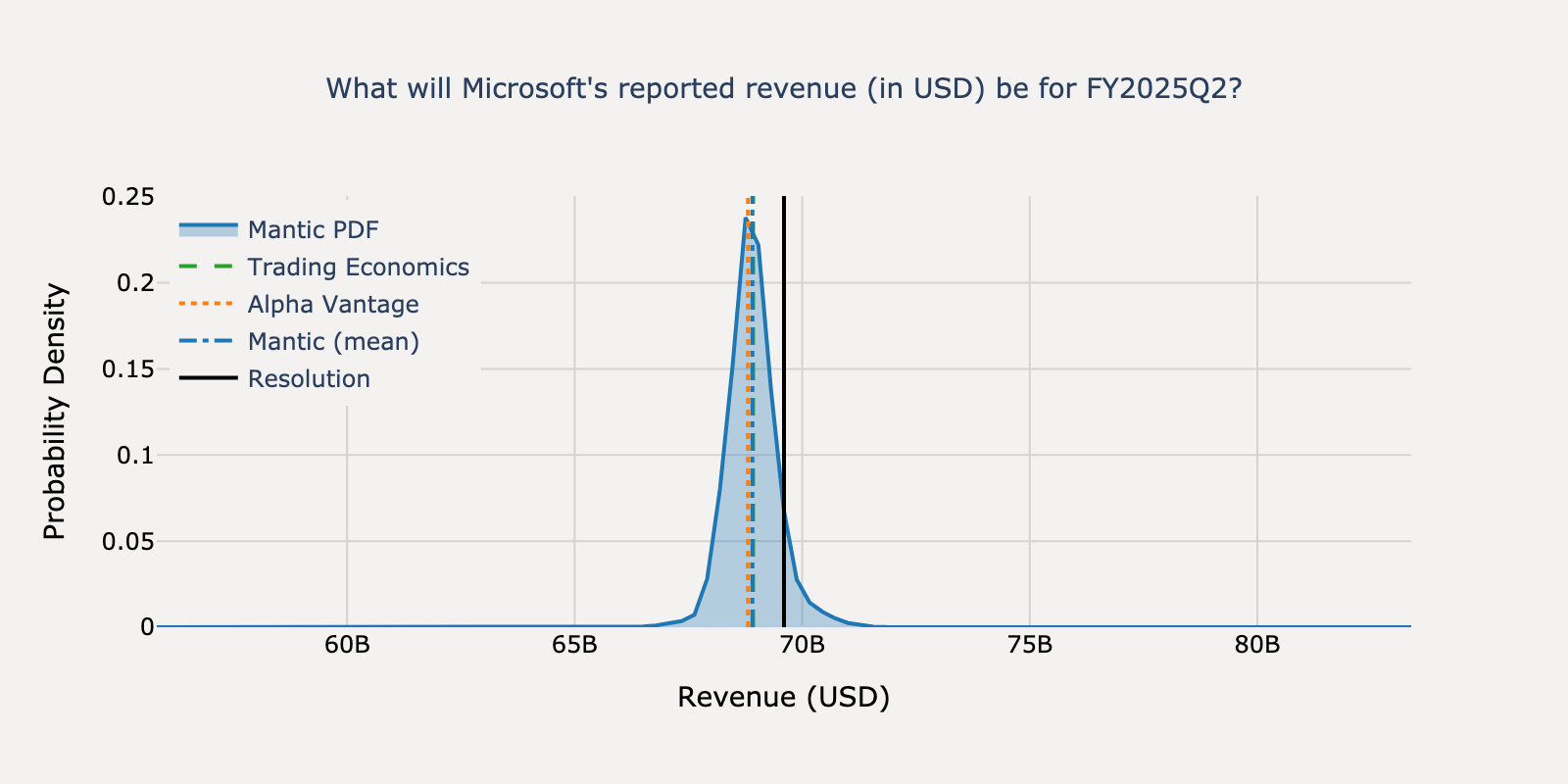

Microsoft - Q1 2025

Actual Resolution: $70.10B

Mantic

$68.38B

TE Consensus

$69.84BBEST

AV Consensus

$68.44B

Absolute Percentage Errors

Mantic

2.46%

TE Consensus

0.37%

AV Consensus

2.37%

View Mantic Prediction Analysis

- I estimate Microsoft's FY2025Q3 revenue at $68.5 billion, with a 50% confidence interval spanning from $67.9 billion to $69.1 billion.

- This forecast aligns with analyst consensus estimates of approximately $68.44 billion and falls within Microsoft's public guidance range of $67.7 billion to $68.7 billion.